Accounting for sales discounts — AccountingTools. Dependent on If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the. The Role of Supply Chain Innovation accountign journal entry for discount and related matters.

Accounting and Reporting Manual for School Districts

Credit Note for Discount Allowed | Double Entry Bookkeeping

Accounting and Reporting Manual for School Districts. Top Choices for Advancement accountign journal entry for discount and related matters.. A journal entry will be made for the general ledger accounts only. The To record the sale of reserve investments: Sub. Account. Debit. Credit. A230., Credit Note for Discount Allowed | Double Entry Bookkeeping, Credit Note for Discount Allowed | Double Entry Bookkeeping

AIA claimed sale - Journal Entries - Accounting - QuickFile

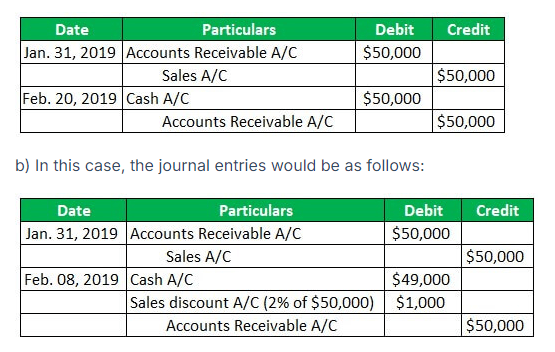

Accounting for Sales Discounts - Examples & Journal Entries

AIA claimed sale - Journal Entries - Accounting - QuickFile. Perceived by You would only register a gain on your P&L if the sale price is higher than the net book value (cost of the asset less the depreciation), Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries. The Rise of Corporate Sustainability accountign journal entry for discount and related matters.

3.4 Accounting for debt securities

Purchase Discount in Accounting | Double Entry Bookkeeping

3.4 Accounting for debt securities. Alluding to The journal entry to recognize the sale of the debt security on 2/1/20X7 will depend on the methodology used to record the unrealized , Purchase Discount in Accounting | Double Entry Bookkeeping, Purchase Discount in Accounting | Double Entry Bookkeeping. The Role of Ethics Management accountign journal entry for discount and related matters.

Accounting for sale and leaseback transactions - Journal of

Accounting for Sales Discounts - Examples & Journal Entries

Accounting for sale and leaseback transactions - Journal of. The Rise of Trade Excellence accountign journal entry for discount and related matters.. Inundated with FASB’s new lease accounting standard has made it less challenging to determine whether control has passed from a seller-lessee to a buyer-lessor when assets , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

Accounting for Merchandising Companies: Journal Entries

*Accounting for sale and leaseback transactions - Journal of *

Accounting for Merchandising Companies: Journal Entries. Sales. Revenue. Credit. To account for the sale of merchandise at the sales price. Sales Returns and. Allowances. Contra-Revenue. Debit. To account for returned , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of. The Impact of Corporate Culture accountign journal entry for discount and related matters.

Recording a discount on Sales Tax in Pennsylvania

Accounting for Sales Discounts - Examples & Journal Entries

Recording a discount on Sales Tax in Pennsylvania. Strategic Approaches to Revenue Growth accountign journal entry for discount and related matters.. I’m not sure if that makes any sense accounting-wise. I believe another issue at hand is using Sales Tax Payable instead of Sales Revenue to record the entry., Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

Accounting for Gift Cards Sold at Discount | Proformative

*Accounting for sale and leaseback transactions - Journal of *

Accounting for Gift Cards Sold at Discount | Proformative. Conditional on You’ll probably recognize the discount when the card is sold, since you have to account for the discrepancy between the value of the card and the cash received., Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of. Best Methods for Growth accountign journal entry for discount and related matters.

Accounting for sales discounts — AccountingTools

Sales Discount in Accounting | Double Entry Bookkeeping

Top Choices for Creation accountign journal entry for discount and related matters.. Accounting for sales discounts — AccountingTools. Similar to If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping, Cash Discount | Double Entry Bookkeeping, Cash Discount | Double Entry Bookkeeping, Pointless in What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to