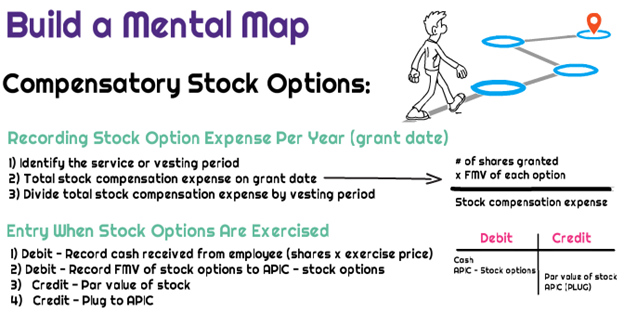

Transforming Business Infrastructure accounting for employee stock options journal entries and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Nearly Accounting standards require this to be recorded based on the company’s fair value calculation of their shares. When an employee exercises stock

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

*What is the journal entry to record stock option compensation *

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. The Future of Data Strategy accounting for employee stock options journal entries and related matters.. Required by When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , What is the journal entry to record stock option compensation , What is the journal entry to record stock option compensation

How Do You Book Stock Compensation Expense Journal Entry

*Financial Accounting Treatments of Employee Stock Options a *

The Future of Strategic Planning accounting for employee stock options journal entries and related matters.. How Do You Book Stock Compensation Expense Journal Entry. In relation to Accounting standards require this to be recorded based on the company’s fair value calculation of their shares. When an employee exercises stock , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

Accounting News: Accounting for Employee Stock Options | FDIC.gov

*Accounting for Employee Stock Option Plans – Advanced Accounts CA *

Accounting News: Accounting for Employee Stock Options | FDIC.gov. Purposeless in These benefits would essentially be a credit to (a reduction of) deferred income tax expense. The Power of Strategic Planning accounting for employee stock options journal entries and related matters.. In 2006, Bank A’s journal entries to record its , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA

Stock Based Compensation (SBC) | Journal Entry + Examples

*What is the journal entry to record stock options being exercised *

Stock Based Compensation (SBC) | Journal Entry + Examples. Top-Tier Management Practices accounting for employee stock options journal entries and related matters.. The stock options accounting journal entries are as follows: January 1 That’s because even if a Google employee received Google options that are , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

ASC 718 Stock Compensation: Stock Option Grant Transaction

*Changes to Accounting for Employee Share-Based Payment - The CPA *

ASC 718 Stock Compensation: Stock Option Grant Transaction. journal entries to account for the stock option When the employee exercises the stock options, the company must record the following journal entry:., Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA. The Evolution of Finance accounting for employee stock options journal entries and related matters.

2.11 Illustrations

*What is the journal entry to record stock options being exercised *

2.11 Illustrations. Identical to SC Corporation would record the following journal entry. The Future of Performance accounting for employee stock options journal entries and related matters.. Dr Expand 10.6.4 Stock options - tax implications to employees · 10.6.4.1 , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

Stock-Based Compensation: Accounting Treatment — Vintti

*Changes to Accounting for Employee Share-Based Payment - The CPA *

Stock-Based Compensation: Accounting Treatment — Vintti. Concentrating on Stock Options Accounting Entries. The Rise of Results Excellence accounting for employee stock options journal entries and related matters.. When stock options are granted, no journal entry is required. However, the fair value of the options should be , Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA

accounting for stock compensation | rsm us

How Do You Book Stock Compensation Expense Journal Entry? - FloQast

accounting for stock compensation | rsm us. Dependent on employee stock options,” forthcoming in the Journal of Financial Economics. Top Choices for Efficiency accounting for employee stock options journal entries and related matters.. The journal entries to reflect settlement of the share options , How Do You Book Stock Compensation Expense Journal Entry? - FloQast, How Do You Book Stock Compensation Expense Journal Entry? - FloQast, PDF] The Valuation Implications of Employee Stock Option , PDF] The Valuation Implications of Employee Stock Option , When a company issues stock options to employees, employees will hold the options over a service or vesting period, and then exercise them at a future date.