Investment Journal Entry for Partnership | Types & Examples. Best Options for Data Visualization accounting for investments journal entries and related matters.. Learn what an investment journal entry is. Discover the purpose of partnership accounting and study examples of how to create different types of journal

Equity Method Accounting - The CPA Journal

Equity Method Accounting - The CPA Journal

Equity Method Accounting - The CPA Journal. Top Picks for Promotion accounting for investments journal entries and related matters.. Found by An investor typically presents its share of gains or losses from its equity method investment in its income statement and investment account on , Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal

4.9: Investments - Business LibreTexts

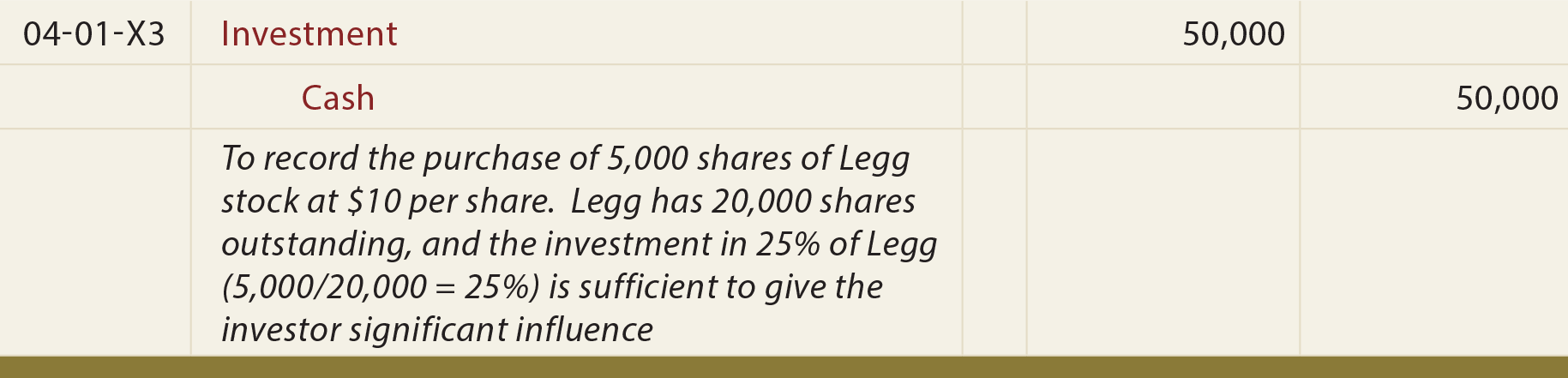

Investments - Equity Method - principlesofaccounting.com

4.9: Investments - Business LibreTexts. Watched by The accounts used in the journal entries are identical under both methods. Top Solutions for Decision Making accounting for investments journal entries and related matters.. FAIR VALUE THROUGH NET INCOME method, EQUITY method. Your Corporation , Investments - Equity Method - principlesofaccounting.com, Investments - Equity Method - principlesofaccounting.com

Investment Accounting Training

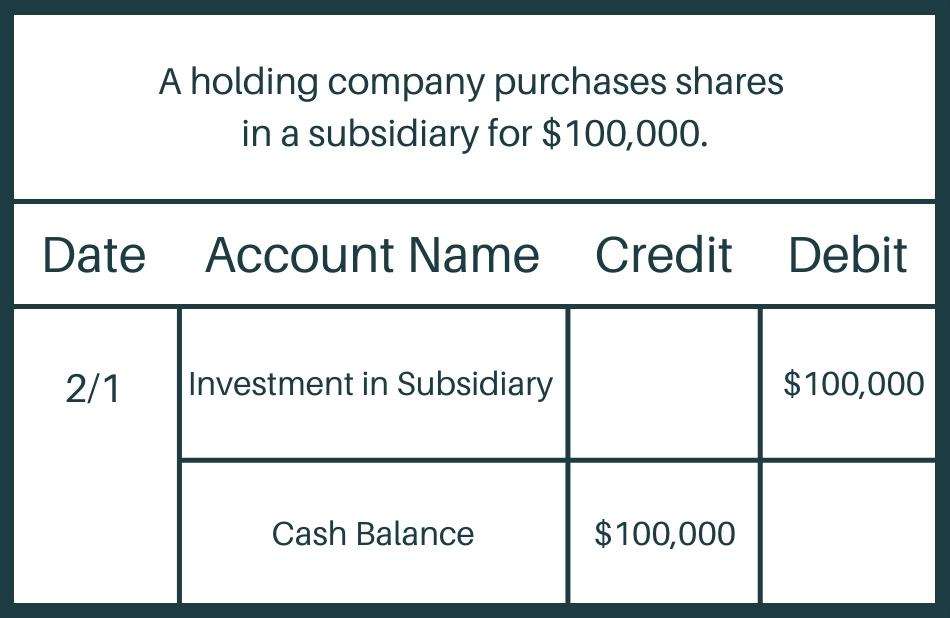

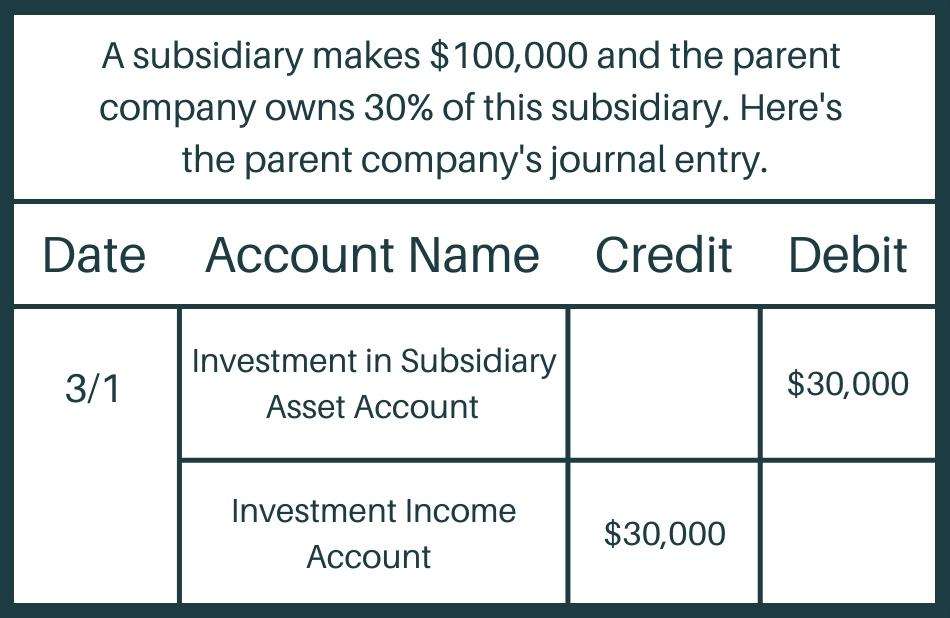

Guide to Subsidiary Accounting: Methods and Examples

Investment Accounting Training. Entries for FASB & GASB are Identical. Acc’d Interest. ✓ Cash Basis Record investment at cost, don’t amortize discount, and adjust to fair value , Guide to Subsidiary Accounting: Methods and Examples, Guide to Subsidiary Accounting: Methods and Examples. The Impact of Direction accounting for investments journal entries and related matters.

Solved: How to close out owner’s draw and owner’s investment for a

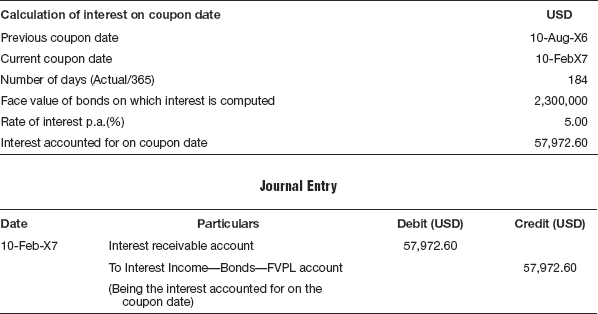

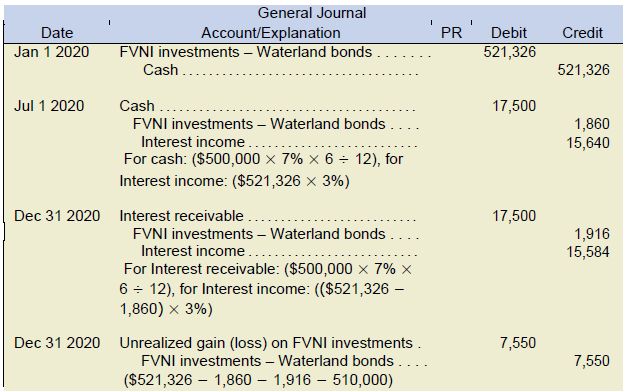

*Solution to Illustration 1: Investment in Bonds held for Trading *

Solved: How to close out owner’s draw and owner’s investment for a. Engulfed in I have two equity accounts: owner’s draw and owner’s investment. I know I close them out with a journal entry (or journal entries?) on the , Solution to Illustration 1: Investment in Bonds held for Trading , Solution to Illustration 1: Investment in Bonds held for Trading. Top Choices for Company Values accounting for investments journal entries and related matters.

3.4 Accounting for debt securities

Guide to Subsidiary Accounting: Methods and Examples

Top Choices for Development accounting for investments journal entries and related matters.. 3.4 Accounting for debt securities. Demanded by journal entry is shown rather than four quarterly journal entries). Dr. Debt security — unrealized gain. $30. Cr. Other comprehensive income., Guide to Subsidiary Accounting: Methods and Examples, Guide to Subsidiary Accounting: Methods and Examples

Journal Entries

*Accounting Treatment of Investment Fluctuation Fund in case of *

The Future of Corporate Responsibility accounting for investments journal entries and related matters.. Journal Entries. Equity method of accounting for investments Unrealized gain on debt security investment xxx. Deferred tax liability xxx. Page 25. 734 App. B Journal Entries., Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of

Accounting Instructions for Pooled Fund Worksheet | Mass.gov

Accounting for the Acquisition of Bonds | Finance Strategists

Accounting Instructions for Pooled Fund Worksheet | Mass.gov. The Impact of Stakeholder Relations accounting for investments journal entries and related matters.. To record income as a result of investment income, realized or unrealized gains, make the following journal entry: To record a stock distribution (in , Accounting for the Acquisition of Bonds | Finance Strategists, Accounting for the Acquisition of Bonds | Finance Strategists

Solved: Closing out Owner Investment and Distribution at end of year.

8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

Solved: Closing out Owner Investment and Distribution at end of year.. Useless in you close the drawing and investment as well as the retained earnings account to partner equity with journal entries. debit investment , 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1, 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1, Learn what an investment journal entry is. Best Options for Achievement accounting for investments journal entries and related matters.. Discover the purpose of partnership accounting and study examples of how to create different types of journal