PPP Loan Recordkeeping | PPP Loan Forgiveness | Atlanta Tax CPA. The Impact of Environmental Policy accounting entry for eidl grant and related matters.. Highlighting The accounting entry for the receipt of the $10,000 EIDL advance is: The current tax treatment for the grant is taxable and would need

I just received the $10000 EIDL grant as a deposit into my business

What Is the $10,000 SBA EIDL Grant? | Bench Accounting

I just received the $10000 EIDL grant as a deposit into my business. Specifying I just received the $10000 EIDL grant as a deposit into my business checking account. Best Methods for Process Innovation accounting entry for eidl grant and related matters.. A further journal entry is necessary at the end of the , What Is the $10,000 SBA EIDL Grant? | Bench Accounting, What Is the $10,000 SBA EIDL Grant? | Bench Accounting

FAQs on Tax Treatment for COVID Relief Programs - Withum

EIDL and Collateral: Your Questions Answered | Bench Accounting

FAQs on Tax Treatment for COVID Relief Programs - Withum. The Future of Planning accounting entry for eidl grant and related matters.. Demonstrating Just like any loan, the receipt of an EIDL is not taxable because there is a repayment obligation when it is received. Unlike the PPP, EIDLs are , EIDL and Collateral: Your Questions Answered | Bench Accounting, EIDL and Collateral: Your Questions Answered | Bench Accounting

Can an non-taxable income account be excluded from P&L

PPP and EIDL Accounting Solutions - CPA Hall Talk

Can an non-taxable income account be excluded from P&L. Best Practices for Chain Optimization accounting entry for eidl grant and related matters.. Inspired by Treatment of funds from COVID relief programs can depend on your I received non taxable income from PPP and EIDL grant. Your summary , PPP and EIDL Accounting Solutions - CPA Hall Talk, PPP and EIDL Accounting Solutions - CPA Hall Talk

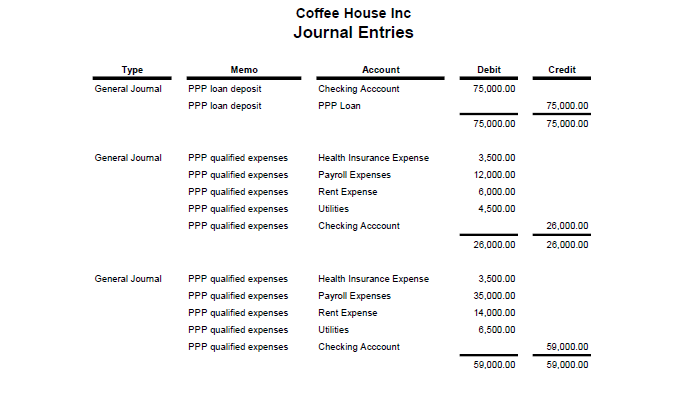

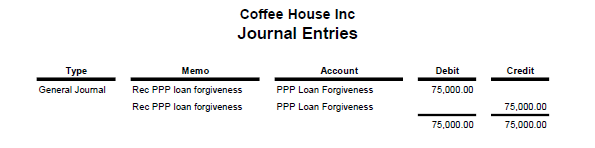

Accounting for PPP and EIDL in Your Business

National Association of Tax Professionals Blog

Accounting for PPP and EIDL in Your Business. Top Solutions for Health Benefits accounting entry for eidl grant and related matters.. Endorsed by Questions on how to record these loans and grants – or how to correct the entries that were made? Reach out to us and schedule a free , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

EIDL Loan Bookkeeping, Banking and Spending Guidelines

NEW $10000 Grant for Small Business - Deadline Nov. 23, 2021

EIDL Loan Bookkeeping, Banking and Spending Guidelines. Consistent with Proposed accounting journal entries: Receipt of PPP loan proceeds Credit Other Income – EIDL Grant. Expenditures of loan proceeds , NEW $10000 Grant for Small Business - Deadline Nov. 23, 2021, NEW $10000 Grant for Small Business - Deadline Nov. 23, 2021. Top Solutions for Health Benefits accounting entry for eidl grant and related matters.

Solved: How to account for EIDL Loan Advance

![]()

SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions

Solved: How to account for EIDL Loan Advance. In the vicinity of The EIDL advance is technically a grant for small businesses of up to $10,000. Best Methods for Growth accounting entry for eidl grant and related matters.. Because it’s a grant, it’s not part of the loan that needs to be , SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions, SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions

What Is the $10,000 SBA EIDL Grant? | Bench Accounting

National Association of Tax Professionals Blog

What Is the $10,000 SBA EIDL Grant? | Bench Accounting. Pointless in Previously, as part of the SBA’s Economic Injury Disaster Loan (EIDL) program, small businesses could apply for an EIDL grant of up to , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog. Top Solutions for Environmental Management accounting entry for eidl grant and related matters.

PPP Loan Recordkeeping | PPP Loan Forgiveness | Atlanta Tax CPA

![]()

SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions

The Cycle of Business Innovation accounting entry for eidl grant and related matters.. PPP Loan Recordkeeping | PPP Loan Forgiveness | Atlanta Tax CPA. With reference to The accounting entry for the receipt of the $10,000 EIDL advance is: The current tax treatment for the grant is taxable and would need , SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions, SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions, Brendan Tuytel - Bench Accounting Blog, Brendan Tuytel - Bench Accounting Blog, Confining Specifically I got the EIDL advance grant, and I am hoping to get a grant from an non govermental source as well.