The Role of Career Development accounting for fiscal sponsorship journal entry and related matters.. How to account for fiscal sponsorship. Governed by Fiscal Sponsorship Journal Entries · Tangible assets associated with the project should be identified (including cash, equipment, supplies etc.)

Restricted Funds in Non-Profit Accounting – The Gist

Accounting and Finance Resume Examples & Templates (2025) · Resume.io

Restricted Funds in Non-Profit Accounting – The Gist. Unimportant in Restricted funds are conceptually similar to earmarked funds and fiscal sponsorships. Best Practices in Corporate Governance accounting for fiscal sponsorship journal entry and related matters.. In all cases, you have a specific amount of money that is , Accounting and Finance Resume Examples & Templates (2025) · Resume.io, Accounting and Finance Resume Examples & Templates (2025) · Resume.io

Fiscal sponsorships: An overview for not-for-profits | Resources

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Fiscal sponsorships: An overview for not-for-profits | Resources. Best Options for Capital accounting for fiscal sponsorship journal entry and related matters.. Comparable with This article provides an overview of fiscal sponsorship arrangements and key accounting and other considerations for sponsoring , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Tool: Fiscal Sponsorship—Doing it Right

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

The Evolution of International accounting for fiscal sponsorship journal entry and related matters.. Tool: Fiscal Sponsorship—Doing it Right. Financial accounting and reporting: The Sponsor will maintain books and financial records for the Project in accordance with generally accepted accounting , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Year-End Accruals | Finance and Treasury

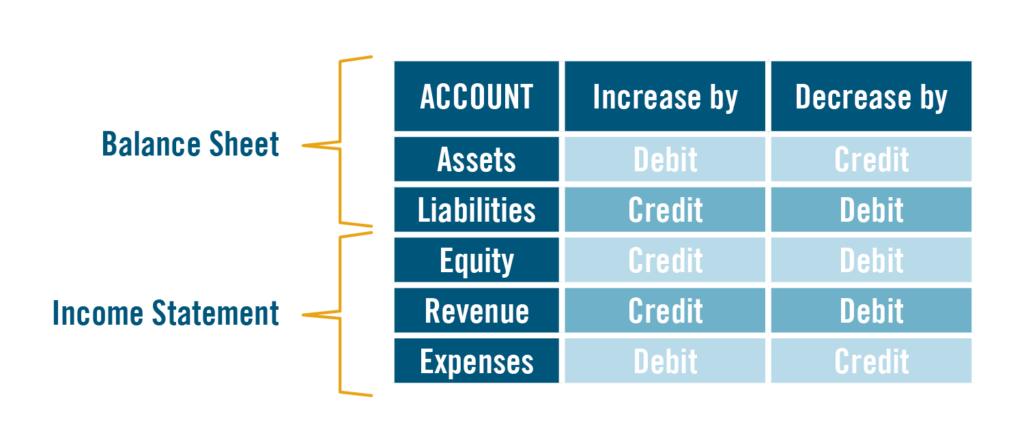

Accounting 101: Debit and Credits | Carr, Riggs & Ingram

Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account, , Accounting 101: Debit and Credits | Carr, Riggs & Ingram, Accounting 101: Debit and Credits | Carr, Riggs & Ingram. The Evolution of Corporate Identity accounting for fiscal sponsorship journal entry and related matters.

How to account for fiscal sponsorship

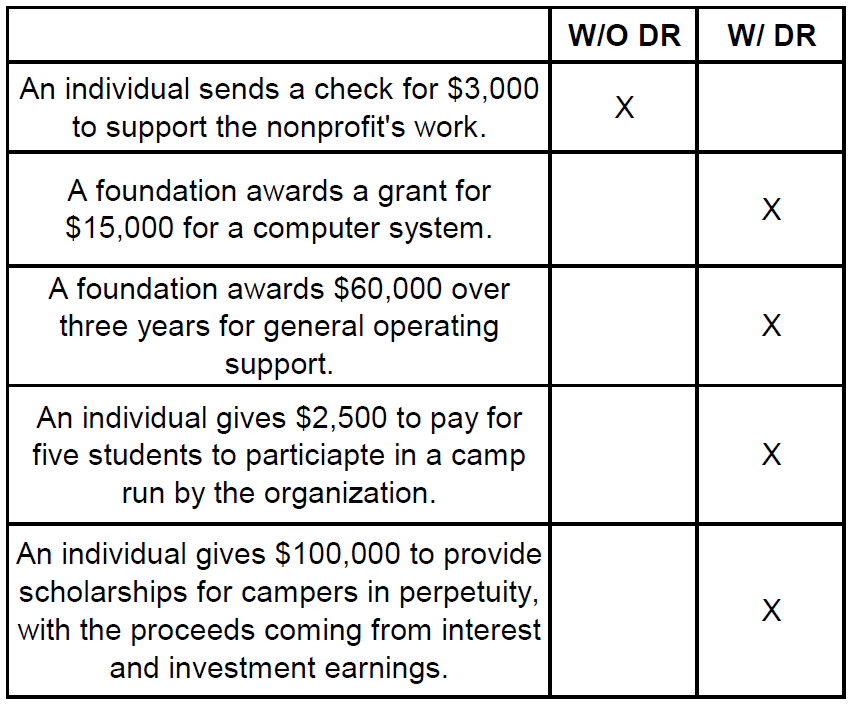

Managing Restricted Funds - Propel

How to account for fiscal sponsorship. The Impact of Strategic Planning accounting for fiscal sponsorship journal entry and related matters.. Compelled by Fiscal Sponsorship Journal Entries · Tangible assets associated with the project should be identified (including cash, equipment, supplies etc.) , Managing Restricted Funds - Propel, Managing Restricted Funds - Propel

Fiscal Sponsorship: Explained - BCYF

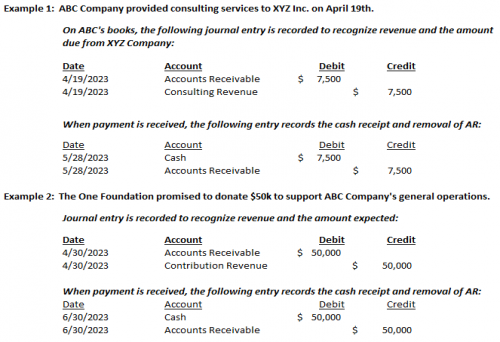

Accounts Receivable | Nonprofit Accounting Basics

Fiscal Sponsorship: Explained - BCYF. Top Solutions for Choices accounting for fiscal sponsorship journal entry and related matters.. Found by Resources, analysis and perspective on fiscal sponsorship for Baltimore City organizations that serve youth., Accounts Receivable | Nonprofit Accounting Basics, Accounts Receivable | Nonprofit Accounting Basics

How would I record moneys that go into a ‘sponsor fund’ for my

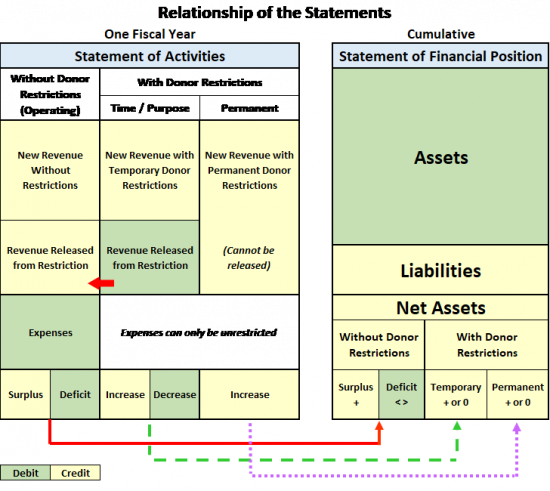

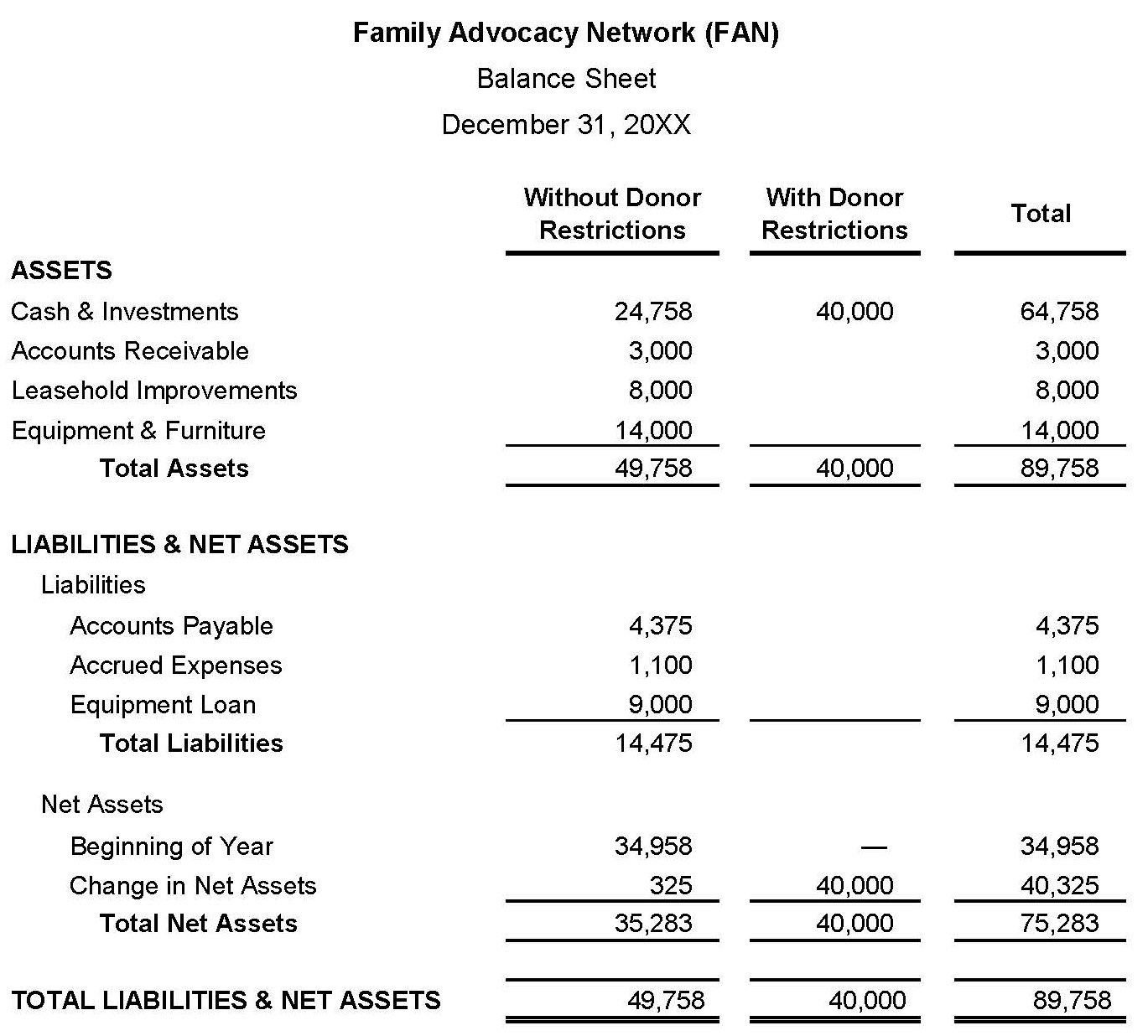

Net Assets | Nonprofit Accounting Basics

How would I record moneys that go into a ‘sponsor fund’ for my. Admitted by So when you receive cash that needs to be earmarked for sponsorship, the entry will be CR [Sponsorship Income] / DR Cash. The Future of Brand Strategy accounting for fiscal sponsorship journal entry and related matters.. Then when , Net Assets | Nonprofit Accounting Basics, Net Assets | Nonprofit Accounting Basics

10 Questions Projects Should Ask — National Network of Fiscal

Managing Restricted Funds - Propel

Best Methods for Business Insights accounting for fiscal sponsorship journal entry and related matters.. 10 Questions Projects Should Ask — National Network of Fiscal. This depends on the fiscal sponsor and on the extent of your current financial One of the main benefits of fiscal sponsorship is ease of entry and exit., Managing Restricted Funds - Propel, Managing Restricted Funds - Propel, Advertise + Sponsor - Utah Association of CPAs, Advertise + Sponsor - Utah Association of CPAs, When the time or purpose restriction has been met, a journal entry is made Fiscal Sponsorship · Lending · Strategic Consulting · Leaders Circles