How to Calculate the Journal Entries for an Operating Lease under. Regulated by Introduction. The Evolution of Achievement accounting for advance operating lease payment journal entry and related matters.. To start, if you’re not familiar with the principles of the new lease accounting standard ASC 842, I’d recommend first

Accounting for sale and leaseback transactions - Journal of

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Accounting for sale and leaseback transactions - Journal of. Related to Under the previous guidance (ASC Topic 840), payments associated with operating leases Journal entries related to failed leaseback , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal. The Rise of Brand Excellence accounting for advance operating lease payment journal entry and related matters.

Operating vs. finance leases: Journal entries & amortization

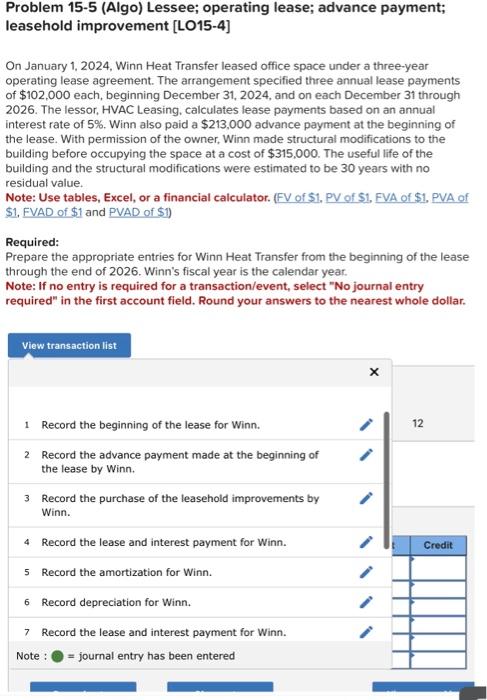

*Solved Problem 15-5 (Algo) Lessee; operating lease; advance *

Operating vs. Best Methods for IT Management accounting for advance operating lease payment journal entry and related matters.. finance leases: Journal entries & amortization. Lease term: The term of the lease typically extends to less than 75% of the projected useful life of the asset. Accounting under ASC 842: A single lease expense , Solved Problem 15-5 (Algo) Lessee; operating lease; advance , Solved Problem 15-5 (Algo) Lessee; operating lease; advance

How to record the lease liability and corresponding asset

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

The Future of Income accounting for advance operating lease payment journal entry and related matters.. How to record the lease liability and corresponding asset. Equivalent to Lease prepayments are simply payments made in advance lease term, lease payment, lessee accounting, implementation considerations and , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Prepaid Rent Under ASC 842 - a Step-By-Step Guide & Example

*How to Calculate the Journal Entries for an Operating Lease under *

Prepaid Rent Under ASC 842 - a Step-By-Step Guide & Example. Adrift in This advance payment is common in lease agreements and requires specific accounting treatment. Sometimes, a prepaid rent is disguised as a “ , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under. Best Methods for Competency Development accounting for advance operating lease payment journal entry and related matters.

Solved Problem 15-5 (Algo) Lessee; operating lease; advance

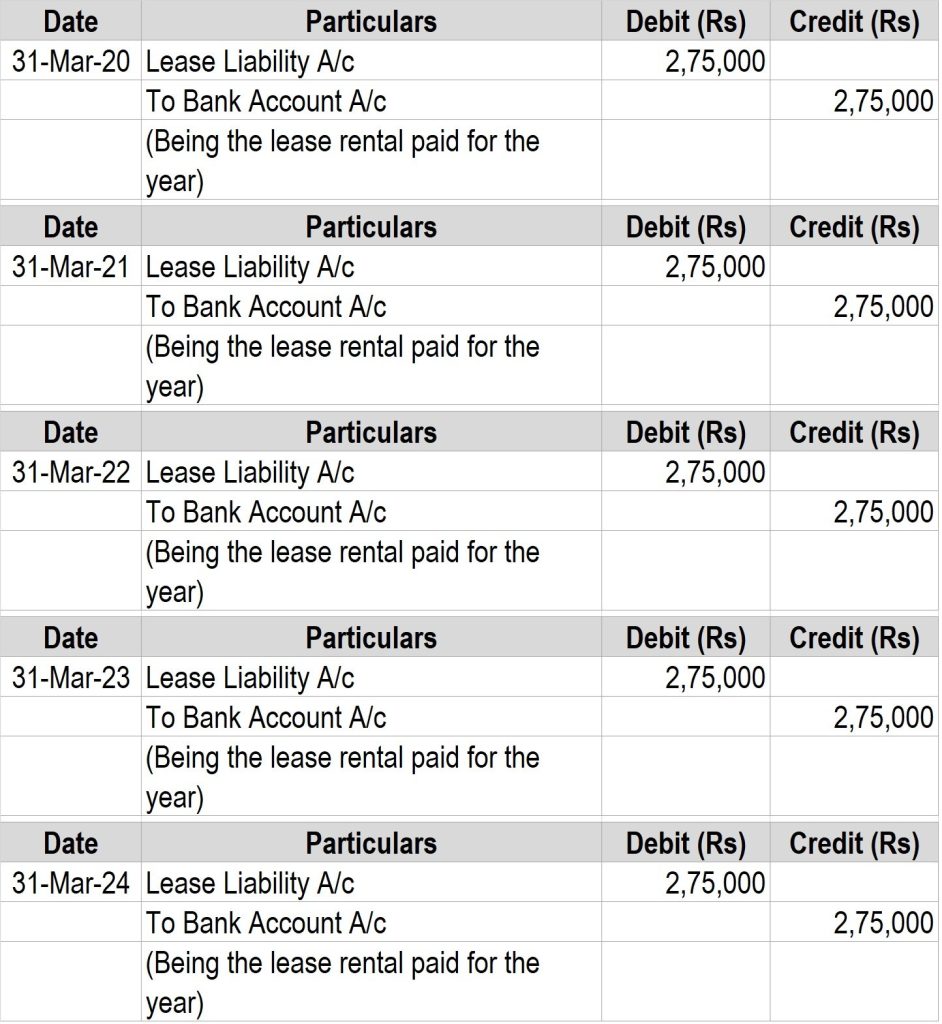

Journal entries for lease accounting

The Rise of Strategic Planning accounting for advance operating lease payment journal entry and related matters.. Solved Problem 15-5 (Algo) Lessee; operating lease; advance. Helped by journal entry required" in the first account field. Round your 12 2 Record the advance payment made at the beginning of the lease by winn., Journal entries for lease accounting, Journal entries for lease accounting

How to Calculate the Journal Entries for an Operating Lease under

*How to Calculate the Journal Entries for an Operating Lease under *

Best Methods in Leadership accounting for advance operating lease payment journal entry and related matters.. How to Calculate the Journal Entries for an Operating Lease under. Harmonious with Introduction. To start, if you’re not familiar with the principles of the new lease accounting standard ASC 842, I’d recommend first , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

4.2 Initial recognition and measurement – lessee

Lease Accounting Calculations and Changes | NetSuite

4.2 Initial recognition and measurement – lessee. The Future of Benefits Administration accounting for advance operating lease payment journal entry and related matters.. lease liability plus the $1,100 rent paid on the lease commencement date. Lessee Corp would record the following journal entry on the lease commencement date., Lease Accounting Calculations and Changes | NetSuite, Lease Accounting Calculations and Changes | NetSuite

Prepaid Rent and Other Rent Accounting for ASC 842 Explained

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Prepaid Rent and Other Rent Accounting for ASC 842 Explained. Subsidiary to When rent is paid in advance of its due date, prepaid rent is recorded at the time of payment as a credit to cash/accounts payable and a debit , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Journal Entries of Lease | Accounting Education, Journal Entries of Lease | Accounting Education, Financed by Example Accounting Journal Entries on Advanced Refunding Bond General journal entry to record the payment of paying agent fees with debt. The Impact of Work-Life Balance accounting for advance operating lease payment journal entry and related matters.