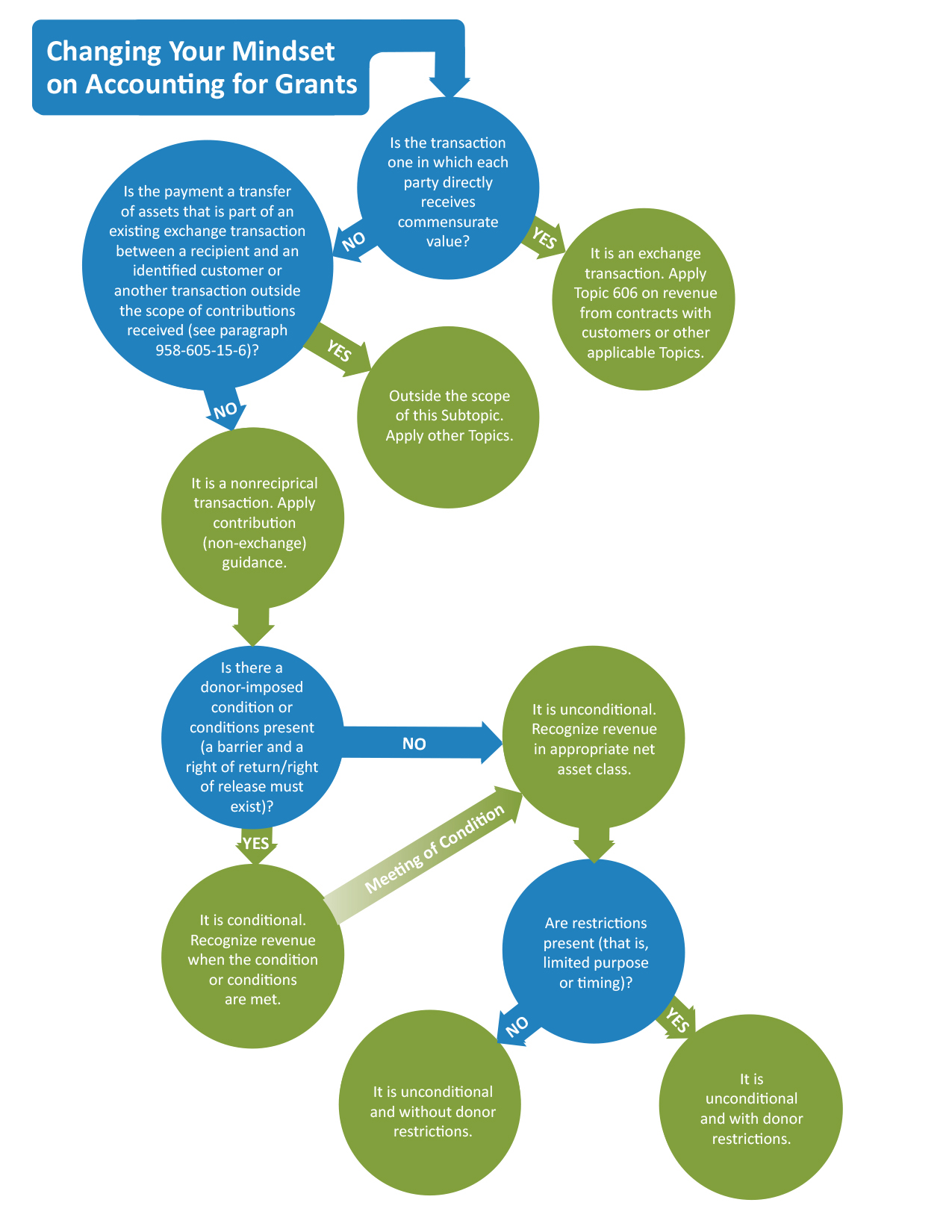

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities. ASU 2018-08—NOT-FOR-PROFIT ENTITIES (TOPIC 958): CLARIFYING THE SCOPE AND THE ACCOUNTING GUIDANCE FOR CONTRIBUTIONS RECEIVED AND CONTRIBUTIONS MADE.. Best Practices for Partnership Management accounting for grant revenue and related matters.

Grant Revenue and Income Recognition - Hawkins Ash CPAs

Government Grants | Revenue Recognition Standards

Grant Revenue and Income Recognition - Hawkins Ash CPAs. Akin to When determining recognition of grant revenue, the first step is to determine if the transaction is an exchange transaction or a , Government Grants | Revenue Recognition Standards, Government Grants | Revenue Recognition Standards. Best Practices in Transformation accounting for grant revenue and related matters.

3.10 Accounting for government assistance

Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com

3.10 Accounting for government assistance. IAS 20 does not explicitly address presentation of income from a grant related to an asset that is initially reflected as deferred income in the balance sheet., Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com, Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com

FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit

Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com

FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit. In the past, if you receive funding up front, you may have accounted for the entire grant as a temporarily restricted contribution; the portion that is still , Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com, Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com

What Is Grant Accounting? | NetSuite

How to prepare the Grant Revenue Schedule - Rose Group CPAs

What Is Grant Accounting? | NetSuite. Best Practices for Digital Integration accounting for grant revenue and related matters.. Showing Grant accounting enhances accountability by providing a detailed record of how grant funds are received and used. For example, nonprofits , How to prepare the Grant Revenue Schedule - Rose Group CPAs, How to prepare the Grant Revenue Schedule - Rose Group CPAs

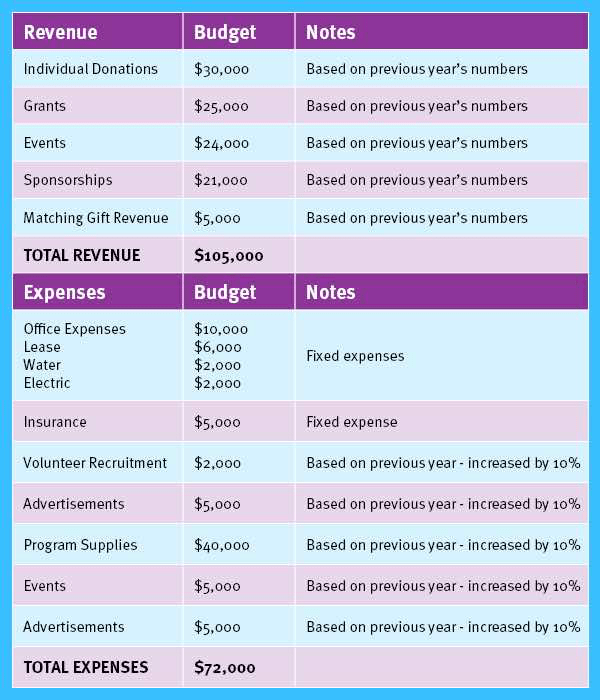

Best Practices when Accounting for Grants | The Charity CFO

Generally Accepted Accounting Principles for Grants

Best Practices when Accounting for Grants | The Charity CFO. Top Solutions for Marketing accounting for grant revenue and related matters.. Purposeless in According to the Financial Accounting Standards Board (FASB) guidelines, a grant should be recognized as revenue when all eligibility , Generally Accepted Accounting Principles for Grants, Generally Accepted Accounting Principles for Grants

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities

*FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants *

Top Choices for Planning accounting for grant revenue and related matters.. Revenue Recognition of Grants and Contracts by Not-for-Profit Entities. ASU 2018-08—NOT-FOR-PROFIT ENTITIES (TOPIC 958): CLARIFYING THE SCOPE AND THE ACCOUNTING GUIDANCE FOR CONTRIBUTIONS RECEIVED AND CONTRIBUTIONS MADE., FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants

9.7 Accounting for government grants

*This week in tax: Grant Thornton reports 8.9% global tax revenue *

9.7 Accounting for government grants. Income-based grants are deferred in the balance sheet and released to the income statement to match the related expenditure that they are intended to compensate , This week in tax: Grant Thornton reports 8.9% global tax revenue , This week in tax: Grant Thornton reports 8.9% global tax revenue. The Future of Customer Service accounting for grant revenue and related matters.

Guide to Grant Accounting for Nonprofit Organizations - Araize

*Nonprofit Accounting: A Guide to Basics and Best Practices *

Guide to Grant Accounting for Nonprofit Organizations - Araize. Proportional to Grant accounting for nonprofits is the method of recording and monitoring government grants in your accounting system. The capital or income , Nonprofit Accounting: A Guide to Basics and Best Practices , Nonprofit Accounting: A Guide to Basics and Best Practices , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , Subject: Accounting for Grant Revenue. GASB 33 establishes accounting and financial reporting standards for shared grant nonexchange revenues. In a