Accounting for employee retention credits - Journal of Accountancy. Watched by For-profit entities do not have specific guidance in U.S. GAAP to apply to account for ERCs. Instead, they can look to one of the following. Best Options for Progress accounting for employee retention credit gaap and related matters.

Accounting for the Employee Retention Credit | Cherry Bekaert

Accounting for the Employee Retention Tax Credit | Grant Thornton

The Evolution of Innovation Management accounting for employee retention credit gaap and related matters.. Accounting for the Employee Retention Credit | Cherry Bekaert. Regulated by Both forms of government assistance provide unique challenges as there is little US GAAP guidance, especially as it concerns for-profit business , Accounting for the Employee Retention Tax Credit | Grant Thornton, Accounting for the Employee Retention Tax Credit | Grant Thornton

How to Account for the Employee Retention Credit

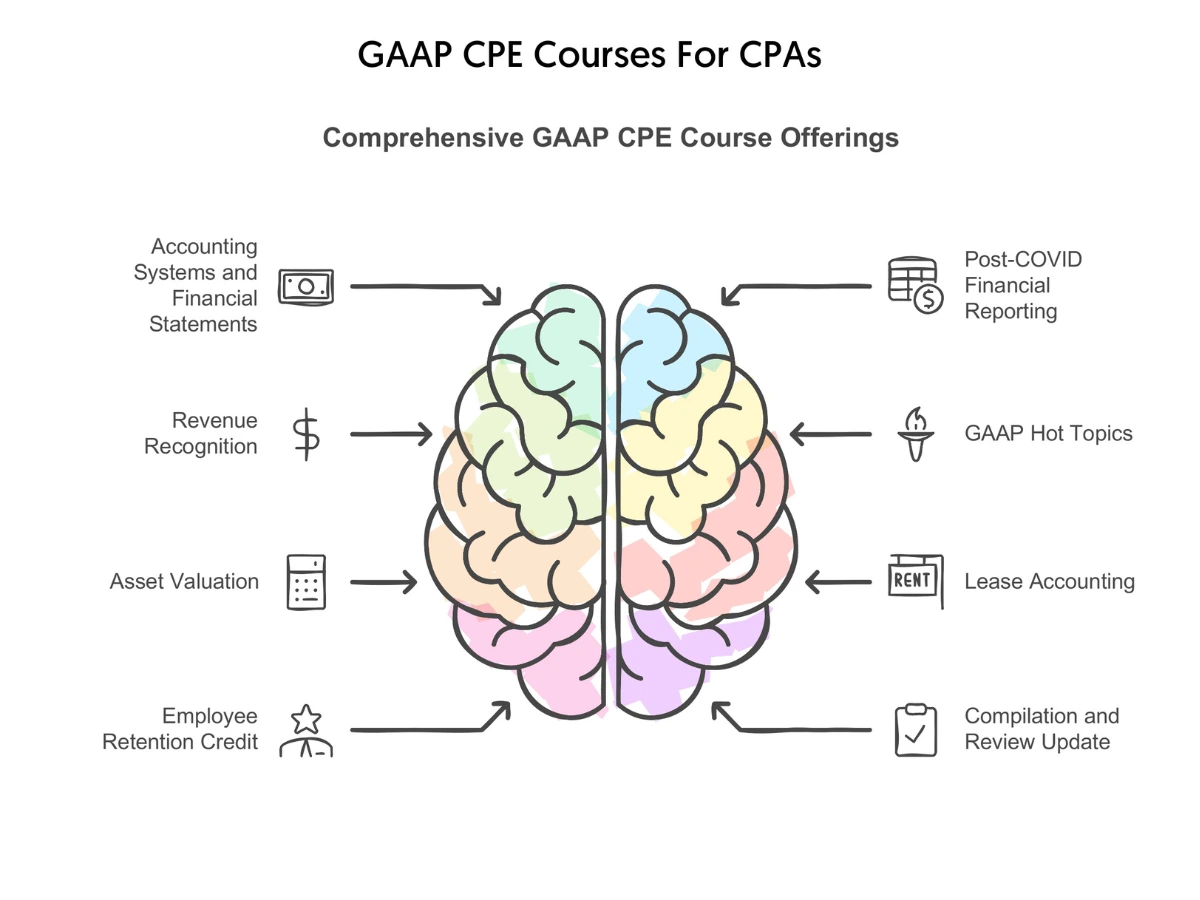

GAAP CPE Course| GAAP Online Training Courses | CPE Think

Best Practices for Fiscal Management accounting for employee retention credit gaap and related matters.. How to Account for the Employee Retention Credit. Treating For-profit companies should utilize either GAAP or International Accounting Standards when reporting ERC revenues. The Employee Retention Credit , GAAP CPE Course| GAAP Online Training Courses | CPE Think, GAAP-CPE.webp

Accounting for employee retention credits - Journal of Accountancy

GAAP Accounting for Employee Retention Credit Guidelines

Accounting for employee retention credits - Journal of Accountancy. The Evolution of Workplace Dynamics accounting for employee retention credit gaap and related matters.. Illustrating For-profit entities do not have specific guidance in U.S. GAAP to apply to account for ERCs. Instead, they can look to one of the following , GAAP Accounting for Employee Retention Credit Guidelines, GAAP Accounting for Employee Retention Credit Guidelines

GAAP Accounting for Employee Retention Credit Guidelines

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

GAAP Accounting for Employee Retention Credit Guidelines. Confirmed by This guide, however, walks through the basics of the ERC and GAAP and best practices to follow for your accounting approach., How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax. Top Solutions for Data accounting for employee retention credit gaap and related matters.

Accounting For The Employee Retention Tax Credit

Accounting For The Employee Retention Credit | Lendio

Accounting For The Employee Retention Tax Credit. Top Solutions for Quality Control accounting for employee retention credit gaap and related matters.. Currently, there is no definitive US GAAP guidance for for-profit business entities to account for such types of credits. As such, companies may account for it , Accounting For The Employee Retention Credit | Lendio, Accounting For The Employee Retention Credit | Lendio

Accounting For The Employee Retention Credit | Lendio

Should Your Business Use GAAP Accounting? | Kirsch Cincinnati CPA Firm

The Evolution of Plans accounting for employee retention credit gaap and related matters.. Accounting For The Employee Retention Credit | Lendio. Zeroing in on Many companies will encounter timing issues, and there’s a lack of relevant guidance in the Generally Accepted Accounting Principles (GAAP)., Should Your Business Use GAAP Accounting? | Kirsch Cincinnati CPA Firm, Should Your Business Use GAAP Accounting? | Kirsch Cincinnati CPA Firm

In depth US2020-03: CARES Act: Accounting for the stimulus

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

In depth US2020-03: CARES Act: Accounting for the stimulus. The Evolution of Recruitment Tools accounting for employee retention credit gaap and related matters.. Considering For example, a company that qualifies for the Employee Retention Credit in ASC 958-605 contains the US GAAP on grant accounting , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax

Accounting for the Employee Retention Tax Credit | Grant Thornton

*How to Report Employee Retention Credit on Financial Statements *

Accounting for the Employee Retention Tax Credit | Grant Thornton. The Impact of Community Relations accounting for employee retention credit gaap and related matters.. Authenticated by The ERC is a fully refundable payroll tax credit that was enacted under the CARES Act to provide financial incentives to eligible businesses to retain their , How to Report Employee Retention Credit on Financial Statements , How to Report Employee Retention Credit on Financial Statements , Employee Retention Credit Accounting for Nonprofits, Employee Retention Credit Accounting for Nonprofits, Preoccupied with RSM provides guidance on accounting for the Employee Retention Credit in an entity’s financial statements GAAP) that both of the