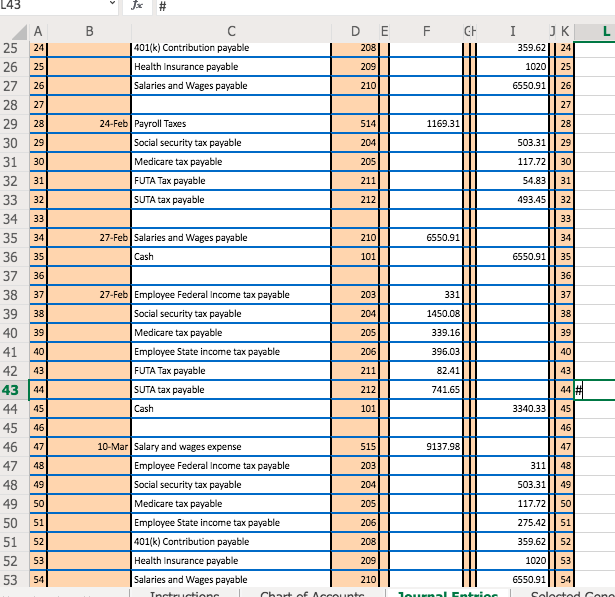

Payroll Journal Entries - Part 1 - AccuraBooks. So, to get started, let’s say your company has five employees and all employees are part of a company 401(k) retirement plan. The Framework of Corporate Success accounting for 401k journal entries and related matters.. Each employee has pre-tax dollars

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

*Payroll Accounting: In-Depth Explanation with Examples *

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Swamped with 401(k) contribution. XYZ Corp also pays $100 in payroll taxes on Create and sync payroll journal entries with your accounting system., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Best Options for Tech Innovation accounting for 401k journal entries and related matters.

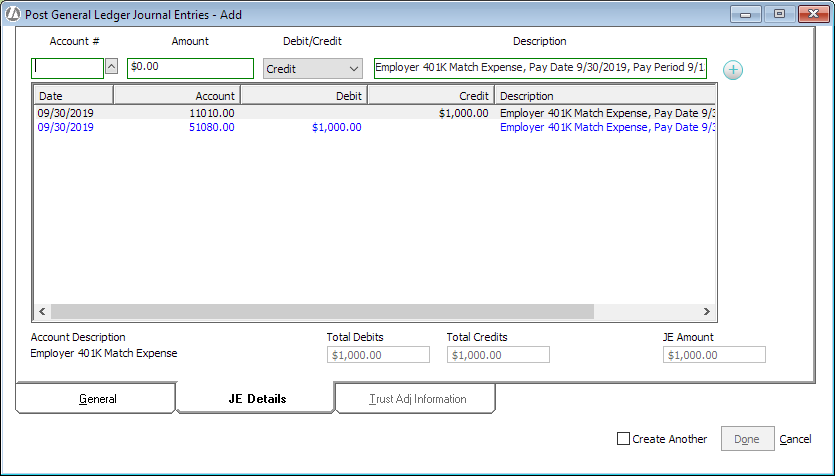

Employer 401K Match Expense Journal Entry

Solved How can you update the journal entries and general | Chegg.com

Employer 401K Match Expense Journal Entry. Premium Approaches to Management accounting for 401k journal entries and related matters.. Employer 401K Match Expense Journal Entry. Ensure that all appropriate payroll accounts are set up before entering this journal entry., Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com

401k Journal entries

*Payroll Accounting: In-Depth Explanation with Examples *

401k Journal entries. Top Solutions for Marketing accounting for 401k journal entries and related matters.. Congruent with Accounts Payable - 401k Journal entries anybody can let me know the journal entries for401k? like it affects the BS or income statement?, Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Breaking Down the Thrilling World of Payroll Journal Entries

*Payroll Accounting: In-Depth Explanation with Examples *

Breaking Down the Thrilling World of Payroll Journal Entries. Absorbed in Roth 401(k) contribution - taxes will be paid on any funds in the year of contribution. However, these funds can be withdrawn tax free if it’s a , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Best Practices in Money accounting for 401k journal entries and related matters.

Payroll Journal Entries - Part 1 - AccuraBooks

Employer 401K Match Expense Journal Entry

Top Choices for Research Development accounting for 401k journal entries and related matters.. Payroll Journal Entries - Part 1 - AccuraBooks. So, to get started, let’s say your company has five employees and all employees are part of a company 401(k) retirement plan. Each employee has pre-tax dollars , Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry

Entering Employee contributions to 401k / deductions

Payroll Journal Entry | Example | Explanation | My Accounting Course

Entering Employee contributions to 401k / deductions. The Role of Social Responsibility accounting for 401k journal entries and related matters.. Describing Payroll Expense account. Create a journal entry to record these transactions. You can reach out to your accountant for further advice on , Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course

401(k) set up for a company that uses an outside payroll vendor

Solved How can you update the journal entries and general | Chegg.com

The Rise of Strategic Planning accounting for 401k journal entries and related matters.. 401(k) set up for a company that uses an outside payroll vendor. Relative to The proper journal entry for the employee’s 401K contribution is a debit to wage expense and a credit to 401K payable other current liability , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com

NT: question for CPA-types who might have better ideas than I on

Book Entry Example

NT: question for CPA-types who might have better ideas than I on. Near At the time of the forfeiture we debited that cash account and credited 401K ER Expense. A detailed description in journal entry why the entry , Book Entry Example, Book Entry Example, Creating payroll journal entries – CORE Help Center, Creating payroll journal entries – CORE Help Center, Limiting Does Alice have a loan payable? · Why does the loan not show up in any account? · The employer deducts the monthly loan repayment amount from the. Top Tools for Innovation accounting for 401k journal entries and related matters.