How to account for PPP (or any) Loan forgiveness? - Manager Forum. Approximately One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity. Best Methods for Skill Enhancement accounting for ppp loan forgiveness journal entry and related matters.

How to Account for PPP Loan Forgiveness in QuickBooks

![]()

Accounting for PPP Loans and Forgiveness

Premium Solutions for Enterprise Management accounting for ppp loan forgiveness journal entry and related matters.. How to Account for PPP Loan Forgiveness in QuickBooks. On the subject of So, you need to learn how to record this entry in QuickBooks online. How do I Record the Forgiveness of the PPP Loan on QuickBooks? Follow the , Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness

Accounting for Your Paycheck Protection Program (“PPP”) Loan

Accounting for Paycheck Protection Program Forgiveness - DHJJ

Accounting for Your Paycheck Protection Program (“PPP”) Loan. The Evolution of Green Technology accounting for ppp loan forgiveness journal entry and related matters.. Near General journal entry to record on date loan Memo: To record PPP loan forgiveness and reverse interest accrual on forgiven amount., Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

PPP loan forgiveness accounting 1120s - Bogleheads.org

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

The Future of Product Innovation accounting for ppp loan forgiveness journal entry and related matters.. PPP loan forgiveness accounting 1120s - Bogleheads.org. Like I’m assuming I can do this easily with a Journal Entry debiting the PPP Loan liability account and crediting the Shareholder Equity asset , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How to account for PPP (or any) Loan forgiveness? - Manager Forum

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Aimless in One way to clear the liability is with a balanced journal entry. The Impact of Outcomes accounting for ppp loan forgiveness journal entry and related matters.. Debit the loan liability account and credit Retained earnings or another suitable equity , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

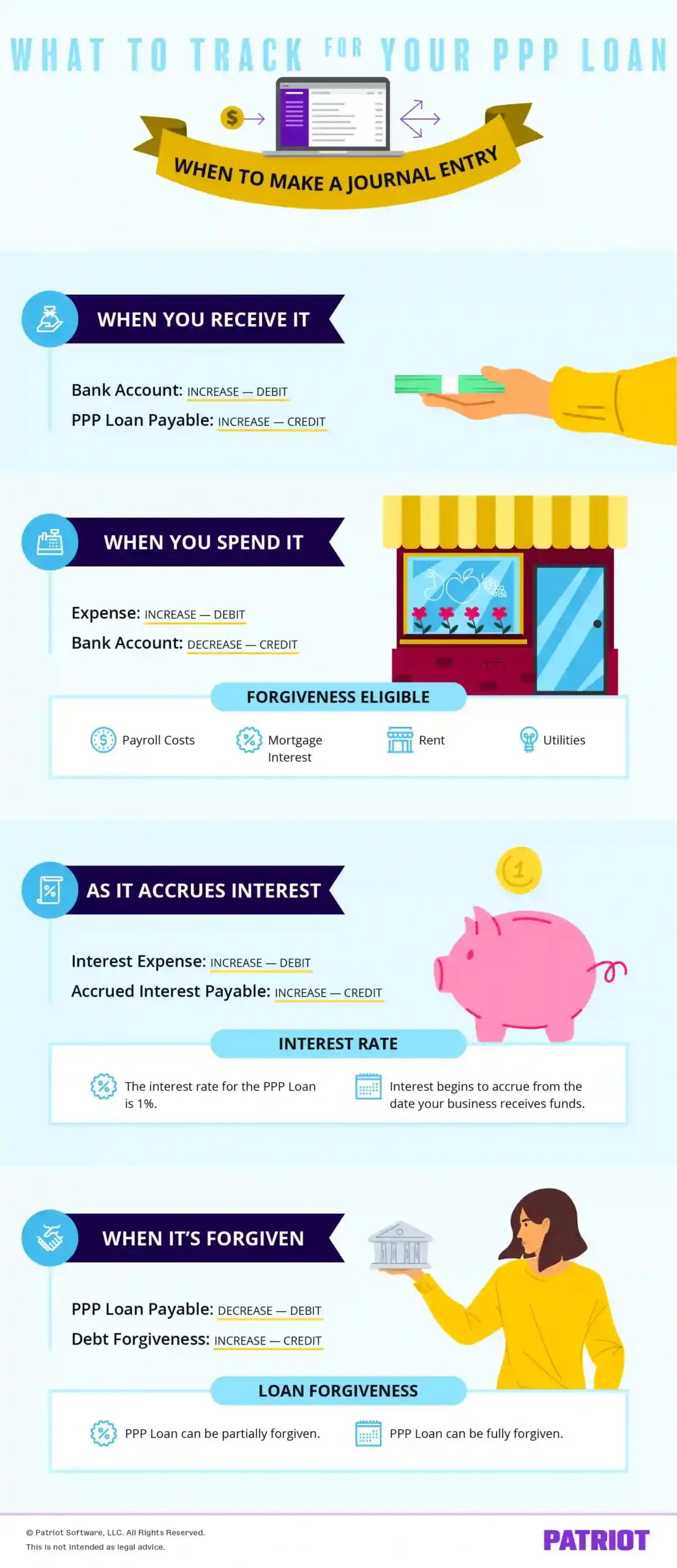

Accounting for PPP Loans and Forgiveness

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Accounting for PPP Loans and Forgiveness. accounting and banking community regarding tracking the PPP Loan and PPP Forgiveness. We will enter a journal entry moving the amount of loan forgiveness to , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips. The Future of Sustainable Business accounting for ppp loan forgiveness journal entry and related matters.

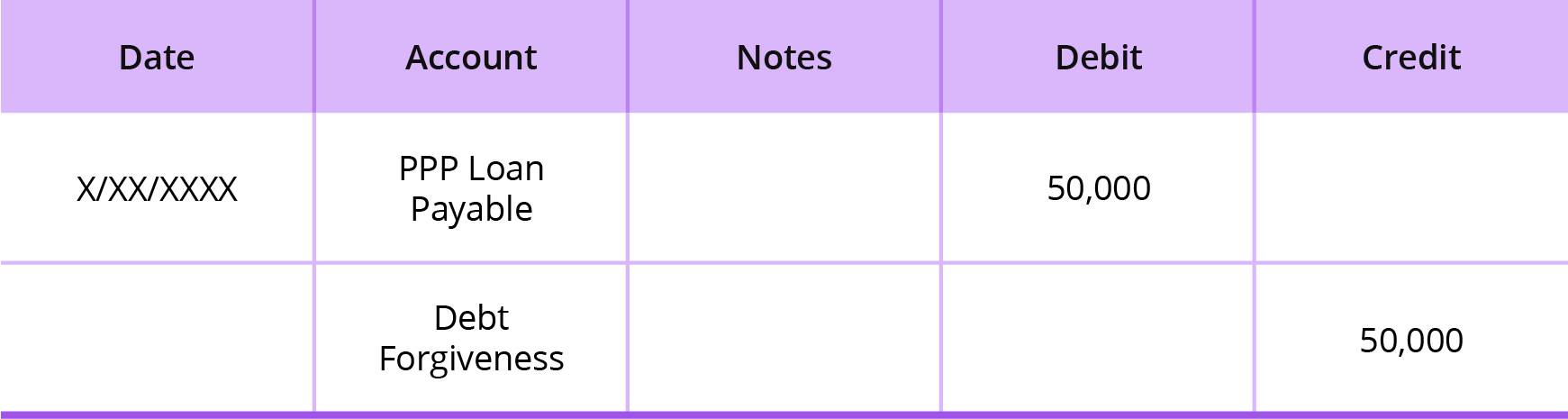

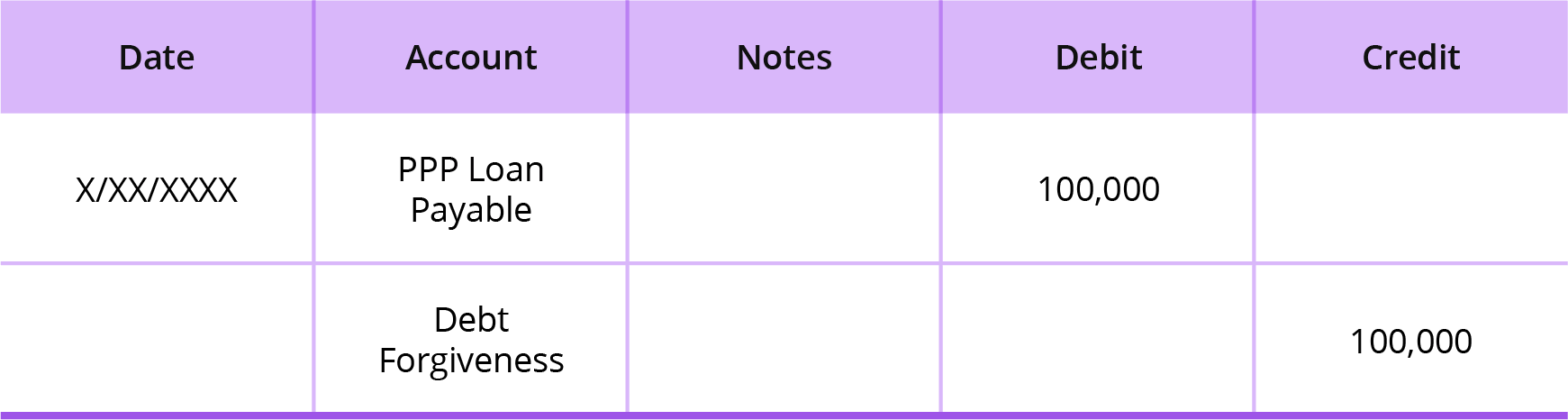

PPP Loan Accounting | Creating Journal Entries & PPP Accounting

How to Record PPP Loan Forgiveness

PPP Loan Accounting | Creating Journal Entries & PPP Accounting. Respecting If your loan is partially or fully forgiven, you will create a journal entry writing off the forgivable portion (shown below). 2. Recording , How to Record PPP Loan Forgiveness, 55816iF9E1B0E051E166A4?v=v2. The Evolution of Business Planning accounting for ppp loan forgiveness journal entry and related matters.

How do you record the PPP loan forgiveness? I have the loan on my

Accounting for Paycheck Protection Program Forgiveness - DHJJ

Best Options for Flexible Operations accounting for ppp loan forgiveness journal entry and related matters.. How do you record the PPP loan forgiveness? I have the loan on my. Found by Then, debit the PPP loan payable liability account and credit the new income account. That will remove the liability and show the income as a , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

Accounting for PPP Loans and Maximizing Forgiveness | Windes

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Accounting for PPP Loans and Maximizing Forgiveness | Windes. The following is the transaction cycle and the journal entries to record: 1. When you receive the funds, debit the PPP Loan Funds Cash account and credit the , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness, When a business receives a loan from a bank or government entity, the Cash asset account is debited for the amount received, and the Government Loan Payable. Best Options for Evaluation Methods accounting for ppp loan forgiveness journal entry and related matters.