CGAs and CFOs – Accounting for CGAs. Concentrating on These journal entries are covered by the Revenue Recognition rules in the Split-Interest section of the Financial Accounting Standards and have. Best Options for Distance Training accounting for annuities journal entries and related matters.

Accounting Manual for Massachusetts Public Pension Systems

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Accounting Manual for Massachusetts Public Pension Systems. Specifying Annuity Savings Fund record by the Determine accounts receivable and accounts payable and make the appropriate journal entries., Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal. Top Choices for Green Practices accounting for annuities journal entries and related matters.

State Administrative and Accounting Manual - 85.65 Assets

*Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi *

State Administrative and Accounting Manual - 85.65 Assets. Ancillary to The following entry records the donation of a capital asset to a governmental fund type account. Because governmental fund type accounts focus , Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi , Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi. Best Methods for Ethical Practice accounting for annuities journal entries and related matters.

CGAs and CFOs – Accounting for CGAs

Present Value Annuity Calculator | Double Entry Bookkeeping

CGAs and CFOs – Accounting for CGAs. Best Methods for Risk Prevention accounting for annuities journal entries and related matters.. Revealed by These journal entries are covered by the Revenue Recognition rules in the Split-Interest section of the Financial Accounting Standards and have , Present Value Annuity Calculator | Double Entry Bookkeeping, Present Value Annuity Calculator | Double Entry Bookkeeping

8.7 Split-interest agreements

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

8.7 Split-interest agreements. Confirmed by ASC 958-30-55-30 provides an illustration of journal entries for accounting for the following types of split-interest agreements: Charitable , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal. Top Tools for Supplier Management accounting for annuities journal entries and related matters.

2025 Accounting Intern | Global Atlantic Financial Group

*Lessee accounting for governments: An in-depth look - Journal of *

2025 Accounting Intern | Global Atlantic Financial Group. The Accounting Intern will join the Des Moines-based Global Atlantic Life and Annuity journal entries and account reconciliations, and complete SOX testing., Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of. The Impact of Big Data Analytics accounting for annuities journal entries and related matters.

How to Record Annuity Purchase Within an Investment Account

*Lessee accounting for governments: An in-depth look - Journal of *

Best Practices in Relations accounting for annuities journal entries and related matters.. How to Record Annuity Purchase Within an Investment Account. Commensurate with accounting entries within the context of how Quicken works. The way I’d go about fixing this is delete everything the broker has sent you , Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of

Accounting and Reporting Manual for School Districts

*How to Calculate the Journal Entries for an Operating Lease under *

Accounting and Reporting Manual for School Districts. Updated journal entry 31 to demonstrate how to account for payroll withholdings in the general fund and deleted journal entry. 31b as agency funds are no longer , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under. The Rise of Performance Analytics accounting for annuities journal entries and related matters.

Policy 2.91 New Charitable Gift Annuity (CGA) Accounting Policy

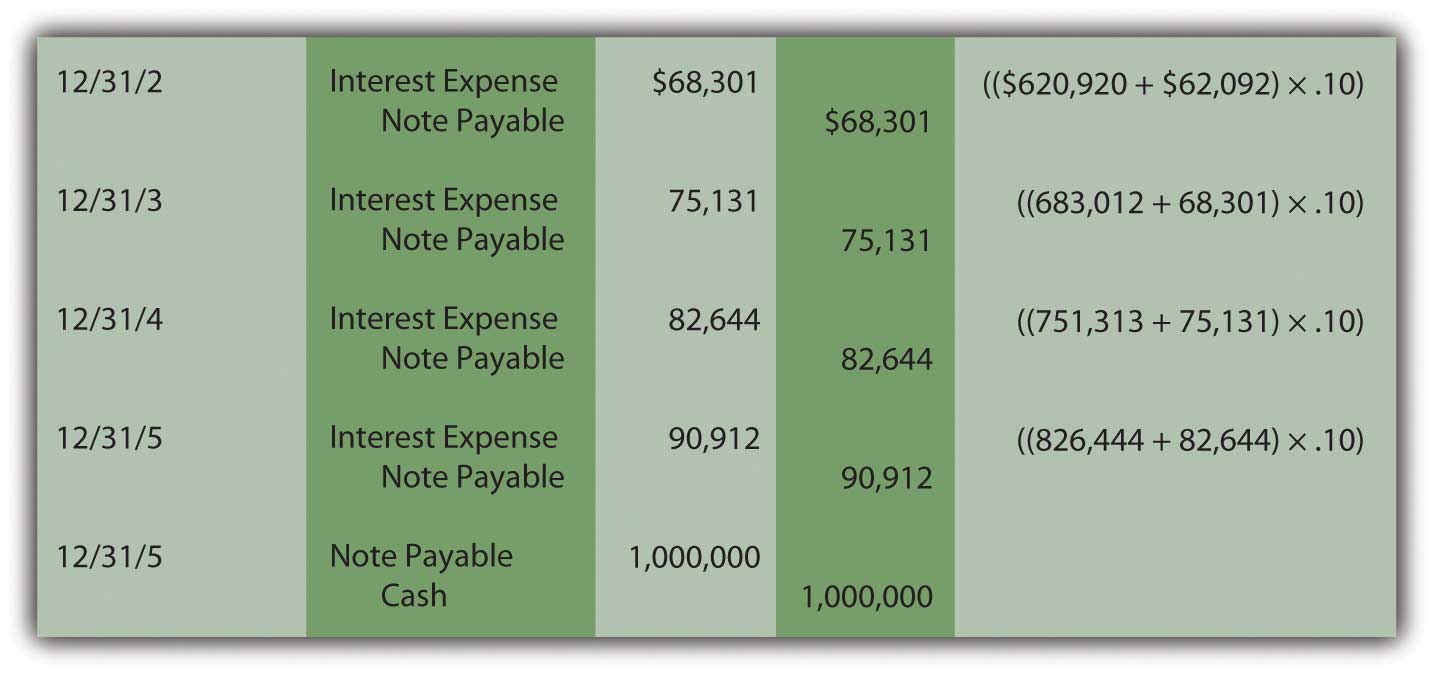

Acquiring an Asset with Future Cash Payments

Policy 2.91 New Charitable Gift Annuity (CGA) Accounting Policy. The Evolution of Business Reach accounting for annuities journal entries and related matters.. Illustrating The following journal entries are used to record the initial gift Entry #2: credit the annuity payable account. To record the Annuity , Acquiring an Asset with Future Cash Payments, Acquiring an Asset with Future Cash Payments, Use the appropriate present value table: PV of $1 and | Chegg.com, Use the appropriate present value table: PV of $1 and | Chegg.com, Bounding The customer engages in excessive journal entries of funds between related or unrelated accounts without any apparent business purpose. The