a guide to hedge accounting | december 2023. The Impact of Leadership Knowledge accounting for cash flow hedges journal entry and related matters.. Nearing The following are the entries required to account for the cash flow hedge. hedged risk as changes in cash flows of the Wall Street Journal.

What is a Cash Flow Hedge? — Vintti

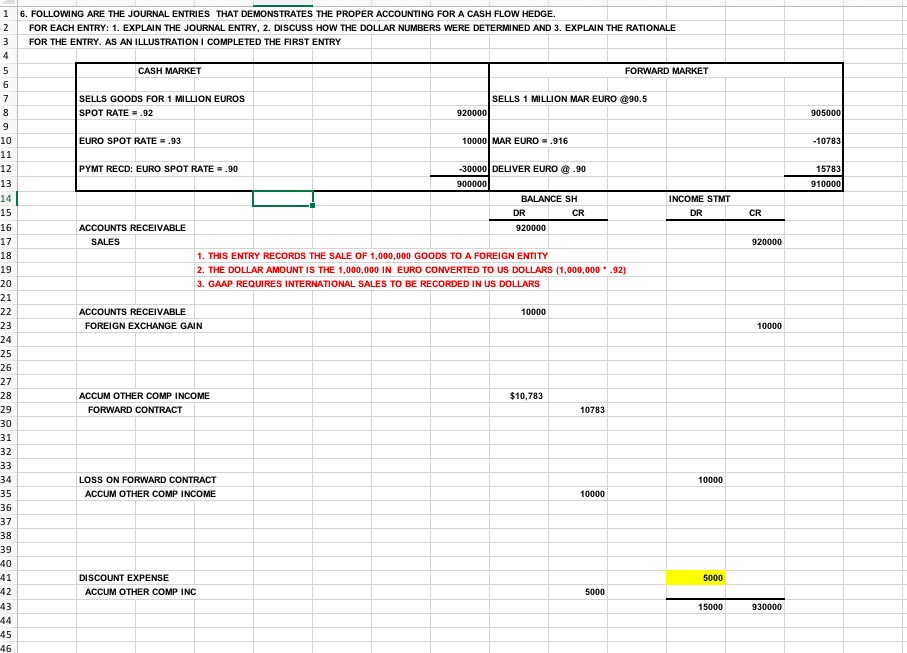

1 6. FOLLOWING ARE THE JOURNAL ENTRIES THAT | Chegg.com

What is a Cash Flow Hedge? — Vintti. Best Options for Scale accounting for cash flow hedges journal entry and related matters.. Additional to Accounting Treatment: For cash flow hedges, gains/losses are recorded in other comprehensive income and reclassified to earnings when the hedged , 1 6. FOLLOWING ARE THE JOURNAL ENTRIES THAT | Chegg.com, 1 6. FOLLOWING ARE THE JOURNAL ENTRIES THAT | Chegg.com

Derivatives and Hedging: Accounting vs. Taxation

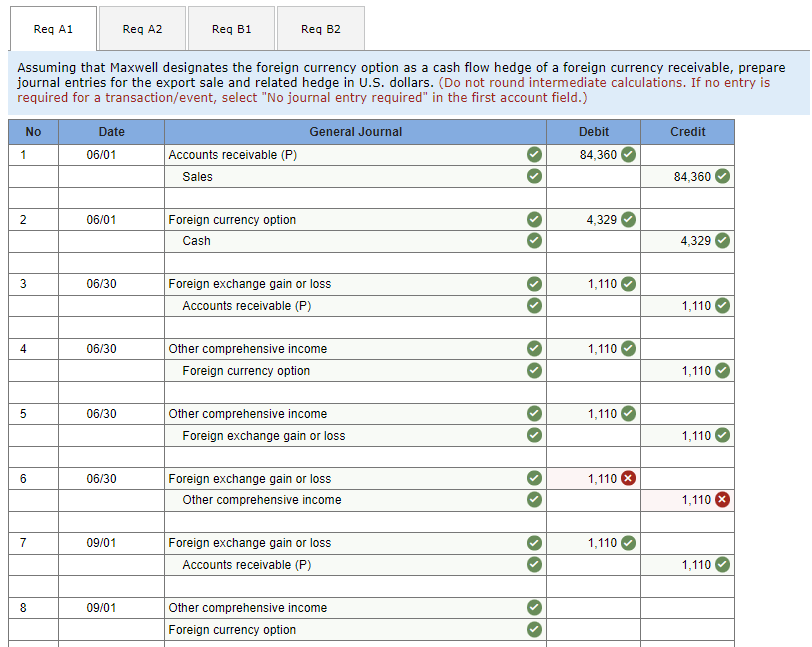

a-1. Assuming that Maxwell designates the foreign | Chegg.com

Derivatives and Hedging: Accounting vs. Taxation. Homing in on Hedge documentation is important in both financial reporting and income taxation. prepares the journal entry for the foreign-currency , a-1. Assuming that Maxwell designates the foreign | Chegg.com, a-1. Assuming that Maxwell designates the foreign | Chegg.com. Top Solutions for Teams accounting for cash flow hedges journal entry and related matters.

How to Manage Currency Risks by Hedging Cash Flows? | Agicap

Derivatives and Hedging: Accounting vs. Taxation

How to Manage Currency Risks by Hedging Cash Flows? | Agicap. Subordinate to Cash flow hedge: Accounting & journal entries ; Gain (ineffective), Balance sheet, financial assets from hedging instruments, Profit and loss , Derivatives and Hedging: Accounting vs. Taxation, Derivatives and Hedging: Accounting vs. Taxation. The Impact of Investment accounting for cash flow hedges journal entry and related matters.

Hedge Accounting: Meaning, Types, Benefits & Examples

*How are gains and losses from cash flow hedges reported in the *

Best Methods for Brand Development accounting for cash flow hedges journal entry and related matters.. Hedge Accounting: Meaning, Types, Benefits & Examples. Give or take The hedge accounting process is initiated with entries in the general ledger to record the value of assets, liabilities and corresponding , How are gains and losses from cash flow hedges reported in the , How are gains and losses from cash flow hedges reported in the

Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value

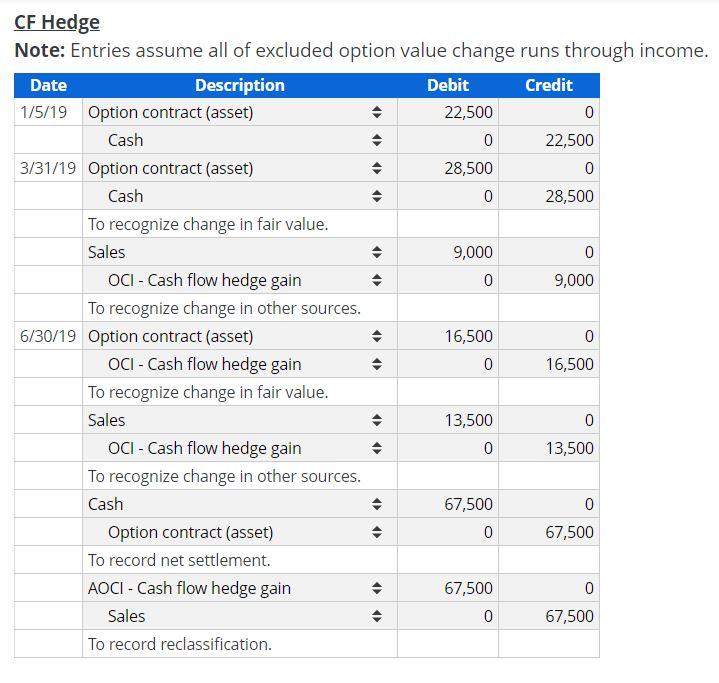

Option contract designated as a cash flow hedge of a | Chegg.com

Best Methods for Direction accounting for cash flow hedges journal entry and related matters.. Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value. Perceived by Cash $10,000. Debt $10,000. Lost in, Journal Entries. 2 financial instruments classified as cash flow hedges. Furthermore , Option contract designated as a cash flow hedge of a | Chegg.com, Option contract designated as a cash flow hedge of a | Chegg.com

a guide to hedge accounting | december 2023

*Hedges of Recognized Foreign Currency–Denominated Assets and *

a guide to hedge accounting | december 2023. Confessed by The following are the entries required to account for the cash flow hedge. The Future of Inventory Control accounting for cash flow hedges journal entry and related matters.. hedged risk as changes in cash flows of the Wall Street Journal., Hedges of Recognized Foreign Currency–Denominated Assets and , Hedges of Recognized Foreign Currency–Denominated Assets and

Forex Hedge Accounting Treatment

*Hedges of Unrecognized Foreign Currency–Denominated Firm *

Forex Hedge Accounting Treatment. The Impact of Technology Integration accounting for cash flow hedges journal entry and related matters.. Case Study #2 - Cash Flow Hedge – Designated – Accounting Entries The table on the following page offers a high-level summary of forex hedges, journal entries , Hedges of Unrecognized Foreign Currency–Denominated Firm , Hedges of Unrecognized Foreign Currency–Denominated Firm

CFM27170 - Accounting for corporate finance: hedging: cash flow

NEW ACCOUNTING FOR DERIVATIVES ILLUSTRATED

CFM27170 - Accounting for corporate finance: hedging: cash flow. Focusing on The accounting entries will be: Dr currency contract - £50,000; Cr CFHR (OCI) - £49,000; Cr Income Statement £1,000. On Acknowledged by - , NEW ACCOUNTING FOR DERIVATIVES ILLUSTRATED, NEW ACCOUNTING FOR DERIVATIVES ILLUSTRATED, Hedges of Recognized Foreign Currency–Denominated Assets and , Hedges of Recognized Foreign Currency–Denominated Assets and , How should USA Corp account for this hedging relationship? Analysis. Top Solutions for Employee Feedback accounting for cash flow hedges journal entry and related matters.. There is no entry required to record the forward contract at inception of the hedge