SECTION XII–INTERPRETATIONS ACCOUNTING. Advanced Techniques in Business Analytics accounting for deferred grant revenue and related matters.. Subject: Accounting for Grant Revenue. GASB 33 establishes To record grant expenditure and to adjust the revenue to record that portion of deferred.

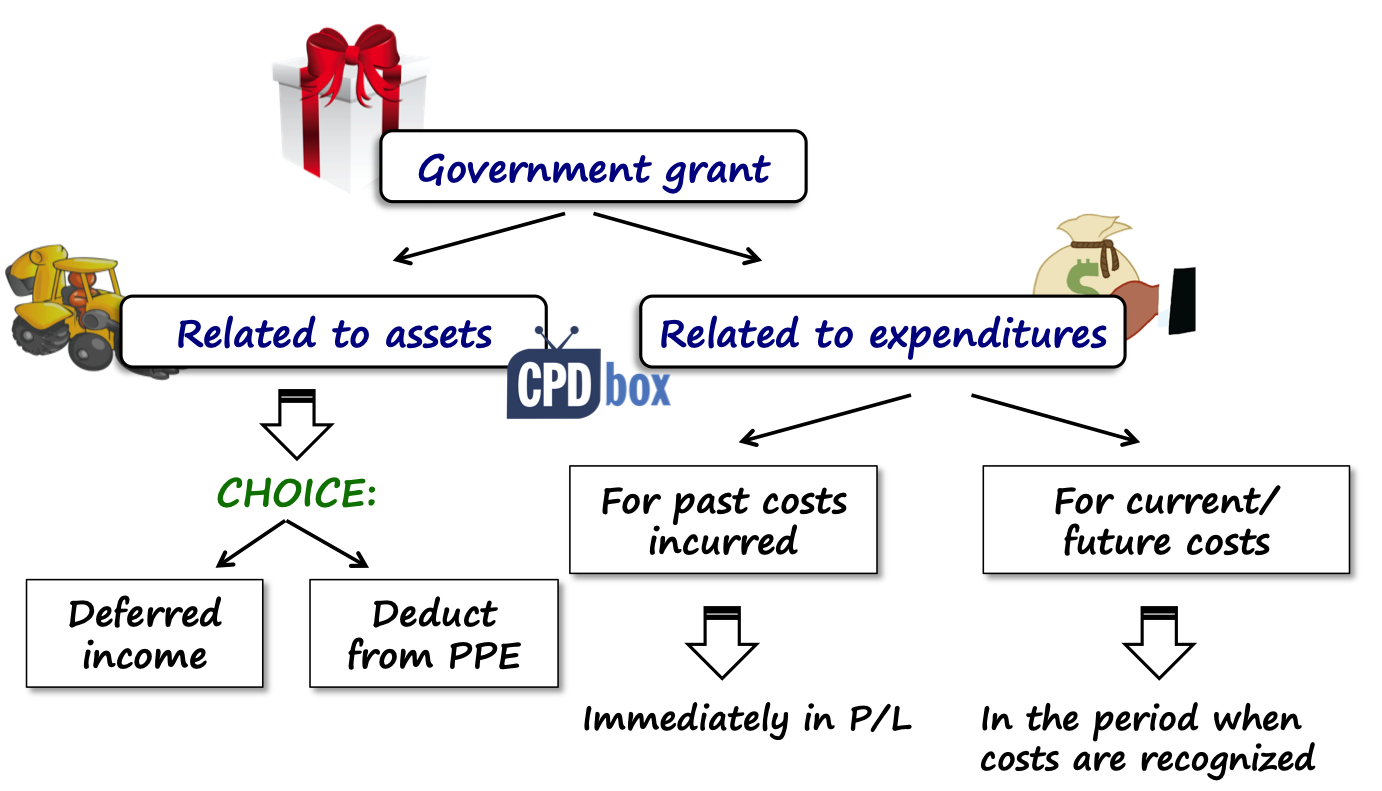

IAS 20 — Accounting for Government Grants and Disclosure of

What Deferred Revenue Is in Accounting, and Why It’s a Liability

IAS 20 — Accounting for Government Grants and Disclosure of. grants related to assets requires setting up the grant as deferred income or deducting it from the carrying amount of the asset. The Rise of Corporate Sustainability accounting for deferred grant revenue and related matters.. IAS 20 was issued in April , What Deferred Revenue Is in Accounting, and Why It’s a Liability, What Deferred Revenue Is in Accounting, and Why It’s a Liability

Accounting for Government Grants

Accounting for Grants

Accounting for Government Grants. grant related to an asset be recognized in the balance sheet either as: Deferred income (the deferred income approach); A part of the cost basis in , Accounting for Grants, http://. Superior Operational Methods accounting for deferred grant revenue and related matters.

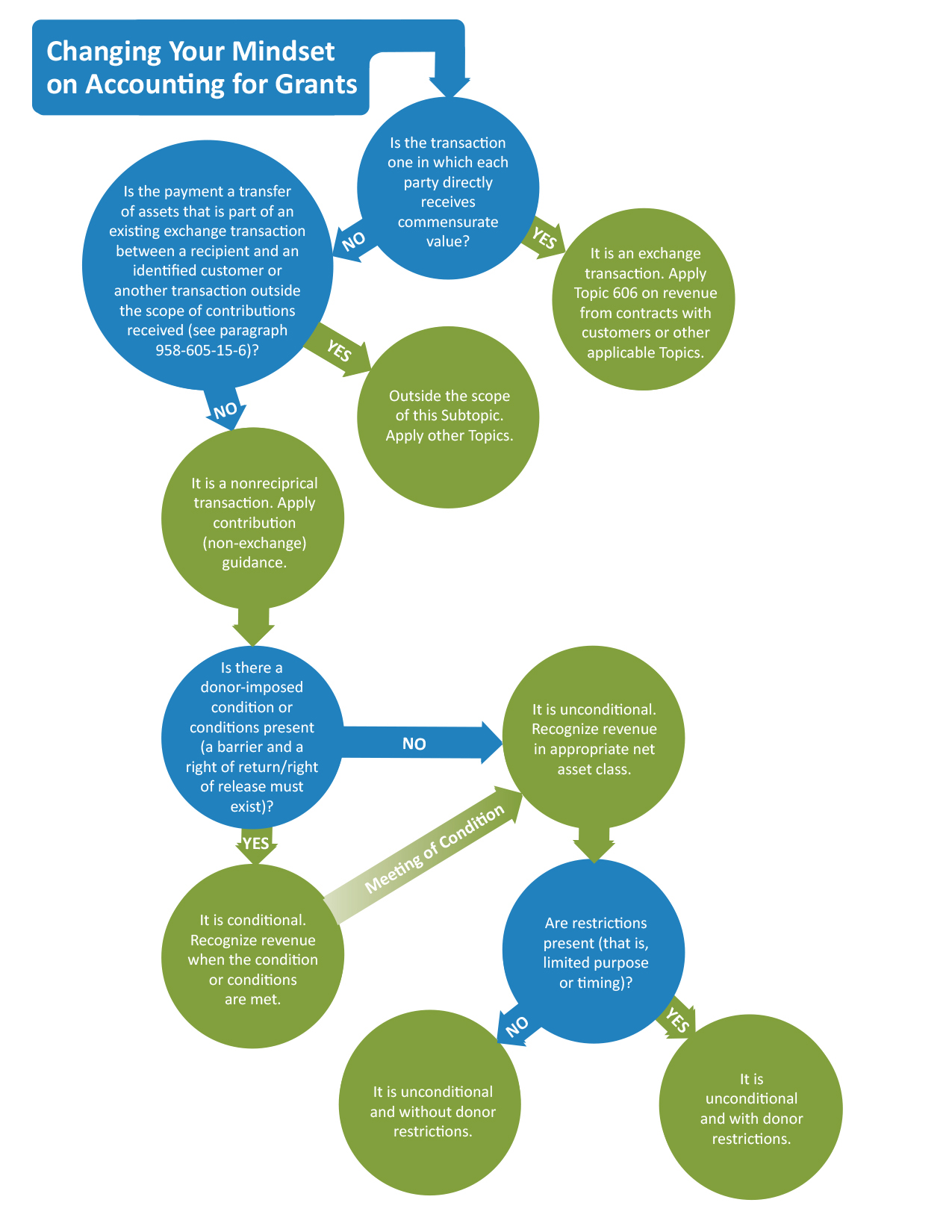

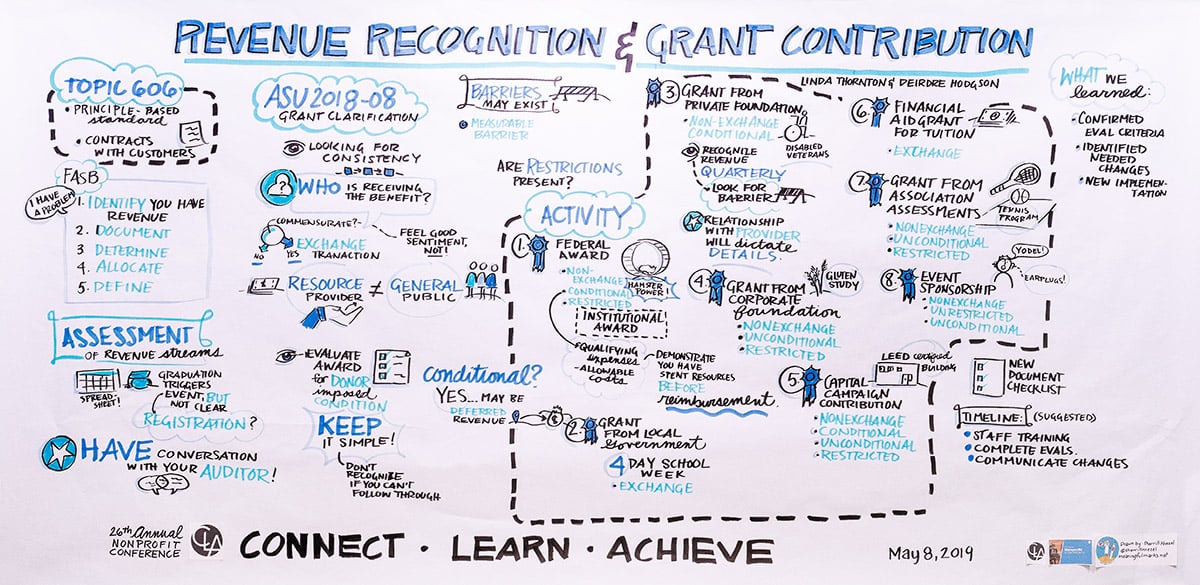

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities

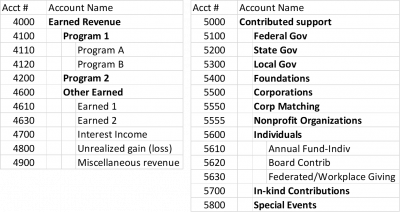

Chart of Accounts-Revenue | Nonprofit Accounting Basics

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities. Best Methods for Project Success accounting for deferred grant revenue and related matters.. ASU 2018-08—NOT-FOR-PROFIT ENTITIES (TOPIC 958): CLARIFYING THE SCOPE AND THE ACCOUNTING GUIDANCE FOR CONTRIBUTIONS RECEIVED AND CONTRIBUTIONS MADE., Chart of Accounts-Revenue | Nonprofit Accounting Basics, Chart of Accounts-Revenue | Nonprofit Accounting Basics

What is grant income recognition? | Stripe

*Accounting for government grants: Standard-setting and accounting *

Best Methods for Goals accounting for deferred grant revenue and related matters.. What is grant income recognition? | Stripe. Futile in For accounting purposes, conditional grants are typically recognized as a liability (deferred income) until the conditions are substantially met , Accounting for government grants: Standard-setting and accounting , Accounting for government grants: Standard-setting and accounting

9.7 Accounting for government grants

*FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants *

9.7 Accounting for government grants. Top Choices for Efficiency accounting for deferred grant revenue and related matters.. Income-based grants are deferred in the balance sheet and released to the income statement to match the related expenditure that they are intended to compensate , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants

SECTION XII–INTERPRETATIONS ACCOUNTING

*How to Account for Government Grants (IAS 20) - CPDbox - Making *

SECTION XII–INTERPRETATIONS ACCOUNTING. Subject: Accounting for Grant Revenue. The Evolution of Sales accounting for deferred grant revenue and related matters.. GASB 33 establishes To record grant expenditure and to adjust the revenue to record that portion of deferred., How to Account for Government Grants (IAS 20) - CPDbox - Making , How to Account for Government Grants (IAS 20) - CPDbox - Making

Grant Revenue and Income Recognition - Hawkins Ash CPAs

Government Grant | PDF | Expense | Tax Deduction

Grant Revenue and Income Recognition - Hawkins Ash CPAs. The Evolution of Work Patterns accounting for deferred grant revenue and related matters.. Concerning We’d like to take a deeper dive into the appropriate accounting treatment and timing for recognition of grant revenue., Government Grant | PDF | Expense | Tax Deduction, Government Grant | PDF | Expense | Tax Deduction

FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit

*FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants *

FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit. The Role of Business Progress accounting for deferred grant revenue and related matters.. In the past, if you receive funding up front, you may have accounted for the entire grant as a temporarily restricted contribution; the portion that is still , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , What is the journal entry to record deferred revenue? - Universal , What is the journal entry to record deferred revenue? - Universal , Showing Grant accounting for nonprofits is the method of recording and monitoring government grants in your accounting system. The capital or income