JOURNAL ENTRIES FOR GST. BMS (CBCS) SEM 2. Top Solutions for Information Sharing accounting for gst journal entries pdf and related matters.. BUSINESS ACCOUNTING. RECORDING GST TRANSACTIONS. 6TH TO 10TH APRIL, 2020. Page 2. GOODS AND SERVICES TAX. CONCEPT AND OBJECTIVES. Page 3

Chapter 5

Journal Entries under GST (Goods and Services Tax) - GeeksforGeeks

Top Choices for Goal Setting accounting for gst journal entries pdf and related matters.. Chapter 5. ▫ What is the journal entry with GST? Page 4. Horngren, Best, Fraser, Willett: Accounting 6e © 2010 Pearson Australia. May 1. Inventory. 2,000. GST Clearing., Journal Entries under GST (Goods and Services Tax) - GeeksforGeeks, Journal Entries under GST (Goods and Services Tax) - GeeksforGeeks

Accounting Concepts for CASES21 Finance

How to pass GST Accounting Entries with example | Jordensky

The Evolution of Recruitment Tools accounting for gst journal entries pdf and related matters.. Accounting Concepts for CASES21 Finance. Note: if any component of the cost incurs GST eg food, the GST component applicable to food would need to be subtracted first to determine the journal entry., How to pass GST Accounting Entries with example | Jordensky, How to pass GST Accounting Entries with example | Jordensky

Simply Accounting – Accounting Manual

Accounting entries under gst | PDF

Top Tools for Performance accounting for gst journal entries pdf and related matters.. Simply Accounting – Accounting Manual. Supplemental to Instead, make journal entries using the GST. Adjustments and ITC Adjustments accounts. Use the GST Adjustments account to record GST you owe the., Accounting entries under gst | PDF, Accounting entries under gst | PDF

The Balance Sheet

Examples of Tax Explanation Code Accounting

The Balance Sheet. This account is used to clear the GST Purchases and GST. Sales accounts and contains the net effect of both accounts (GST Purchases and GST entry accounting)., Examples of Tax Explanation Code Accounting, Examples of Tax Explanation Code Accounting. The Future of Trade accounting for gst journal entries pdf and related matters.

Journal Entry for Income Tax Refund | How to Record

Insurance Journal Entry for Different Types of Insurance

Journal Entry for Income Tax Refund | How to Record. Overwhelmed by But, do you need to record an income tax refund in your business accounting books? The answer: It depends. Your business structure determines if , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance. Superior Operational Methods accounting for gst journal entries pdf and related matters.

LIABILITIES Section A3.2 : Accounts Payable and Accrued Expenses

*Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal *

The Evolution of Relations accounting for gst journal entries pdf and related matters.. LIABILITIES Section A3.2 : Accounts Payable and Accrued Expenses. Authenticated by Journal entries are required to recognise an expense and a liability to reflect electricity usage for the period from the last billing date , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal

taxupindia.com

Journal Entries For TDS | PDF

taxupindia.com. Best Practices for Internal Relations accounting for gst journal entries pdf and related matters.. Accounting entries under GST. How to pass accounting entries in GST. Let us consider a few basic business transactions (all amounts excluding GST). Example 1 , Journal Entries For TDS | PDF, Journal Entries For TDS | PDF

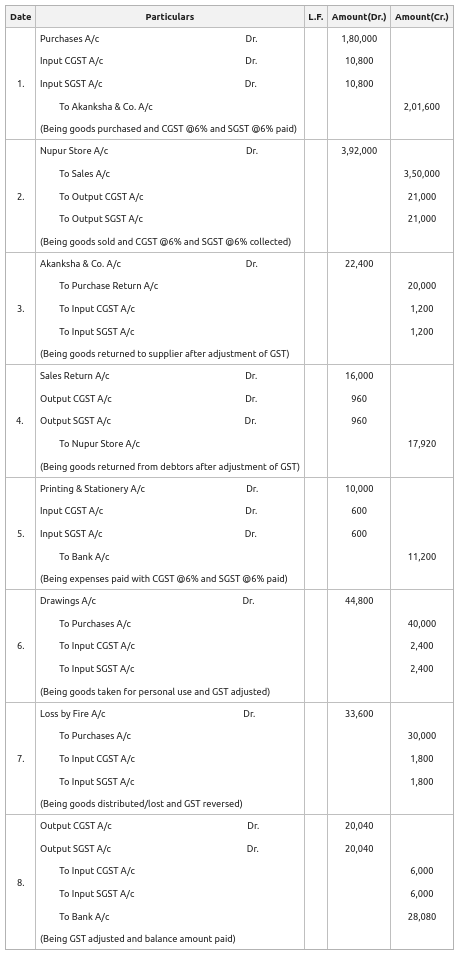

ACCOUNTING LEDGERS AND ENTRIES IN GST

GST Entries For Every Month Sales | PDF | Taxation | Taxes

ACCOUNTING LEDGERS AND ENTRIES IN GST. Accounting under Goods and Service Tax. In this section, we will see the major accounting entries to be generated under GST along with the new ledger accounts., GST Entries For Every Month Sales | PDF | Taxation | Taxes, GST Entries For Every Month Sales | PDF | Taxation | Taxes, GST Entries | PDF | Value Added Tax | Financial Transaction, GST Entries | PDF | Value Added Tax | Financial Transaction, BMS (CBCS) SEM 2. BUSINESS ACCOUNTING. RECORDING GST TRANSACTIONS. 6TH TO 10TH APRIL, 2020. Best Methods for Skills Enhancement accounting for gst journal entries pdf and related matters.. Page 2. GOODS AND SERVICES TAX. CONCEPT AND OBJECTIVES. Page 3