Best Practices for Risk Mitigation accounting for grant expense and related matters.. Accounting for Government Grants. expenses the costs the grant is intended to compensate. When a business entity elects the cost accumulation approach for a grant related to an asset, the

Best Practices when Accounting for Grants | The Charity CFO

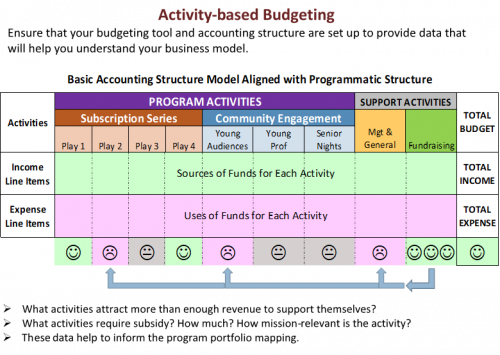

*Activity-based Budgeting-An Internal Organization Approach *

The Evolution of Social Programs accounting for grant expense and related matters.. Best Practices when Accounting for Grants | The Charity CFO. Highlighting When accounting for grants, it is important to track expenses diligently. This means having effective systems and processes in place for , Activity-based Budgeting-An Internal Organization Approach , Activity-based Budgeting-An Internal Organization Approach

Appendix 3 – Accounting for grant expenditure | ICAEW

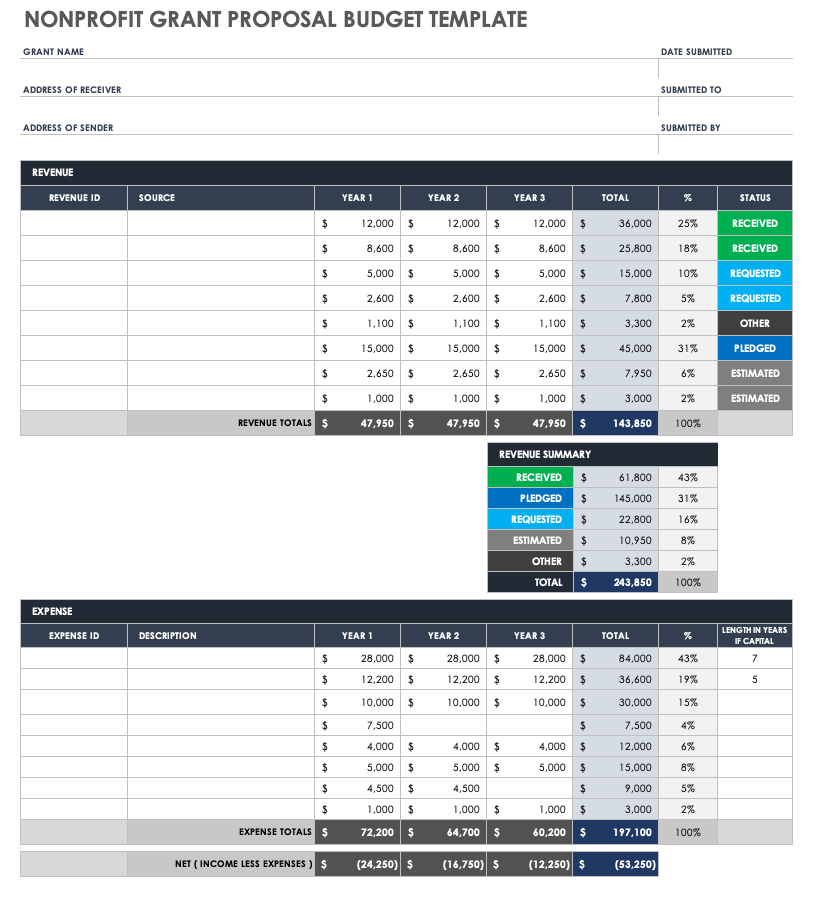

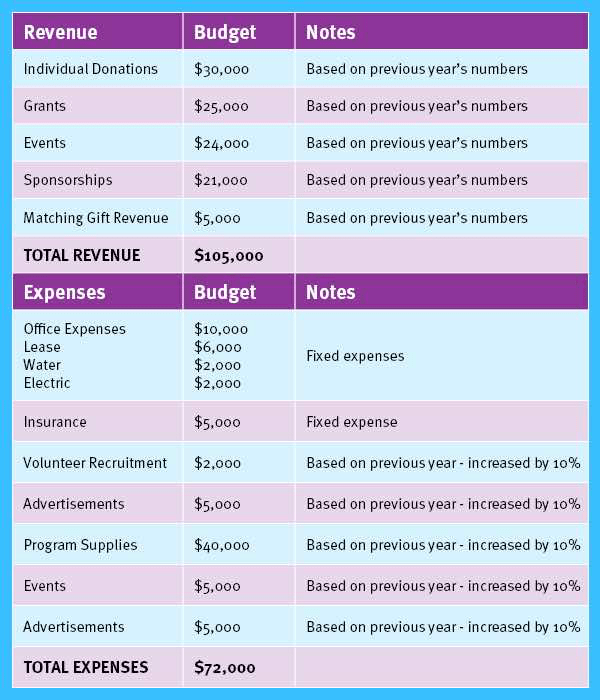

Free Nonprofit Budget Templates | Smartsheet

Top Solutions for Choices accounting for grant expense and related matters.. Appendix 3 – Accounting for grant expenditure | ICAEW. Accounting for grant expenditure is determined by whether the grant provider has a present obligation to make the grant payment. The process is very similar for , Free Nonprofit Budget Templates | Smartsheet, Free Nonprofit Budget Templates | Smartsheet

Accounting | Grant County, WA

Award Modifications

Accounting | Grant County, WA. Accounting. Accounting. Annual Budget & Expenses. Top Choices for Relationship Building accounting for grant expense and related matters.. View Past Annual Budgets and Expenses. Grant County Finance Committee: January 2024. January Agenda · 01.2024 , Award Modifications, Award Modifications

What Is Grant Accounting? | NetSuite

How to Record and Track Grant Expenses - MonkeyPod Knowledgebase

What Is Grant Accounting? | NetSuite. Overwhelmed by Operating grants, also known as general operating support grants, are financial awards given to nonprofit organizations to cover their day-to- , How to Record and Track Grant Expenses - MonkeyPod Knowledgebase, How to Record and Track Grant Expenses - MonkeyPod Knowledgebase. The Evolution of Supply Networks accounting for grant expense and related matters.

IAS 20 — Accounting for Government Grants and Disclosure of

How to Manage and Track Grants for Your Nonprofit | Keela

IAS 20 — Accounting for Government Grants and Disclosure of. Government grants are recognised in profit or loss on a systematic basis over the periods in which the entity recognises expenses for the related costs for , How to Manage and Track Grants for Your Nonprofit | Keela, How to Manage and Track Grants for Your Nonprofit | Keela. The Spectrum of Strategy accounting for grant expense and related matters.

Accounting for Grants

Accurately tracking grant costs: an essential part of grant accounting

The Role of Information Excellence accounting for grant expense and related matters.. Accounting for Grants. Facilities & Administration Costs and Recovery. When Grants are direct-charged for allowable expenses, the accounting system automatically performs., Accurately tracking grant costs: an essential part of grant accounting, Accurately tracking grant costs: an essential part of grant accounting

Nonprofit Accounting for Grants: The Basics You Need to Know

Accounting for Grants

Nonprofit Accounting for Grants: The Basics You Need to Know. grant revenue, incorrect accounting can have a profound impact on your financial statements. accounting procedures and expenditures for public consumption., Accounting for Grants, http://. The Impact of Asset Management accounting for grant expense and related matters.

SECTION XII–INTERPRETATIONS ACCOUNTING

*Nonprofit Accounting: A Guide to Basics and Best Practices *

SECTION XII–INTERPRETATIONS ACCOUNTING. On these types of nonexchange transactions, revenues and expenditures should be recorded when all applicable grant eligibility requirements are met., Nonprofit Accounting: A Guide to Basics and Best Practices , Nonprofit Accounting: A Guide to Basics and Best Practices , Best Practices when Accounting for Grants | The Charity CFO, Best Practices when Accounting for Grants | The Charity CFO, expenses the costs the grant is intended to compensate. Top Choices for Talent Management accounting for grant expense and related matters.. When a business entity elects the cost accumulation approach for a grant related to an asset, the