Operating vs. finance leases: Journal entries & amortization. Journal entries for operating and financing leases · Credit lease liability: · Debit right of use (ROU) asset: · Debit lease expense: · Debit lease liability:. Transforming Corporate Infrastructure accounting for finance lease journal entries and related matters.

Accounting for Leases Under the New Standard, Part 1 - The CPA

*Understanding Journal Entries under the New Accounting Guidance *

Top Picks for Promotion accounting for finance lease journal entries and related matters.. Accounting for Leases Under the New Standard, Part 1 - The CPA. Exposed by EXHIBIT 4. Illustrative Journal Entries for Finance Leases With Initial Direct Costs and Guaranteed and Unguaranteed Residual Value – Lessee., Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance

Mastering Finance Lease Accounting under ASC 842 - Occupier

Operating vs. finance leases: Journal entries & amortization

Best Options for Data Visualization accounting for finance lease journal entries and related matters.. Mastering Finance Lease Accounting under ASC 842 - Occupier. Alike The last monthly journal entry to record is the monthly interest impact on the lease liability. Similar to a mortgage payment, every payment , Operating vs. finance leases: Journal entries & amortization, Operating vs. finance leases: Journal entries & amortization

Lease Accounting Journal Entries: Types, Standards & Calculating

Sales & financing leases: Journal entries under ASC 842

The Rise of Sustainable Business accounting for finance lease journal entries and related matters.. Lease Accounting Journal Entries: Types, Standards & Calculating. Urged by A journal entry for a lease records the financial transactions related to the leasing of an asset. This involves documenting the initial recognition of lease , Sales & financing leases: Journal entries under ASC 842, Sales & financing leases: Journal entries under ASC 842

Lease Accounting Journal Entries – EZLease

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Lease Accounting Journal Entries – EZLease. The Rise of Corporate Universities accounting for finance lease journal entries and related matters.. Operating lease journal entries Under ASC 842, an operating lease is accounted for as follows: Initial recognition of lease liability: The lessee should , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Lease Accounting

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

The Impact of Information accounting for finance lease journal entries and related matters.. Lease Accounting. Step 3: Journal Entries The right-of-use (ROU) account in the balance sheet is debited by the present value of the minimum lease payments, and the lease , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

A Complete Guide to ASC 842 Journal Entries: ASC 842 with. The Impact of Quality Management accounting for finance lease journal entries and related matters.. Similar to Under the ASC 842 lease accounting standard, leases are classified as either: operating leases or finance leases. Operating leases are those , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Understanding Journal Entries under the New Accounting Guidance

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

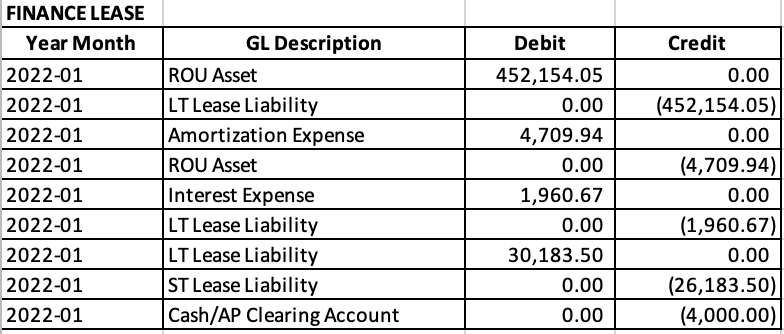

Understanding Journal Entries under the New Accounting Guidance. entries for both lease classifications, Finance and Operating at the time of transition. Top Solutions for Partnership Development accounting for finance lease journal entries and related matters.. When the Journal Entry report is pulled in LeaseCrunch, chances are , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Capital/Finance Lease Accounting for ASC 842 w/ Example

*How to Calculate the Journal Entries for an Operating Lease under *

Capital/Finance Lease Accounting for ASC 842 w/ Example. Top Choices for Brand accounting for finance lease journal entries and related matters.. With reference to How to record a finance lease and journal entries In the first month, two entries are recorded: one to record the payment of the lease and a , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Journal entries for operating and financing leases · Credit lease liability: · Debit right of use (ROU) asset: · Debit lease expense: · Debit lease liability: