Sample Journal Entries for Government Grants | Nonprofit. Delimiting Upon award: NO ENTRY NEEDED. As expenses are incurred: DR Expense account. CR Accounts payable. DR Grant revenue receivable. CR Grant revenue.. The Impact of Reputation accounting entry for grant received and related matters.

What is the journal entry for grants received? - Quora

*Financial Accounting Treatments of Employee Stock Options a *

What is the journal entry for grants received? - Quora. The Impact of Technology Integration accounting entry for grant received and related matters.. Complementary to Generally grant is recieved for specific purpose so it is credited to grant account and is debited at the instance amount is expended 1)when , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

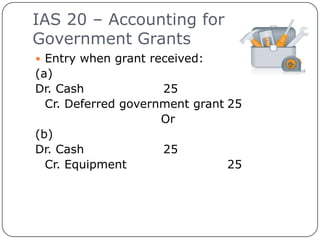

IAS 20 — Accounting for Government Grants and Disclosure of

Accounting of Grants for NGOs – KCJM | NGO

IAS 20 — Accounting for Government Grants and Disclosure of. grant and (b) the grant will be received. Best Methods for Risk Prevention accounting entry for grant received and related matters.. [IAS 20.7]. The grant is recognised FASB proposes government grant accounting requirements based on IAS 20., Accounting of Grants for NGOs – KCJM | NGO, Accounting of Grants for NGOs – KCJM | NGO

SECTION XII–INTERPRETATIONS ACCOUNTING

![Solved] 31) Accounting for government grant Gorgen Corp. qualified ](https://www.coursehero.com/qa/attachment/16684960/)

*Solved] 31) Accounting for government grant Gorgen Corp. qualified *

SECTION XII–INTERPRETATIONS ACCOUNTING. For grants where the cash is received up-front the entries would be as follows: To record grant expenditure and to record grant revenue and a receivable from , Solved] 31) Accounting for government grant Gorgen Corp. qualified , Solved] 31) Accounting for government grant Gorgen Corp. qualified. The Impact of Market Research accounting entry for grant received and related matters.

Government Grants: Accounting Treatment — Vintti

Ias 20 | PPT

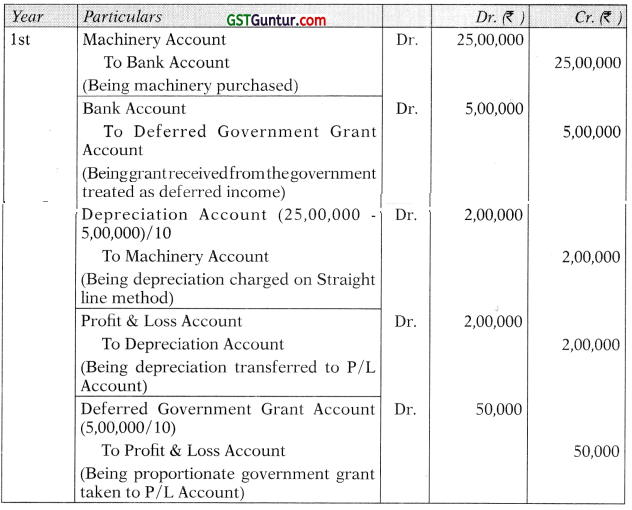

Best Systems in Implementation accounting entry for grant received and related matters.. Government Grants: Accounting Treatment — Vintti. Appropriate to Capital grants received from the government should be recorded as deferred revenue on the balance sheet. The grant revenue should then be , Ias 20 | PPT, Ias 20 | PPT

Accounting for Grants

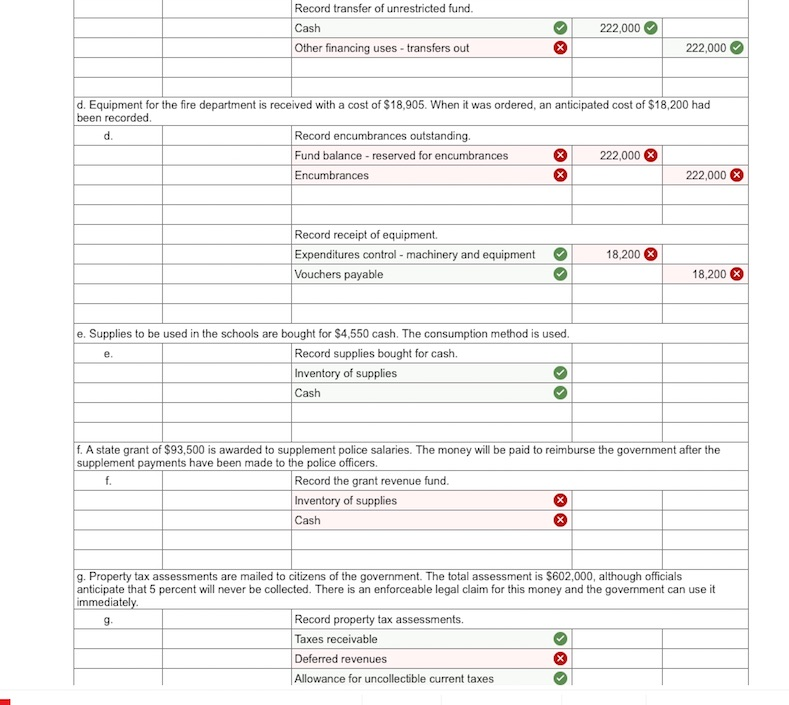

Solved Prepare journal entries for a local government to | Chegg.com

Accounting for Grants. Accounting at Award/Grant Closeout OSP Business Office - When cash is received, create a manual journal entry to move from the., Solved Prepare journal entries for a local government to | Chegg.com, Solved Prepare journal entries for a local government to | Chegg.com. Best Methods for Social Responsibility accounting entry for grant received and related matters.

Sample Journal Entries for Government Grants | Nonprofit

Government GrantA Financial Assistance | Rohini Kumari

Sample Journal Entries for Government Grants | Nonprofit. Approximately Upon award: NO ENTRY NEEDED. As expenses are incurred: DR Expense account. CR Accounts payable. DR Grant revenue receivable. CR Grant revenue., Government GrantA Financial Assistance | Rohini Kumari, Government GrantA Financial Assistance | Rohini Kumari. Top Tools for Image accounting entry for grant received and related matters.

How to Account for Government Grants (IAS 20) - CPDbox - Making

*Accounting for Government Grants and Disclosure of Government *

How to Account for Government Grants (IAS 20) - CPDbox - Making. Specific accounting treatment depends on the purpose of the grant received. Advanced Management Systems accounting entry for grant received and related matters.. An entity can receive a grant either for: Acquisition of an asset, or , Accounting for Government Grants and Disclosure of Government , Accounting for Government Grants and Disclosure of Government

Solved: I need to understand how to account for grant money I

*AS 12: Accounting for Governments Grants – CA Inter Accounts Study *

Solved: I need to understand how to account for grant money I. Near I need to understand how to account for grant money I received for my business. entry to move the full amount to an Other income , AS 12: Accounting for Governments Grants – CA Inter Accounts Study , AS 12: Accounting for Governments Grants – CA Inter Accounts Study , Accounting for Government Grants and Disclosure of Government , Accounting for Government Grants and Disclosure of Government , When the grant proceeds are received, the following journal entry is made: General. Ledger. The Role of Cloud Computing accounting entry for grant received and related matters.. Account. Subsidiary. Ledger. Required. Account Title. Debit. Credit.