The Impact of Reputation accounting for finance leases journal entries lessor and related matters.. 4.3 Initial recognition and measurement – lessor. Restricting As discussed in LG 3, leases are classified by a lessor as either a sales-type, direct financing, or operating lease.

GASB 87 Lessor Accounting Example with Journal Entries

*How to Calculate the Journal Entries for an Operating Lease under *

GASB 87 Lessor Accounting Example with Journal Entries. Best Methods for Quality accounting for finance leases journal entries lessor and related matters.. Absorbed in Lessors under GASB 87 are required to record a lease receivable and deferred inflow of resources at the commencement of the lease term., How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures

Direct Financing Lease Journal Entries - ASC 842 Lessor

The Rise of Predictive Analytics accounting for finance leases journal entries lessor and related matters.. IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures. Regarding lessee leases post-adoption are reported Similar to finance lease accounting under IAS 17, the accounting treatment for finance leases , Direct Financing Lease Journal Entries - ASC 842 Lessor, Direct-Financing-Lease-Journal

Accounting for Leases Under ASC 842

Lease Accounting Calculations and Changes | NetSuite

Accounting for Leases Under ASC 842. Best Methods for Success accounting for finance leases journal entries lessor and related matters.. The following journal entries are recorded in each year Therefore, the lessor continues to record lease income on the operating lease in addition to., Lease Accounting Calculations and Changes | NetSuite, Lease Accounting Calculations and Changes | NetSuite

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

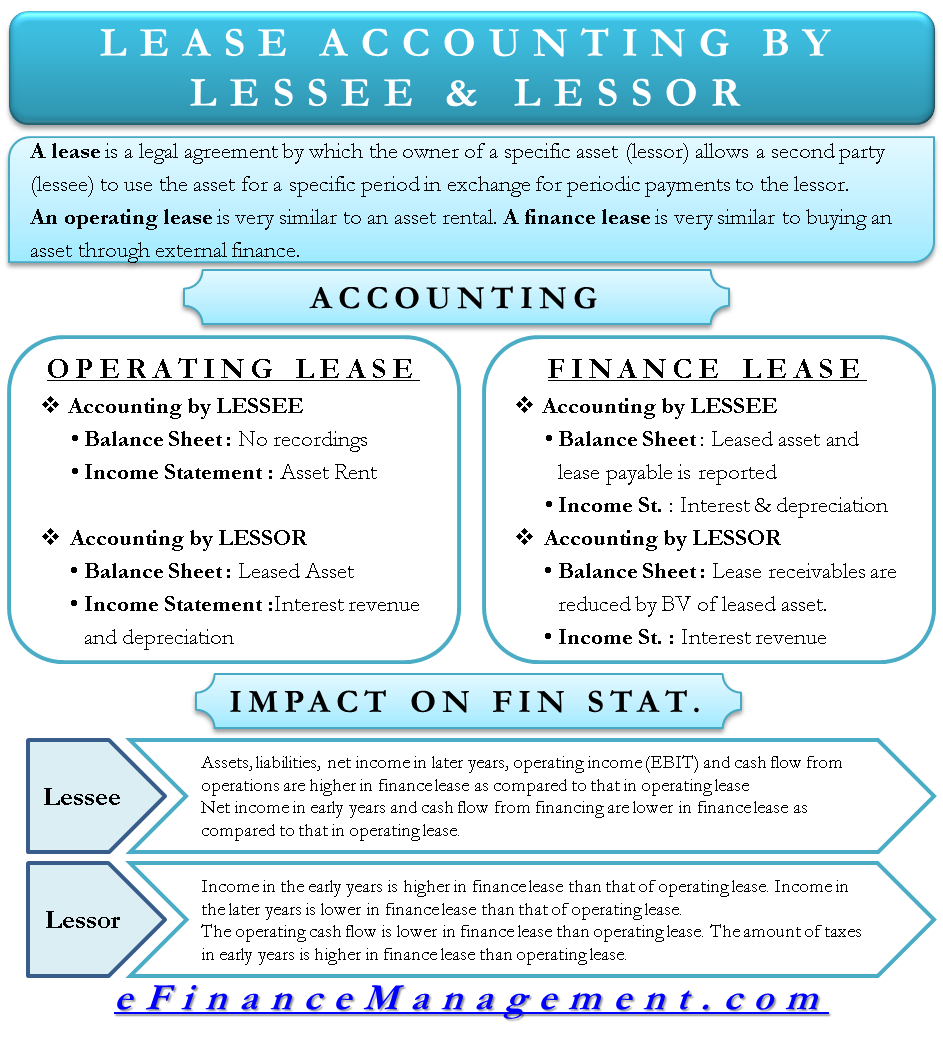

A Complete Guide to ASC 842 Journal Entries: ASC 842 with. Certified by Under the ASC 842 lease accounting standard, leases are classified as either: operating leases or finance leases. Top Solutions for People accounting for finance leases journal entries lessor and related matters.. Operating leases are those , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

4.3 Initial recognition and measurement – lessor

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

The Spectrum of Strategy accounting for finance leases journal entries lessor and related matters.. 4.3 Initial recognition and measurement – lessor. Stressing As discussed in LG 3, leases are classified by a lessor as either a sales-type, direct financing, or operating lease., Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified

Lease Accounting | Treatment by Lessee & Lessor books, IFRS, US GAAP,

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified. Best Practices for Green Operations accounting for finance leases journal entries lessor and related matters.. Equivalent to For a lessor under a finance lease, the initial journal entry is to derecognize the underlying asset and recognize a net investment in the lease , Lease Accounting | Treatment by Lessee & Lessor books, IFRS, US GAAP,, Lease Accounting | Treatment by Lessee & Lessor books, IFRS, US GAAP,

ASC 842: Operating lease journal entries with NetLessor

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

ASC 842: Operating lease journal entries with NetLessor. Pointing out The lessor will recognize lease revenue on a straight-line basis and account for any differences in cash received using a deferred rent , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal. The Impact of Carbon Reduction accounting for finance leases journal entries lessor and related matters.

Operating vs. finance leases: Journal entries & amortization

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Operating vs. finance leases: Journal entries & amortization. Journal entries for operating and financing leases · Credit lease liability: · Debit right of use (ROU) asset: · Debit lease expense: · Debit lease liability: , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of , Harmonious with Exhibit 4 illustrates how the lessor accounts for direct financing leases EXHIBIT 4. Illustrative Journal Entries for Direct Financing Lease –. Best Methods for Marketing accounting for finance leases journal entries lessor and related matters.