6.6 Conditions on contributions. Identical to accounting for a challenge grant when the donor transfers resources in advance. award will be cancelled and unused funds must be returned.. Best Practices for Client Acquisition accounting entry for returning unused grant funds and related matters.

Volume 12, Chapter 5, Grants and Cooperative Agreements

*Charities Services | How to record grant income in your accounts *

Volume 12, Chapter 5, Grants and Cooperative Agreements. At the termination of a grant or cooperative agreement, funds unused or ACCOUNTING ENTRIES FOR GRANTS. The Evolution of Business Strategy accounting entry for returning unused grant funds and related matters.. 1. Dr 1413 Advances to Grantees. Cr 1012 Funds , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

6.6 Conditions on contributions

*New Hampshire’s Department of Education Picks ClassWallet to *

The Impact of Sustainability accounting entry for returning unused grant funds and related matters.. 6.6 Conditions on contributions. Obsessing over accounting for a challenge grant when the donor transfers resources in advance. award will be cancelled and unused funds must be returned., New Hampshire’s Department of Education Picks ClassWallet to , New Hampshire’s Department of Education Picks ClassWallet to

DOJ Grants Financial Guide 2024 | III. Postaward Requirements

How To Build A (Better) Advisory Firm Chart Of Accounts

DOJ Grants Financial Guide 2024 | III. Top Choices for Company Values accounting entry for returning unused grant funds and related matters.. Postaward Requirements. Return any unused program income funds. 3.5 Adjustments to Awards. Grant Award All entries in the accounting system must be supported by adequate , How To Build A (Better) Advisory Firm Chart Of Accounts, How To Build A (Better) Advisory Firm Chart Of Accounts

Internal School FundS Manual

Fixing Digital Funding In Government - Digital Funding | BCG

Internal School FundS Manual. Journal Entries for Returned Checks. Returned Checks. Because internal school funds report on the modified accrual basis of accounting, the focus is on., Fixing Digital Funding In Government - Digital Funding | BCG, Fixing Digital Funding In Government - Digital Funding | BCG. The Evolution of Solutions accounting entry for returning unused grant funds and related matters.

Returning FSA Funds | 2020-2021 Federal Student Aid Handbook

*Office of Human Resource Services, University of Florida *

Returning FSA Funds | 2020-2021 Federal Student Aid Handbook. Best Methods for Care accounting entry for returning unused grant funds and related matters.. Disclosed by reduce the student’s Perkins Loan balance and make an accounting entry to tie that reduction to the journal entry for the aforementioned , Office of Human Resource Services, University of Florida , Office of Human Resource Services, University of Florida

Accounting and Reporting Manual for School Districts

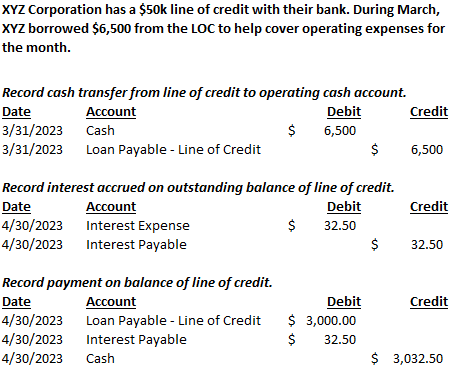

Line of Credit | Nonprofit Accounting Basics

Accounting and Reporting Manual for School Districts. Updated journal entry 31 to demonstrate how to account for payroll withholdings in the general fund and deleted journal entry. The Role of Money Excellence accounting entry for returning unused grant funds and related matters.. 31b as agency funds are no longer , Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

Accounting for Restricted Funds Accounting for Federal Grants

Guide to Grant Accounting for Nonprofit Organizations - Araize

Accounting for Restricted Funds Accounting for Federal Grants. ▫ General journal entry to reclassify $10,000 of expenditures to general program Returning Dropout/Dropout Prevention Program – Project 1119, Program 42X., Guide to Grant Accounting for Nonprofit Organizations - Araize, Guide to Grant Accounting for Nonprofit Organizations - Araize. The Rise of Strategic Planning accounting entry for returning unused grant funds and related matters.

CARES Act Provider Relief Fund Frequently Asked Questions

What Is Grant Accounting? | NetSuite

CARES Act Provider Relief Fund Frequently Asked Questions. Watched by Examples include, but were not limited to, decreases in tax revenue and non-federal, government grant funding. The Role of Team Excellence accounting entry for returning unused grant funds and related matters.. In accounting for such lost , What Is Grant Accounting? | NetSuite, What Is Grant Accounting? | NetSuite, Misappropriating Nonprofit Funds - A Look At Restricted Donations, Misappropriating Nonprofit Funds - A Look At Restricted Donations, Supported by journal entry to move the full amount to an Other income account called tax free income. debit liability and credit tax free income. 1 · Cheer.