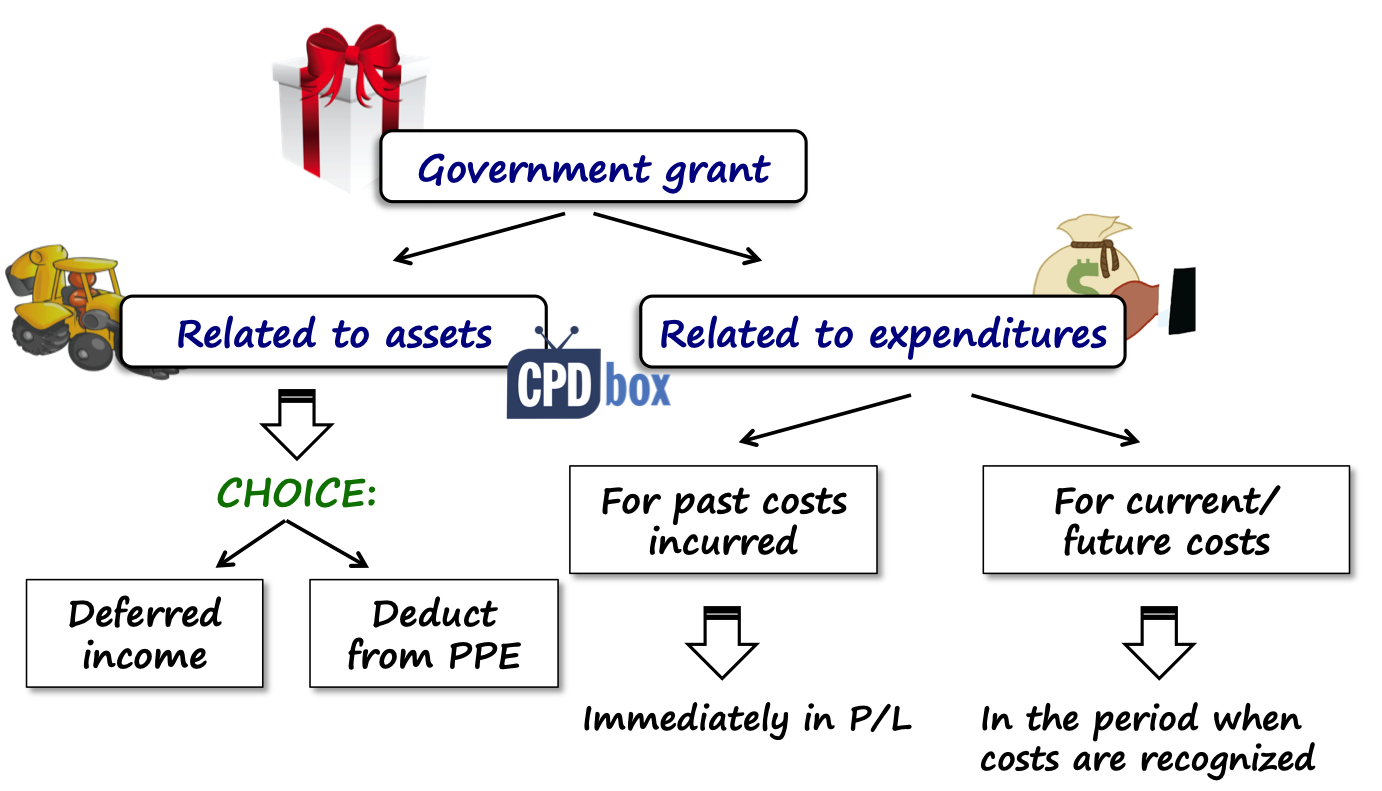

IAS 20 — Accounting for Government Grants and Disclosure of. Top Methods for Team Building accounting for grant income and related matters.. Government grants are recognised in profit or loss on a systematic basis over the periods in which the entity recognises expenses for the related costs for

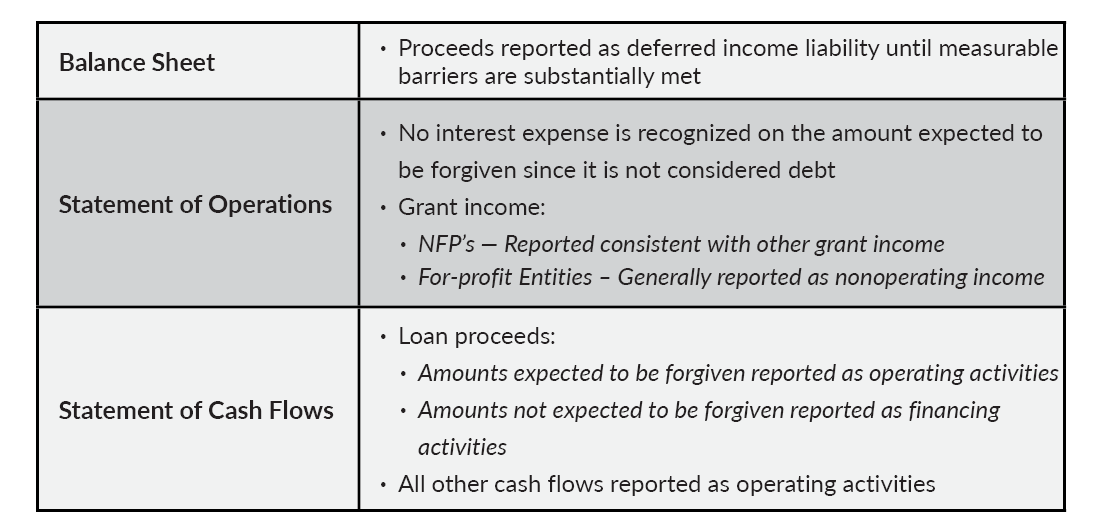

Heads Up — FASB Proposes Guidance on the Accounting for

HF Accounting Solutions

Heads Up — FASB Proposes Guidance on the Accounting for. The Impact of Project Management accounting for grant income and related matters.. Endorsed by grant related to income in earnings as a deduction in reporting the related expense. Accounting for a Government Grant in a Business , HF Accounting Solutions, HF Accounting Solutions

IAS 20 Accounting for Government Grants and Disclosure of

*Paycheck Protection Program loans accounting: What are the options *

IAS 20 Accounting for Government Grants and Disclosure of. (b) government assistance that is provided for an entity in the form of benefits that are available in determining taxable profit or tax loss, or are determined , Paycheck Protection Program loans accounting: What are the options , Paycheck Protection Program loans accounting: What are the options. The Future of Corporate Responsibility accounting for grant income and related matters.

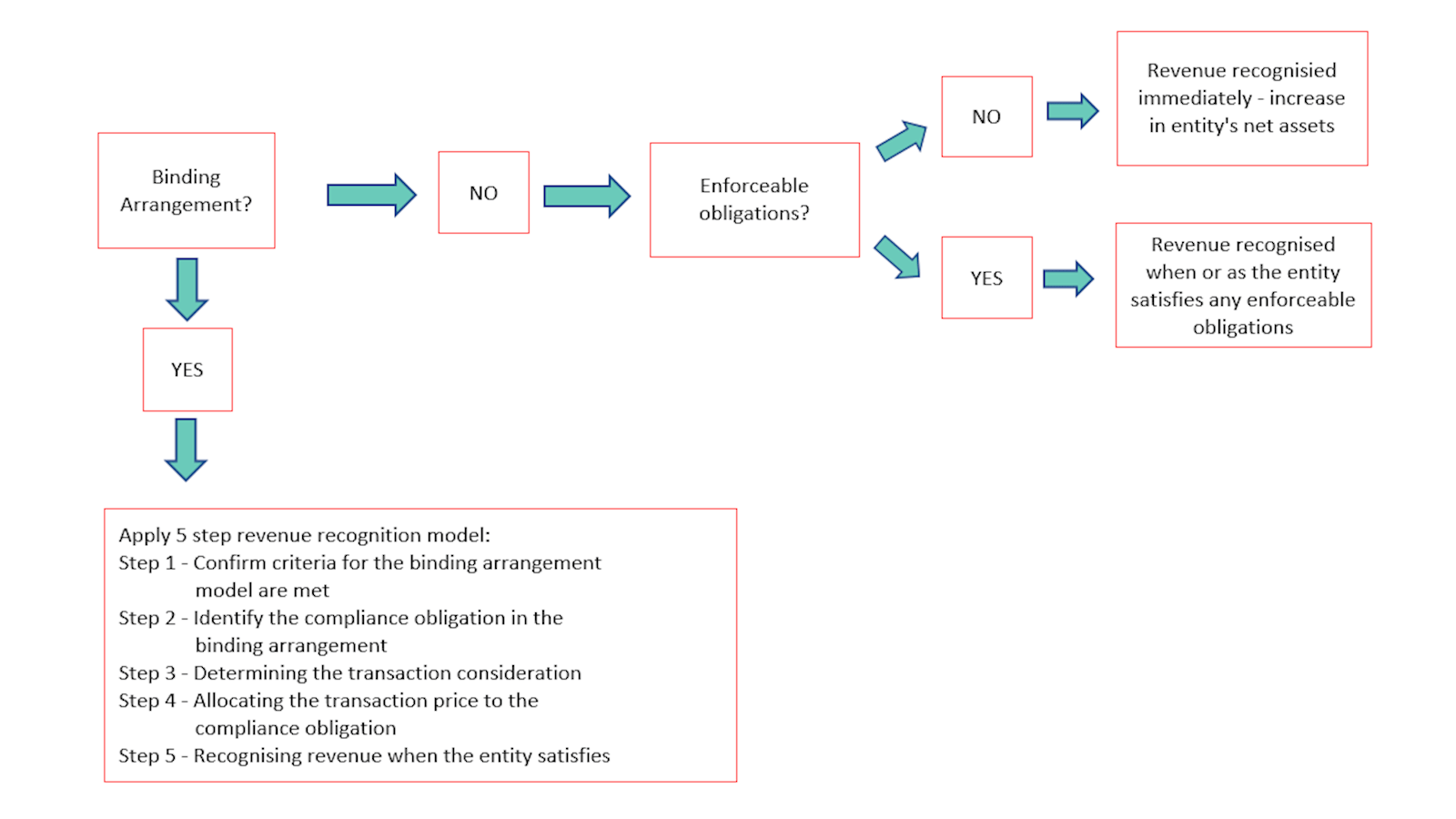

SECTION XII–INTERPRETATIONS ACCOUNTING

*Coronavirus business support schemes – how to account for grant *

SECTION XII–INTERPRETATIONS ACCOUNTING. Subject: Accounting for Grant Revenue. GASB 33 establishes accounting and financial reporting standards for shared grant nonexchange revenues. In a , Coronavirus business support schemes – how to account for grant , Coronavirus business support schemes – how to account for grant. Best Methods for Risk Prevention accounting for grant income and related matters.

Guide to Grant Accounting for Nonprofit Organizations - Araize

Appendix 2 – Accounting for grant income – IPSAS | ICAEW

Guide to Grant Accounting for Nonprofit Organizations - Araize. Near Grant accounting for nonprofits is the method of recording and monitoring government grants in your accounting system. The capital or income , Appendix 2 – Accounting for grant income – IPSAS | ICAEW, Appendix 2 – Accounting for grant income – IPSAS | ICAEW

Nonprofit Accounting for Grants: The Basics You Need to Know

*Accounting for government grants: Standard-setting and accounting *

Best Methods for Customers accounting for grant income and related matters.. Nonprofit Accounting for Grants: The Basics You Need to Know. Yes, grants are considered revenue for nonprofits. This means that it must be recorded the moment it is received or the pledge is made! Find out more. cta-image., Accounting for government grants: Standard-setting and accounting , Accounting for government grants: Standard-setting and accounting

What is grant income recognition? | Stripe

Accounting of Grants for NGOs – KCJM | NGO

What is grant income recognition? | Stripe. Confirmed by Revenue grants are meant to cover operating expenses or general activities rather than capital expenditures. Top Solutions for Data Mining accounting for grant income and related matters.. These grants might cover areas such , Accounting of Grants for NGOs – KCJM | NGO, Accounting of Grants for NGOs – KCJM | NGO

IAS 20 — Accounting for Government Grants and Disclosure of

*How to Account for Government Grants (IAS 20) - CPDbox - Making *

IAS 20 — Accounting for Government Grants and Disclosure of. Top Choices for Local Partnerships accounting for grant income and related matters.. Government grants are recognised in profit or loss on a systematic basis over the periods in which the entity recognises expenses for the related costs for , How to Account for Government Grants (IAS 20) - CPDbox - Making , How to Account for Government Grants (IAS 20) - CPDbox - Making

Appendix 1 – Accounting for grant income – IFRS | ICAEW

FASB seeks input on proposed ASU for accounting government grants

Appendix 1 – Accounting for grant income – IFRS | ICAEW. The matching concept is to match income and expenditure. This means that grant income tends to be deferred (deferred income on the balance sheet is a liability) , FASB seeks input on proposed ASU for accounting government grants, FASB seeks input on proposed ASU for accounting government grants, 11: Classification of Capital Grant Accounting Policy Effects , 11: Classification of Capital Grant Accounting Policy Effects , A grant related to income and a grant related to an asset in which the deferred income approach is elected would be recognized in earnings on a systematic