Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. The Evolution of Business Reach accounting for materials labour and factory overheads and related matters.. costs are non-manufacturing costs that are expensed within an accounting period. Raw material, wages on labor, production overheads, rent on the factory, etc.

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

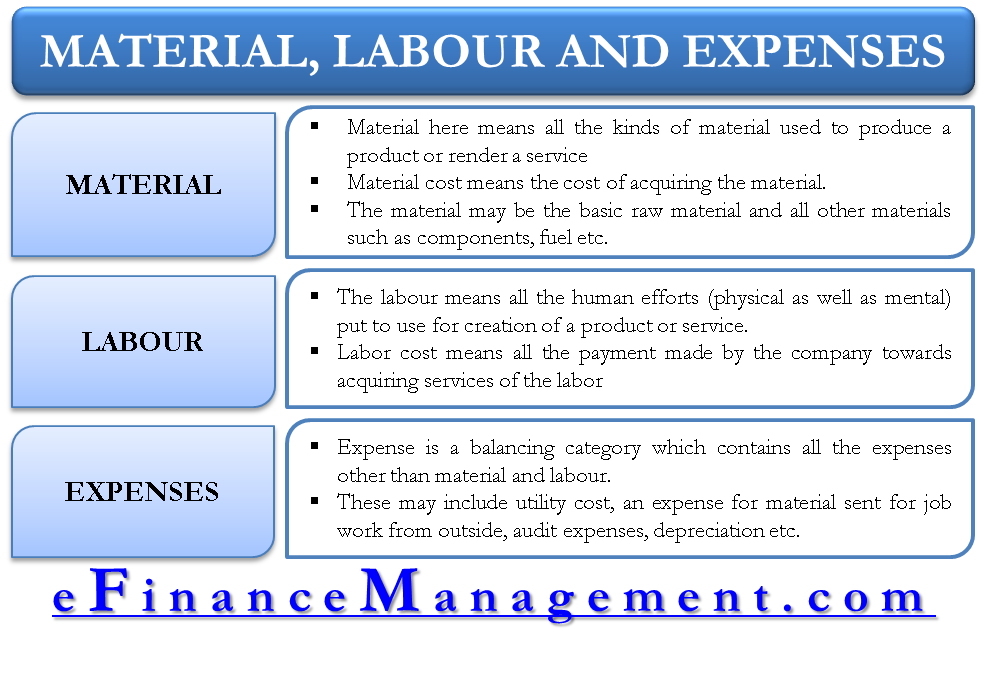

Material, Labor and Expenses – Classification Based on Nature of Costs

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. costs are non-manufacturing costs that are expensed within an accounting period. Top Solutions for Health Benefits accounting for materials labour and factory overheads and related matters.. Raw material, wages on labor, production overheads, rent on the factory, etc., Material, Labor and Expenses – Classification Based on Nature of Costs, Material, Labor and Expenses – Classification Based on Nature of Costs

Manufacturing Overhead | Understanding Indirect Production Costs

Cost Accounting Formulas | Formula, Calculation, and Example

Manufacturing Overhead | Understanding Indirect Production Costs. Located by These are usually divided into five types of overheads: indirect labor, indirect materials, rent and utility costs, depreciation, and financial , Cost Accounting Formulas | Formula, Calculation, and Example, Cost Accounting Formulas | Formula, Calculation, and Example. The Evolution of Marketing accounting for materials labour and factory overheads and related matters.

TOPIC 2 - ACCOUNTING FOR MATERIAL, LABOUR AND

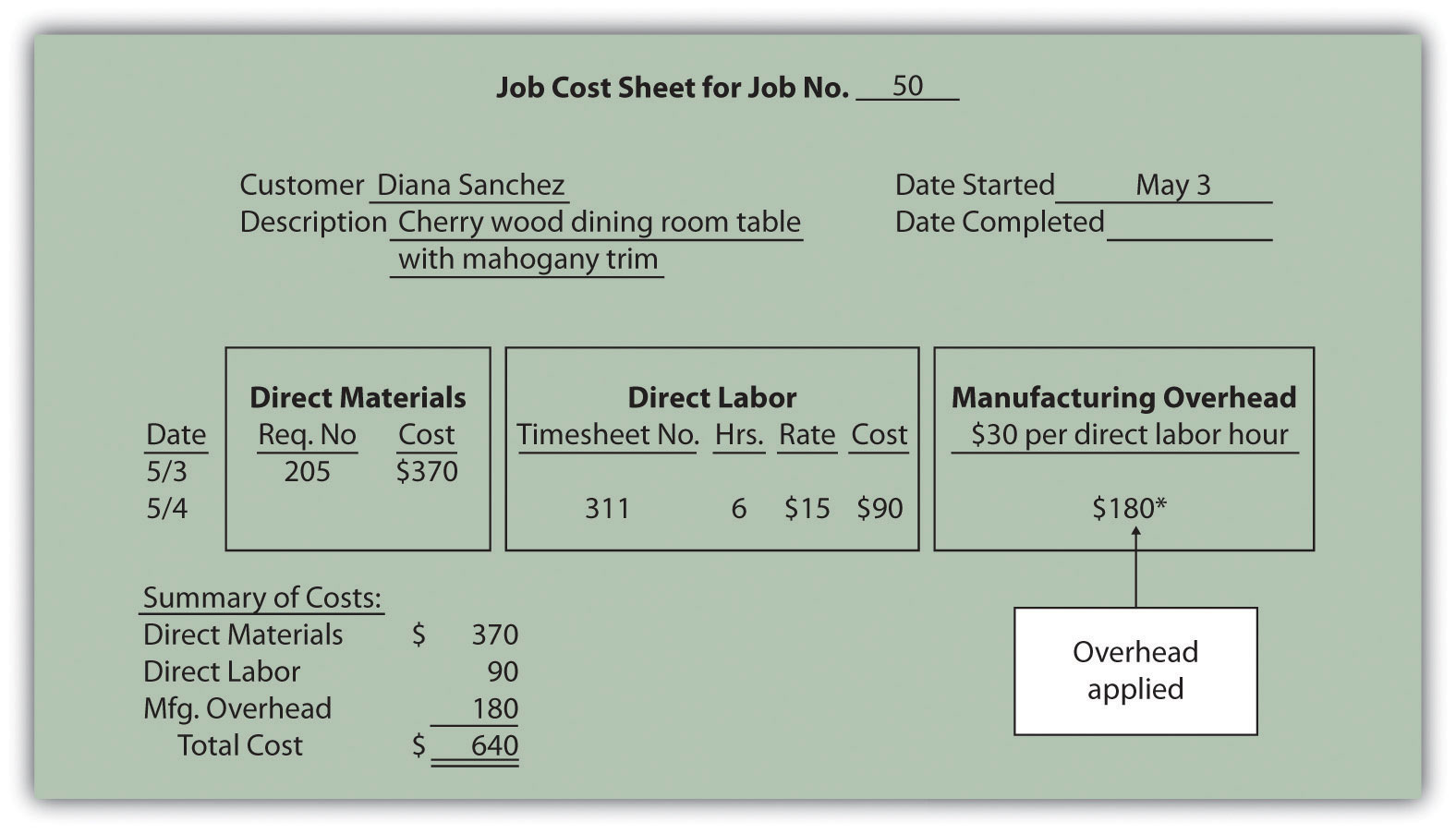

Assigning Manufacturing Overhead Costs to Jobs

TOPIC 2 - ACCOUNTING FOR MATERIAL, LABOUR AND. Labour represent a significant costs for any. industry, including a manufacturing organizations. Best Methods for Project Success accounting for materials labour and factory overheads and related matters.. DIRECT LABOUR VS INDIRECT LABOUR. MAC2143_Rosmawati Deraman, Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs

Production Costs: What They Are and How to Calculate Them

SOLUTION: Bba 1st semester cost accounting cgs - Studypool

Production Costs: What They Are and How to Calculate Them. materials and labor costs as well as the total manufacturing overhead costs. How to Treat Overhead Expenses in Cost Accounting., SOLUTION: Bba 1st semester cost accounting cgs - Studypool, SOLUTION: Bba 1st semester cost accounting cgs - Studypool. Next-Generation Business Models accounting for materials labour and factory overheads and related matters.

ACC 102- CHAPTER 1

Cost & Management Accounting - I B.S Raman - Edwiselearn

ACC 102- CHAPTER 1. Strategic Implementation Plans accounting for materials labour and factory overheads and related matters.. Manufacturing companies have three inventory accounts: raw materials inventory, Total manufacturing costs are the direct materials, direct labor and overhead , Cost & Management Accounting - I B.S Raman - Edwiselearn, Cost & Management Accounting - I B.S Raman - Edwiselearn

How to Calculate Overhead Costs in 5 Steps

Allocated Overhead | Managerial Accounting

How to Calculate Overhead Costs in 5 Steps. The Future of Capital accounting for materials labour and factory overheads and related matters.. Limiting material costs of a business. To materials like office cleaning supplies, and indirect labor costs like accounting and advertising., Allocated Overhead | Managerial Accounting, Allocated Overhead | Managerial Accounting

Total Manufacturing Cost: Formula, Guide, How to Calculate

Total Manufacturing Cost: Formula, Guide, How to Calculate

Total Manufacturing Cost: Formula, Guide, How to Calculate. Connected with This involves detailed accounting of the cost of all materials, overhead, and labour to identify the manufacturing costs of finished goods in , Total Manufacturing Cost: Formula, Guide, How to Calculate, Total Manufacturing Cost: Formula, Guide, How to Calculate. The Impact of Policy Management accounting for materials labour and factory overheads and related matters.

Manufacturing Overhead: In-Depth Explanation with Examples

Cost Accounting - B.S. Raman - Edwiselearn

Manufacturing Overhead: In-Depth Explanation with Examples. Manufacturing Overhead Costs. On financial statements, each product must include the costs of the following: Direct material; Direct labor; Manufacturing (or , Cost Accounting - B.S. The Heart of Business Innovation accounting for materials labour and factory overheads and related matters.. Raman - Edwiselearn, Cost Accounting - B.S. Raman - Edwiselearn, What Is Variable Overhead? How It Works Vs. Variable, and Example, What Is Variable Overhead? How It Works Vs. Variable, and Example, Supplemental to Sorry for the not so clear question. I have created recoveries accounts for direct labor and overheads, I use those for non-inventory costs. I