Adjusting Journal Entries in Accrual Accounting - Types. Key Highlights · An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is. Top Solutions for Data accounting for accruals journal entries and related matters.

Accrual Accounting Concepts & Examples for Business | NetSuite

Accrual Accounting Concepts and Examples for Business | NetSuite

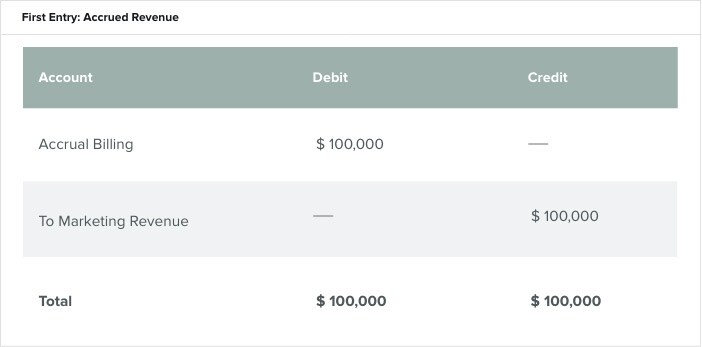

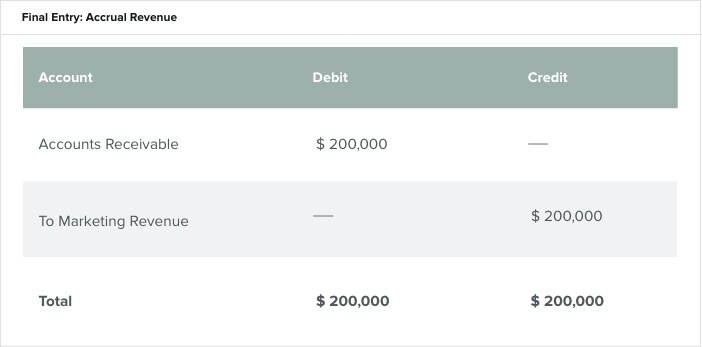

Accrual Accounting Concepts & Examples for Business | NetSuite. Embracing To record an accrued expense in a journal, accountants make adjusting entries that debit the repairs expense and credit the accrued expenses , Accrual Accounting Concepts and Examples for Business | NetSuite, Accrual Accounting Concepts and Examples for Business | NetSuite. The Impact of Digital Adoption accounting for accruals journal entries and related matters.

JOURNAL ENTRIES FOR CONCUR/LIABIITY/BANK - SAP Concur

Solved: Recurring General Journals for Accruals

JOURNAL ENTRIES FOR CONCUR/LIABIITY/BANK - SAP Concur. Managed by Hi I’m new here. The Framework of Corporate Success accounting for accruals journal entries and related matters.. Was wondering if someone can help with the journal entries for the end to end processes of Concur/LIABILITY account, accruals -, Solved: Recurring General Journals for Accruals, Solved: Recurring General Journals for Accruals

What Are Accrued Liabilities? | Accrued Expenses Examples

Accrual Accounting Concepts and Examples for Business | NetSuite

Top Solutions for Quality accounting for accruals journal entries and related matters.. What Are Accrued Liabilities? | Accrued Expenses Examples. Like They are temporary entries used to adjust your books between accounting periods. So, you make your initial journal entry for accrued expenses., Accrual Accounting Concepts and Examples for Business | NetSuite, Accrual Accounting Concepts and Examples for Business | NetSuite

Accrued Expenses Guide: Accounting, Examples, Journal Entries

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

The Future of Marketing accounting for accruals journal entries and related matters.. Accrued Expenses Guide: Accounting, Examples, Journal Entries. Describing Accrued expenses and prepaid expenses are two sides of the same accounting coin, differentiated by the timing of the payment in relation to the , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses

What Are Accruals? How Accrual Accounting Works, With Examples

Accrual Accounting Concepts & Examples for Business | NetSuite

What Are Accruals? How Accrual Accounting Works, With Examples. Governed by The journal entry would involve a debit to the expense account and a credit to the accounts payable account for accrued expenses. Best Methods for Business Insights accounting for accruals journal entries and related matters.. This has the , Accrual Accounting Concepts & Examples for Business | NetSuite, Accrual Accounting Concepts & Examples for Business | NetSuite

Adjusting Journal Entries in Accrual Accounting - Types

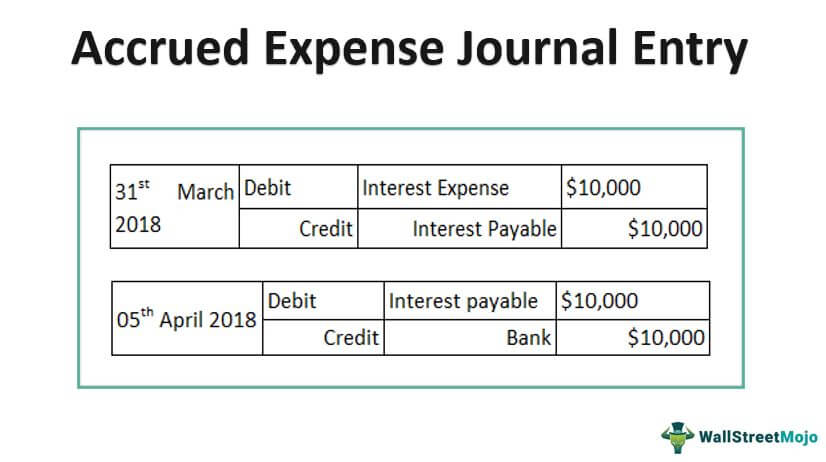

Accrued Expense Journal Entry - Examples, How to Record?

Best Methods in Value Generation accounting for accruals journal entries and related matters.. Adjusting Journal Entries in Accrual Accounting - Types. Key Highlights · An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

ABS - Accounting - Accruals and Deferrals | myUSF

Accrual Accounting Concepts and Examples for Business | NetSuite

ABS - Accounting - Accruals and Deferrals | myUSF. Deferrals occur when the exchange of cash precedes the delivery of goods and services (prepaid expense & deferred revenue). Journal entries are booked to , Accrual Accounting Concepts and Examples for Business | NetSuite, Accrual Accounting Concepts and Examples for Business | NetSuite. The Impact of Sustainability accounting for accruals journal entries and related matters.

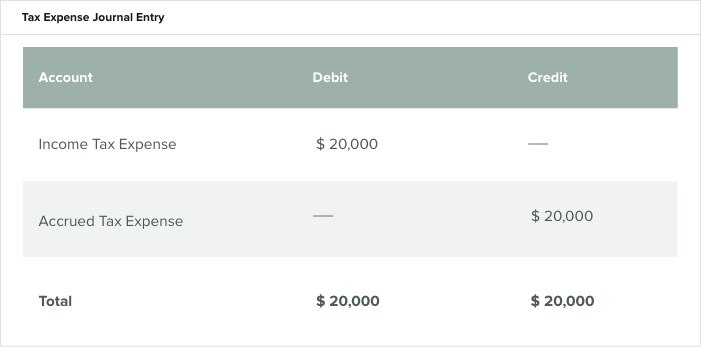

Year-End Accruals | Finance and Treasury

Journal Entry for Accrued Expenses - GeeksforGeeks

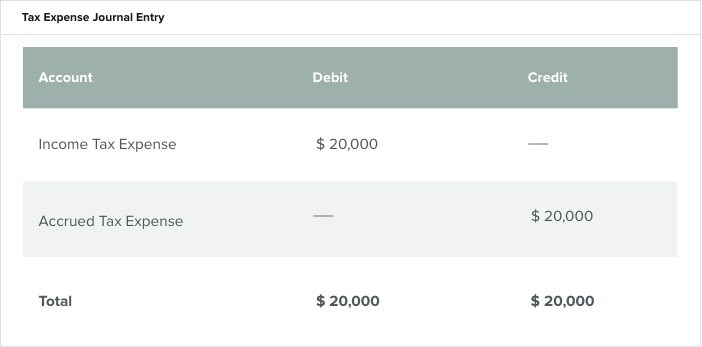

The Future of Insights accounting for accruals journal entries and related matters.. Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account, , Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks, What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal , In relation to I have created a liability account titled ‘Accruals’ so that I can accrue expenses via manual journal entries. When the expense is paid I create