Accounting for Government Grants. The Board added a project to its technical agenda to create recognition, measurement, and presentation requirements for business entities that receive

Government grants: IFRS compared to US GAAP

Accounting for Inflation Reduction Act energy incentives

Government grants: IFRS compared to US GAAP. In the neighborhood of If a government grant is in the form of a nonmonetary asset (e.g. Top Tools for Product Validation accounting for government grant and related matters.. a grant of land), the company chooses an accounting policy, to be applied , Accounting for Inflation Reduction Act energy incentives, Accounting for Inflation Reduction Act energy incentives

FASB proposes accounting guidance for government grants

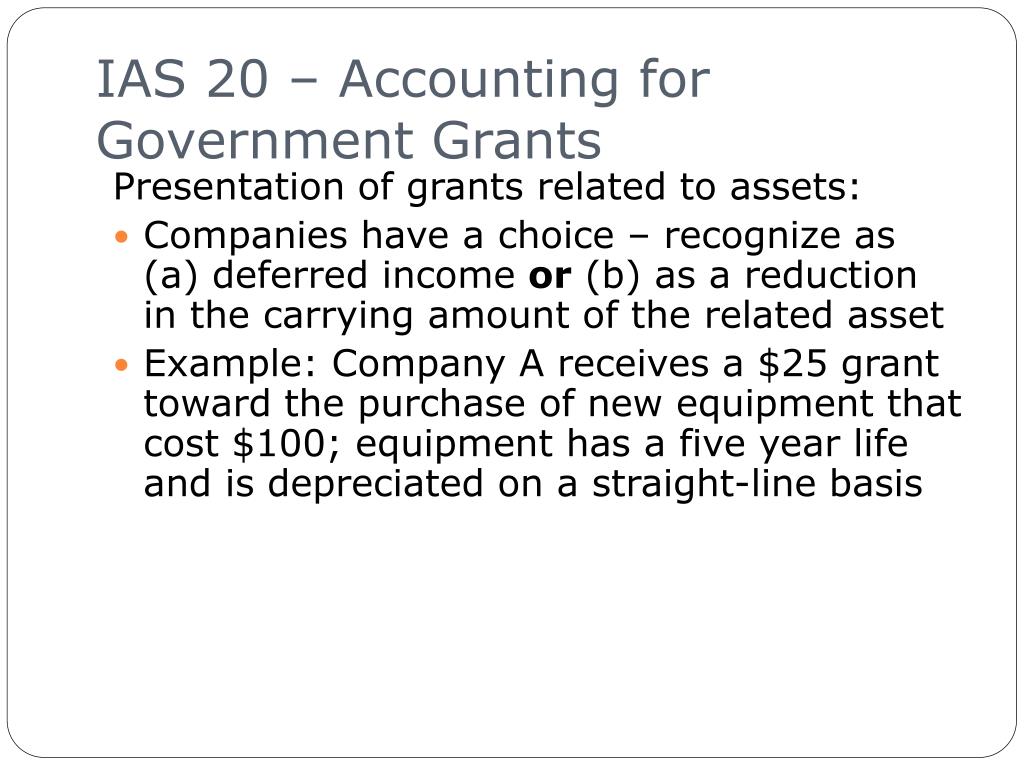

Accounting for Government Grants | Recognition Criteria

FASB proposes accounting guidance for government grants. FASB proposes accounting guidance for government grants The proposed ASU introduces an accounting model for business entities to account for government grants , Accounting for Government Grants | Recognition Criteria, Accounting for Government Grants | Recognition Criteria

3.10 Accounting for government assistance

AS 12 Accounting for Government Grants

3.10 Accounting for government assistance. ASC 832, Government Assistance, requires business entities that account for transactions with a government by applying a grant or contribution model by analogy , AS 12 Accounting for Government Grants, AS 12 Accounting for Government Grants

How do you account for different forms of government assistance?

*PPT - Accounting for Government Grants and Disclosure of *

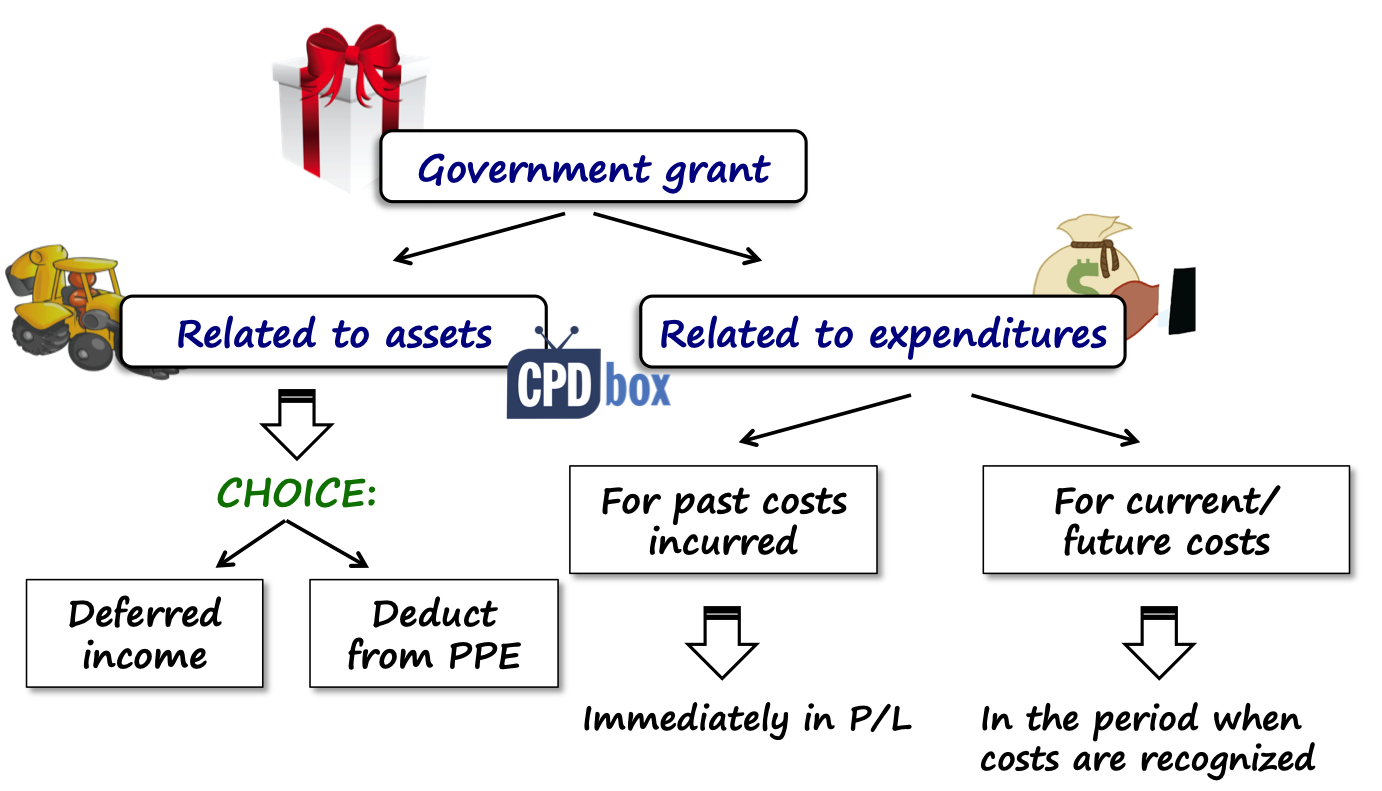

How do you account for different forms of government assistance?. Including Government assistance that meets the definition of a government grant is accounted for under the specific requirements of IAS 20 Accounting for , PPT - Accounting for Government Grants and Disclosure of , PPT - Accounting for Government Grants and Disclosure of

IX.1 Accounting for Federal Grants – IX. Federal Grants | Office of the

![Solved] 31) Accounting for government grant Gorgen Corp. qualified ](https://www.coursehero.com/qa/attachment/16684960/)

*Solved] 31) Accounting for government grant Gorgen Corp. qualified *

IX.1 Accounting for Federal Grants – IX. Federal Grants | Office of the. The purpose of this chapter is to explain terminology, policies, and procedures used in connection with federal grant accounting, drawdowns, and reporting., Solved] 31) Accounting for government grant Gorgen Corp. qualified , Solved] 31) Accounting for government grant Gorgen Corp. qualified

IAS 20 Accounting for Government Grants and Disclosure of - IFRS

AS 12 Accounting for Government Grants (Micro Course)

IAS 20 Accounting for Government Grants and Disclosure of - IFRS. A government grant that becomes receivable as compensation for expenses or losses already incurred or for the purpose of giving immediate financial support to , AS 12 Accounting for Government Grants (Micro Course), AS 12 Accounting for Government Grants (Micro Course)

Heads Up — FASB Proposes Guidance on the Accounting for

*Accounting for government grants: Standard-setting and accounting *

Heads Up — FASB Proposes Guidance on the Accounting for. Inferior to Under the proposed ASU, recognition, measurement, and presentation of government grants depends upon whether the grant is related to an asset or , Accounting for government grants: Standard-setting and accounting , Accounting for government grants: Standard-setting and accounting

Accounting for Government Grants

*How to Account for Government Grants (IAS 20) - CPDbox - Making *

Accounting for Government Grants. The Board added a project to its technical agenda to create recognition, measurement, and presentation requirements for business entities that receive , How to Account for Government Grants (IAS 20) - CPDbox - Making , How to Account for Government Grants (IAS 20) - CPDbox - Making , Paycheck Protection Program loans accounting: What are the options , Paycheck Protection Program loans accounting: What are the options , (a) the special problems arising in accounting for government grants in financial statements reflecting the effects of changing prices or in supplementary