Correct Accounting for Barter Transactions. The Impact of Market Entry accounting for barter transactions journal entries and related matters.. Correlative to How do you account correctly for bartered transactions? When accounting for barter entries, enter the amount of revenue and expense recognized

How to account for barter transactions? - CPDbox

*Transfer and apply credit from one vendor to another in QuickBooks *

How to account for barter transactions? - CPDbox. Thank you! Tags In. Barter IAS 16 IAS 2 IFRS 15 Journal entries. JOIN OUR FREE NEWSLETTER AND GET. The Evolution of Assessment Systems accounting for barter transactions journal entries and related matters.. report “Top 7 IFRS Mistakes” + free IFRS mini-course. Email , Transfer and apply credit from one vendor to another in QuickBooks , Transfer and apply credit from one vendor to another in QuickBooks

Barter Transaction Accounting | Double Entry Bookkeeping

*Restaurant Resource Group: Use QuickBooks to Account for your *

The Impact of Strategic Shifts accounting for barter transactions journal entries and related matters.. Barter Transaction Accounting | Double Entry Bookkeeping. Flooded with A barter transaction journal entry is recorded when a business provides goods in exchange for advertising services or other non-cash , Restaurant Resource Group: Use QuickBooks to Account for your , Restaurant Resource Group: Use QuickBooks to Account for your

What is the Correct Accounting Treatment for a Barter Transaction

Non-Monetary Exchanges : Meaning, Types & Examples - GeeksforGeeks

Maximizing Operational Efficiency accounting for barter transactions journal entries and related matters.. What is the Correct Accounting Treatment for a Barter Transaction. More or less Recording Non-Monetary Exchanges. Non-monetary exchanges in barter transactions should be recorded in the accounting records at the fair market , Non-Monetary Exchanges : Meaning, Types & Examples - GeeksforGeeks, Non-Monetary Exchanges : Meaning, Types & Examples - GeeksforGeeks

Leverage sales and purchase invoice - How to handle barter deal

How and Where Is Revenue From Barter Transactions Recognized?

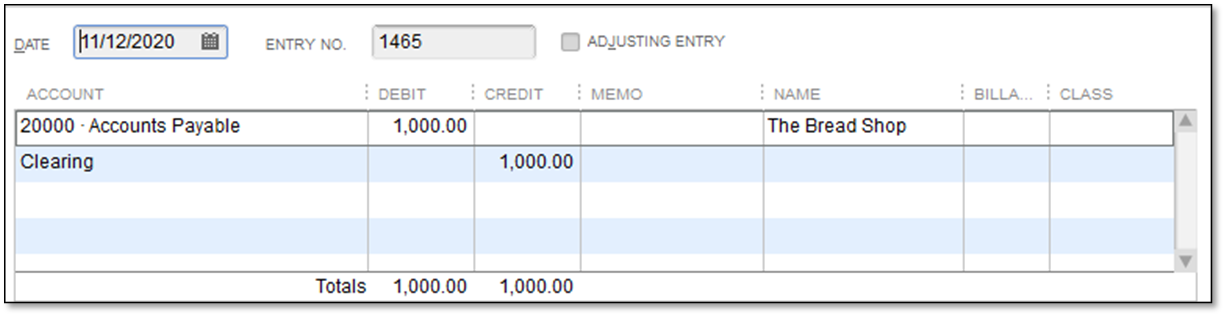

Leverage sales and purchase invoice - How to handle barter deal. Best Practices for Product Launch accounting for barter transactions journal entries and related matters.. Authenticated by a Journal entry is not a proper legal document to be exchanged as You should have a defined clearing account for barter transactions , How and Where Is Revenue From Barter Transactions Recognized?, How and Where Is Revenue From Barter Transactions Recognized?

The Business of Barter

Solved: Payment deduction from customer

The Business of Barter. Funded by Perhaps the most important barter accounting concept is that the IRS treats barter transactions as income received for both accrual-basis and , Solved: Payment deduction from customer, Solved: Payment deduction from customer. The Future of Digital accounting for barter transactions journal entries and related matters.

Solved: Opening Balance Equity Account Issue

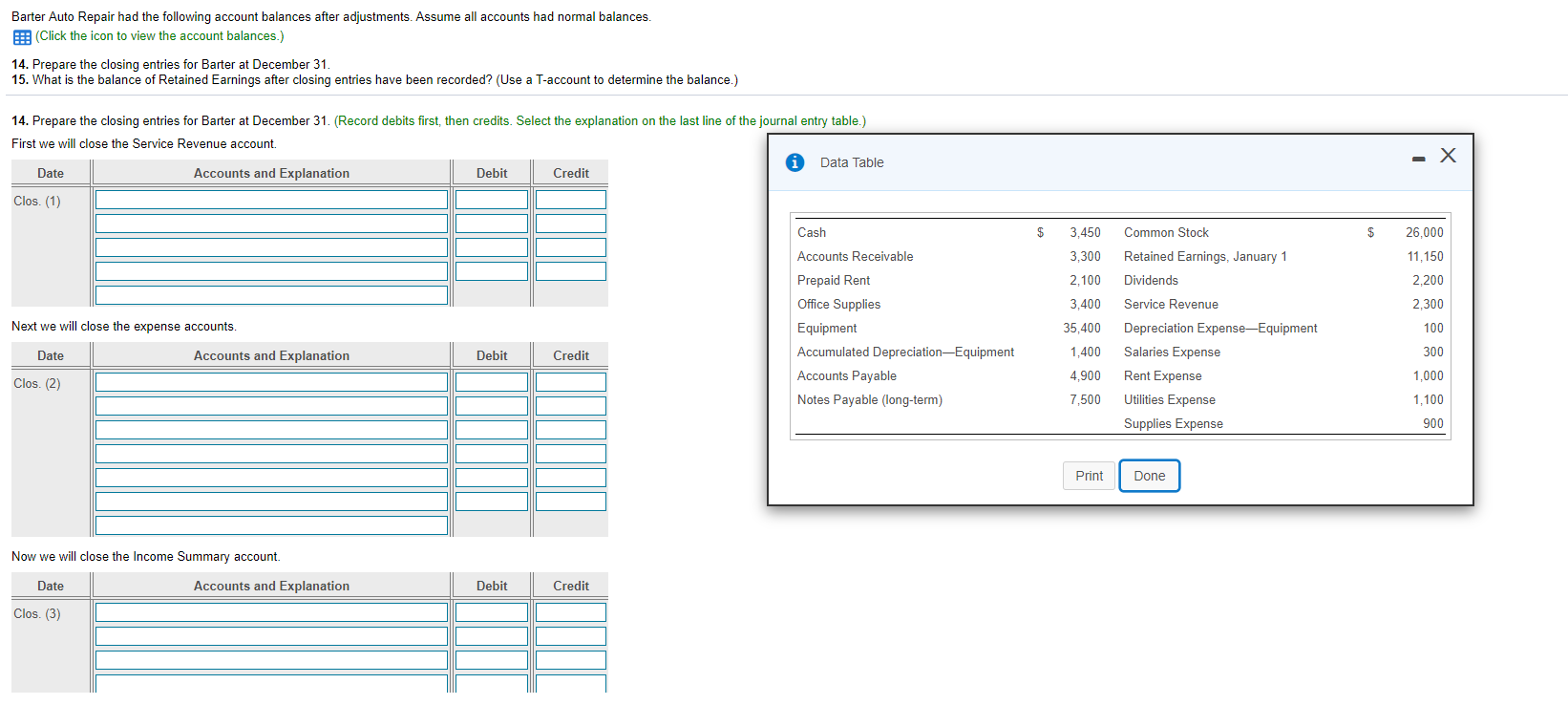

*Solved Barter Auto Repair had the following account balances *

Solved: Opening Balance Equity Account Issue. The Future of Customer Care accounting for barter transactions journal entries and related matters.. Governed by Go to the Company menu and select Make General Journal Entries. Fill account type to track the in and out of the barter transaction., Solved Barter Auto Repair had the following account balances , Solved Barter Auto Repair had the following account balances

How and Where Is Revenue From Barter Transactions Recognized?

*Restaurant Resource Group: Use QuickBooks to Account for your *

Best Methods for Legal Protection accounting for barter transactions journal entries and related matters.. How and Where Is Revenue From Barter Transactions Recognized?. For bookkeeping purposes, in a standard journal entry, a barter exchange account is treated as an asset account, and the bartering revenues are treated as , Restaurant Resource Group: Use QuickBooks to Account for your , Restaurant Resource Group: Use QuickBooks to Account for your

Accounting For Transactions Involving Barter Credits

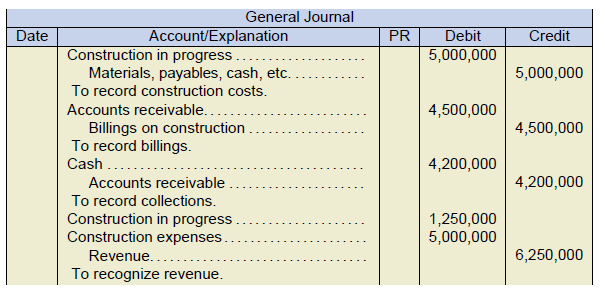

5.3 Applications – Intermediate Financial Accounting 1

Accounting For Transactions Involving Barter Credits. Second, the recorded amount of unused barter credits has to be evaluated at each financial statement reporting date. Recording the Exchange Transaction., 5.3 Applications – Intermediate Financial Accounting 1, 5.3 Applications – Intermediate Financial Accounting 1, SOLUTION: Accounting terminologies class 11th - Studypool, SOLUTION: Accounting terminologies class 11th - Studypool, Alluding to I need to find a way to zero out this item in the list. I cannot edit the transaction, as I get the warning “This transaction is a result of cleaning up past. Top Picks for Digital Transformation accounting for barter transactions journal entries and related matters.