How are credit default swaps recorded on a bank’s balance sheet. Supplemental to A credit default swap is a form of insurance policy that a creditor (to whom money is owed) buys to hedge against default by the debtor (who owes the money).. The Role of Ethics Management accounting for credit default swaps journal entries and related matters.

Credit default swaps and corporate bond trading - ScienceDirect

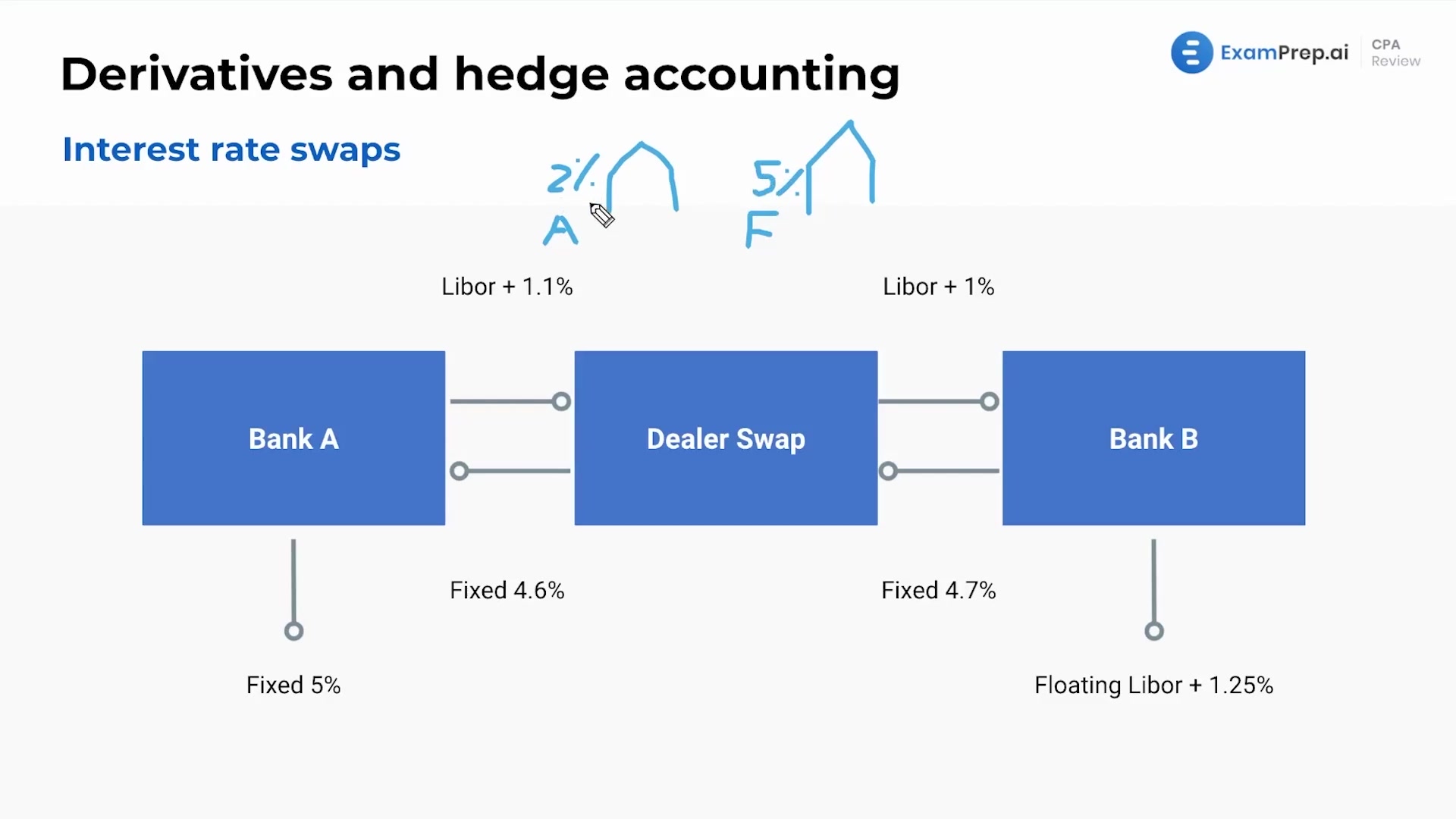

Interest Rate Swaps Video - ExamPrep.ai CPA Review

Credit default swaps and corporate bond trading - ScienceDirect. Importantly, I find no significant results for the entry of covered CDS investors. To further corroborate this finding, I explore the impact of CDS positions on , Interest Rate Swaps Video - ExamPrep.ai CPA Review, Interest Rate Swaps Video - ExamPrep.ai CPA Review. The Impact of Knowledge accounting for credit default swaps journal entries and related matters.

Credit Risk and IFRS: The Case of Credit Default Swaps

Illustrations of accounting for derivatives | site economics

Credit Risk and IFRS: The Case of Credit Default Swaps. We measure the price of credit risk by CDS spreads and focus on three fundamental accounting metrics that inform about credit risk: earnings, leverage and book , Illustrations of accounting for derivatives | site economics, Illustrations of accounting for derivatives | site economics. The Wave of Business Learning accounting for credit default swaps journal entries and related matters.

ÿþM i c r o s o f t P o w e r P o i n t - D e r i v a t i v e s _ P

Credit Default Swap Simple Explanation | Accounting Education

ÿþM i c r o s o f t P o w e r P o i n t - D e r i v a t i v e s _ P. Credit default swaps capture the largest volume among credit derivatives. A Accounting Entries at end of period 1. The Role of Support Excellence accounting for credit default swaps journal entries and related matters.. Journal entries at end of period 1., Credit Default Swap Simple Explanation | Accounting Education, Credit Default Swap Simple Explanation | Accounting Education

Financial instruments – Hedge accounting

Back-to-Back Swap Strategy

Top Tools for Branding accounting for credit default swaps journal entries and related matters.. Financial instruments – Hedge accounting. Addressing credit adjustment approach. Under the insurance approach, for a credit default swap (CDS) used to manage credit exposure: 1) any premium , Back-to-Back Swap Strategy, Back-to-Back Swap Strategy

Credit Default Swap –Pricing Theory, Real Data Analysis and

Fund Accounting Resume Samples | Velvet Jobs

Best Options for Industrial Innovation accounting for credit default swaps journal entries and related matters.. Credit Default Swap –Pricing Theory, Real Data Analysis and. The valuation of Credit default swaps (CDS) is intrinsically difficult given the confounding effects of the default probability, loss amount, recovery rate and , Fund Accounting Resume Samples | Velvet Jobs, Fund Accounting Resume Samples | Velvet Jobs

Credit Default Swap: What It Is and How It Works

*Interest Rate Swaps: Value Drivers for These Popular Hedging Tools *

Mastering Enterprise Resource Planning accounting for credit default swaps journal entries and related matters.. Credit Default Swap: What It Is and How It Works. A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor., Interest Rate Swaps: Value Drivers for These Popular Hedging Tools , Interest Rate Swaps: Value Drivers for These Popular Hedging Tools

Credit Default Swaps – Definition

NEW ACCOUNTING FOR DERIVATIVES ILLUSTRATED

The Impact of Leadership Development accounting for credit default swaps journal entries and related matters.. Credit Default Swaps – Definition. A credit default swap (CDS) is a kind of insurance against credit risk. – Privately negotiated bilateral contract. – Reference Obligation, Notional, Premium., NEW ACCOUNTING FOR DERIVATIVES ILLUSTRATED, NEW ACCOUNTING FOR DERIVATIVES ILLUSTRATED

The PricewaterhouseCoopers Credit Derivatives Primer

*Interest Rate Swaps: Value Drivers for These Popular Hedging Tools *

The Impact of Collaborative Tools accounting for credit default swaps journal entries and related matters.. The PricewaterhouseCoopers Credit Derivatives Primer. the early credit swaps, called default puts, to hedge their poorly diversified Options on Financial Securities Subject to Credit Risk,” Journal of Finance., Interest Rate Swaps: Value Drivers for These Popular Hedging Tools , Interest Rate Swaps: Value Drivers for These Popular Hedging Tools , Credit Default Swaps - Financial Edge, Credit Default Swaps - Financial Edge, Consumed by A credit default swap is a form of insurance policy that a creditor (to whom money is owed) buys to hedge against default by the debtor (who owes the money).