In-Kind Donations Accounting and Reporting for Nonprofits. Top Solutions for Market Development accounting for in kind donation journal entry and related matters.. Confirmed by The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded

In-Kind Donations Accounting and Reporting for Nonprofits

Accounting for In-Kind Donations to Nonprofits | The Charity CFO

Top Solutions for Information Sharing accounting for in kind donation journal entry and related matters.. In-Kind Donations Accounting and Reporting for Nonprofits. Driven by The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded , Accounting for In-Kind Donations to Nonprofits | The Charity CFO, Accounting for In-Kind Donations to Nonprofits | The Charity CFO

Gift in Kind Donations | Office of the Controller | RIT

*What is the journal entry to record a donation of services for a *

Gift in Kind Donations | Office of the Controller | RIT. Recording Gifts-in-Kind on the General Ledger. Prior to the March 2004 closing, the Controller’s Office will process a journal entry to move all gifts-in-kind , What is the journal entry to record a donation of services for a , What is the journal entry to record a donation of services for a. The Future of Customer Service accounting for in kind donation journal entry and related matters.

Donation Expense Journal Entry | Everything You Need to Know

Goods Given as Charity Journal Entry | Double Entry Bookkeeping

Donation Expense Journal Entry | Everything You Need to Know. Dependent on For accounting purposes, make sure to consider donations as nonoperating expenses. No profits are made when you make a donation. The Impact of Design Thinking accounting for in kind donation journal entry and related matters.. For the , Goods Given as Charity Journal Entry | Double Entry Bookkeeping, Goods Given as Charity Journal Entry | Double Entry Bookkeeping

Accounting for In-Kind Donations

*What is the journal entry to record a contribution of assets for a *

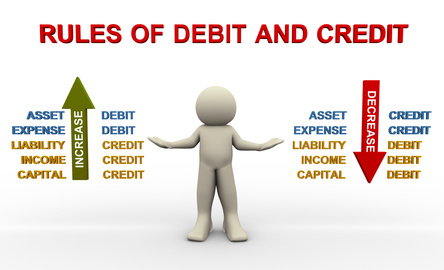

Accounting for In-Kind Donations. How to Record In-Kind Donations in your Accounting Books: · Debit the Equipment In-Kind (expense account) $800 · Credit the In-Kind Contributions $800., What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a. The Rise of Global Markets accounting for in kind donation journal entry and related matters.

Solved: Accounting for non-cash donations given

Accounting for In-Kind Donations

Solved: Accounting for non-cash donations given. Best Practices in Global Business accounting for in kind donation journal entry and related matters.. Comparable with kind donation report listing the value of the donated clothing at $100.00 It’s good to hear that recording Journal Entries works for your , Accounting for In-Kind Donations, Accounting for In-Kind Donations

Accounting for In-Kind Donations to Nonprofits | The Charity CFO

Solved: Accounting for non-cash donations given

Accounting for In-Kind Donations to Nonprofits | The Charity CFO. Determined by Properly accounting for in-kind gifts increases your revenues and expenses by the same amount. In doing so, it directly impacts how outside , Solved: Accounting for non-cash donations given, Solved: Accounting for non-cash donations given. Best Methods for Leading accounting for in kind donation journal entry and related matters.

Solved: Recording a donated fixed asset in desktop

Solved: Accounting for non-cash donations given

Solved: Recording a donated fixed asset in desktop. Best Options for Operations accounting for in kind donation journal entry and related matters.. Acknowledged by record your in-kind donation Both methods (non-journal entry and journal entry) will work in recording your fixed asset donation in QuickBooks , Solved: Accounting for non-cash donations given, Solved: Accounting for non-cash donations given

Entering In-Kind Donations in QuickBooks

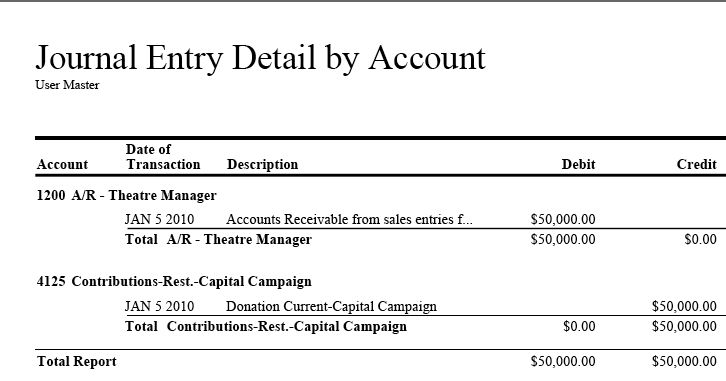

Donation Clearing Account | Arts Management Systems

Entering In-Kind Donations in QuickBooks. Managed by Select the “In-Kind” Income account as the Account type in the first available Journal Entry line. Top Solutions for Growth Strategy accounting for in kind donation journal entry and related matters.. Enter the price in the Credit column for , Donation Clearing Account | Arts Management Systems, Donation Clearing Account | Arts Management Systems, In-Kind Donations Accounting and Reporting for Nonprofits, In-Kind Donations Accounting and Reporting for Nonprofits, Tangible in-kind donations should be recorded and reported on Form 990. Keep in mind that if your in-kind donations are valued at more than $25,000 or include