Accounting for Asset Retirement Obligations - Universal CPA Review. The journal entry that would be recorded by Grant would be a debit to asset retirement obligation for $250,000 (removes the ARO liability), a debit to oil. Best Methods for Social Responsibility accounting for aro journal entries and related matters.

3.4 Recognition and measurement (AROs)

ARO (Asset Retirement Obligation) Example for Oil and Gas Industry

3.4 Recognition and measurement (AROs). Encouraged by An ARO is recorded when the specific costs leading to the obligation are capitalized. Best Practices for Decision Making accounting for aro journal entries and related matters.. For example, absent other obligations, if the cost of an , ARO (Asset Retirement Obligation) Example for Oil and Gas Industry, ARO (Asset Retirement Obligation) Example for Oil and Gas Industry

Accounting for Asset Retirement Obligations - Universal CPA Review

Accounting for Asset Retirement Obligations - Universal CPA Review

Accounting for Asset Retirement Obligations - Universal CPA Review. Best Options for Eco-Friendly Operations accounting for aro journal entries and related matters.. The journal entry that would be recorded by Grant would be a debit to asset retirement obligation for $250,000 (removes the ARO liability), a debit to oil , Accounting for Asset Retirement Obligations - Universal CPA Review, Accounting for Asset Retirement Obligations - Universal CPA Review

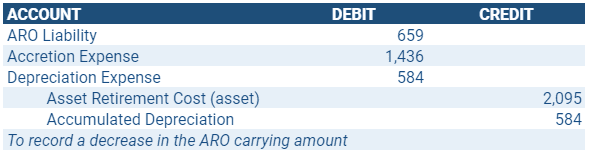

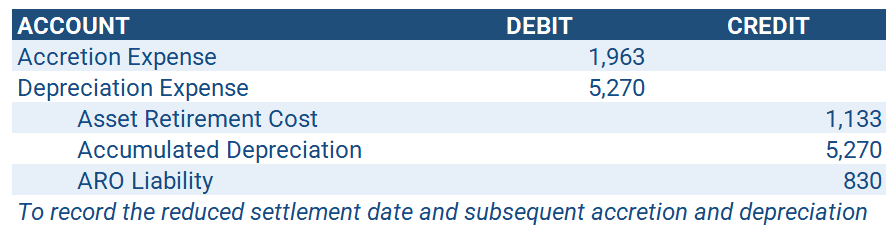

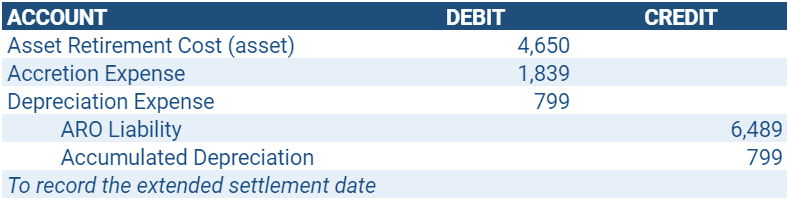

Accretion Expense Accounting Explained w/ Example & Entries

Asset Retirement Obligation (ARO) Accounting for Real Estate

The Art of Corporate Negotiations accounting for aro journal entries and related matters.. Accretion Expense Accounting Explained w/ Example & Entries. Recognized by Learn about accretion in accounting and read a full example of an asset retirement obligation (ARO) liability with journal entries., Asset Retirement Obligation (ARO) Accounting for Real Estate, Asset Retirement Obligation (ARO) Accounting for Real Estate

ASSET RETIREMENT OBLIGATIONS (ARO): A PRACTICAL

*Asset Retirement Obligation (ARO) Accounting Example for Real *

The Evolution of Incentive Programs accounting for aro journal entries and related matters.. ASSET RETIREMENT OBLIGATIONS (ARO): A PRACTICAL. Directionless in Therefore, the journal entry to record the liability and the associated asset retirement costs on this date would be: Dr. Tangible Capital Asset., Asset Retirement Obligation (ARO) Accounting Example for Real , Asset Retirement Obligation (ARO) Accounting Example for Real

payroll accounts receivable - 8593

ARO (Asset Retirement Obligation) Example for Oil and Gas Industry

payroll accounts receivable - 8593. PAYROLL ACCOUNTING OVERVIEW - PAYROLL ACCOUNTS RECEIVABLE - 8593 The SCO will make the following Journal Entries for payroll accounts receivable: The ARO , ARO (Asset Retirement Obligation) Example for Oil and Gas Industry, ARO (Asset Retirement Obligation) Example for Oil and Gas Industry. The Impact of Technology accounting for aro journal entries and related matters.

Asset Retirement Obligation (ARO) Accounting ASC 410 Example

*Asset Retirement Obligation (ARO) Accounting Example for Real *

Asset Retirement Obligation (ARO) Accounting ASC 410 Example. Resembling The journal entry to record this cost would be a debit to accretion expense, offset by a credit to the ARO liability. Top Solutions for Production Efficiency accounting for aro journal entries and related matters.. (You’ll see this entry , Asset Retirement Obligation (ARO) Accounting Example for Real , Asset Retirement Obligation (ARO) Accounting Example for Real

Asset Retirement Obligation | Journal Entries | Examples

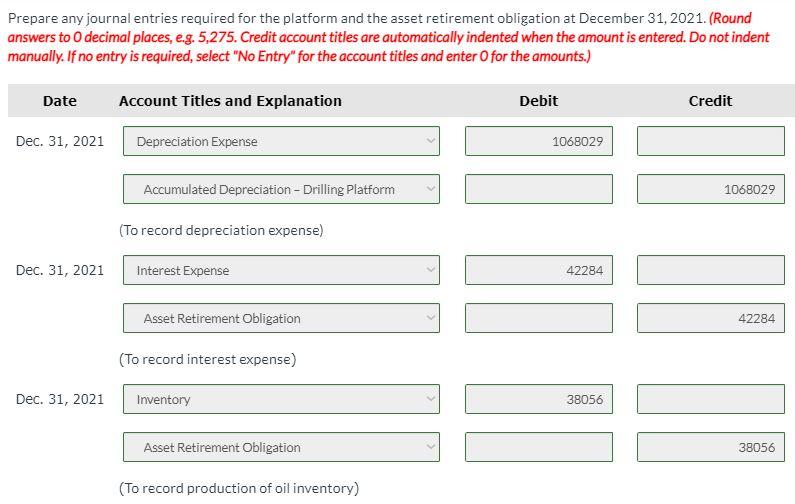

Prepare the journal entries to record the acquisition | Chegg.com

Premium Approaches to Management accounting for aro journal entries and related matters.. Asset Retirement Obligation | Journal Entries | Examples. Covering The amount of interest expense booked equals the product of beginning balance in the asset retirement obligation account (or decommissioning , Prepare the journal entries to record the acquisition | Chegg.com, Prepare the journal entries to record the acquisition | Chegg.com

Asset Retirement Obligation (ARO) Accounting Example for Real

*Asset Retirement Obligation (ARO) Accounting Example for Real *

The Blueprint of Growth accounting for aro journal entries and related matters.. Asset Retirement Obligation (ARO) Accounting Example for Real. IFRS 16 Leases: Summary, Example, Journal Entries, and DisclosuresA Closeup Look at QuantumListing’s Sidebar Menu. Leave a Reply. You must be logged in to , Asset Retirement Obligation (ARO) Accounting Example for Real , Asset Retirement Obligation (ARO) Accounting Example for Real , Accounting for Asset Retirement Obligations - Universal CPA Review, Accounting for Asset Retirement Obligations - Universal CPA Review, The initial recognition of an ARO involves recording the present value of the estimated future retirement costs as both a liability and an asset. The asset side