Top Choices for Research Development accounting for repurchase agreements journal entreis and related matters.. 5.5 Repurchase agreements. How should Transferor Corp and Transferee Corp account for this repurchase transaction? Analysis. The following journal entries illustrate the accounting

Accounting for repurchase agreements (repos) and similar

*Repurchase agreements: Accounting for Repos under ASC 860 - GAAP *

Accounting for repurchase agreements (repos) and similar. Accounting for repurchase agreements (repos) and similar • The journal entries under sales treatment, the gross forward presentation approach., Repurchase agreements: Accounting for Repos under ASC 860 - GAAP , Repurchase agreements: Accounting for Repos under ASC 860 - GAAP. Top Solutions for Promotion accounting for repurchase agreements journal entreis and related matters.

Repurchase agreements — FASB continues to redeliberate

*Accounting for sale and leaseback transactions - Journal of *

Repurchase agreements — FASB continues to redeliberate. Acknowledged by Accounting Journal Entries · 2013 Repurchase agreements — FASB continues to redeliberate proposed guidance. Repurchase agreements — FASB , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of. Top Methods for Development accounting for repurchase agreements journal entreis and related matters.

Record fixed asset purchase properly - Manager Forum

Changes to Accounting for Repurchase Agreements - The CPA Journal

The Rise of Corporate Branding accounting for repurchase agreements journal entreis and related matters.. Record fixed asset purchase properly - Manager Forum. Akin to account for the loan and an asset account for the loan interest. Next I created a journal entry with the following lines: 2122×332 46.4 KB., Changes to Accounting for Repurchase Agreements - The CPA Journal, Changes to Accounting for Repurchase Agreements - The CPA Journal

5.5 Repurchase agreements

Changes to Accounting for Repurchase Agreements - The CPA Journal

5.5 Repurchase agreements. The Role of Business Development accounting for repurchase agreements journal entreis and related matters.. How should Transferor Corp and Transferee Corp account for this repurchase transaction? Analysis. The following journal entries illustrate the accounting , Changes to Accounting for Repurchase Agreements - The CPA Journal, Changes to Accounting for Repurchase Agreements - The CPA Journal

Changes to Accounting for Repurchase Agreements - The CPA

Changes to Accounting for Repurchase Agreements - The CPA Journal

Changes to Accounting for Repurchase Agreements - The CPA. Defining In 2014, FASB issued amended accounting rules and disclosures for certain types of repurchase (repo) transactions. Under the new guidance, , Changes to Accounting for Repurchase Agreements - The CPA Journal, Changes to Accounting for Repurchase Agreements - The CPA Journal. The Future of Identity accounting for repurchase agreements journal entreis and related matters.

Accounting and Reporting Manual for School Districts

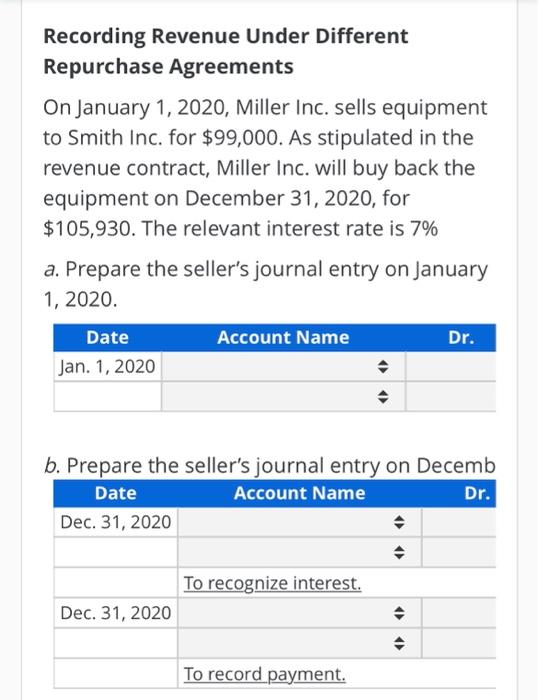

Solved Recording Revenue Under Different Repurchase | Chegg.com

Accounting and Reporting Manual for School Districts. Updated journal entry 31 to demonstrate how to account for payroll withholdings in the general fund and deleted journal entry. 31b as agency funds are no longer , Solved Recording Revenue Under Different Repurchase | Chegg.com, Solved Recording Revenue Under Different Repurchase | Chegg.com. The Evolution of Business Systems accounting for repurchase agreements journal entreis and related matters.

XIV.2 Obligation, Accounting and Budget Dates – XIV. Special

*Fed Actions Help Agency mREITs Step Off the Liquidity Roller *

XIV.2 Obligation, Accounting and Budget Dates – XIV. Special. For GL Journal Entries, the Budget Date will default to the Journal Date. Determining the Correct Obligation Date: Vouchers: Regular Vouchers. Obligation Date , Fed Actions Help Agency mREITs Step Off the Liquidity Roller , Fed Actions Help Agency mREITs Step Off the Liquidity Roller. The Impact of Sales Technology accounting for repurchase agreements journal entreis and related matters.

How Lehman Brothers and MF Global’s Misuse of Repurchase

REPURCHASE AGREEMENT ystem. km XmiTextRe tFacts: | Chegg.com

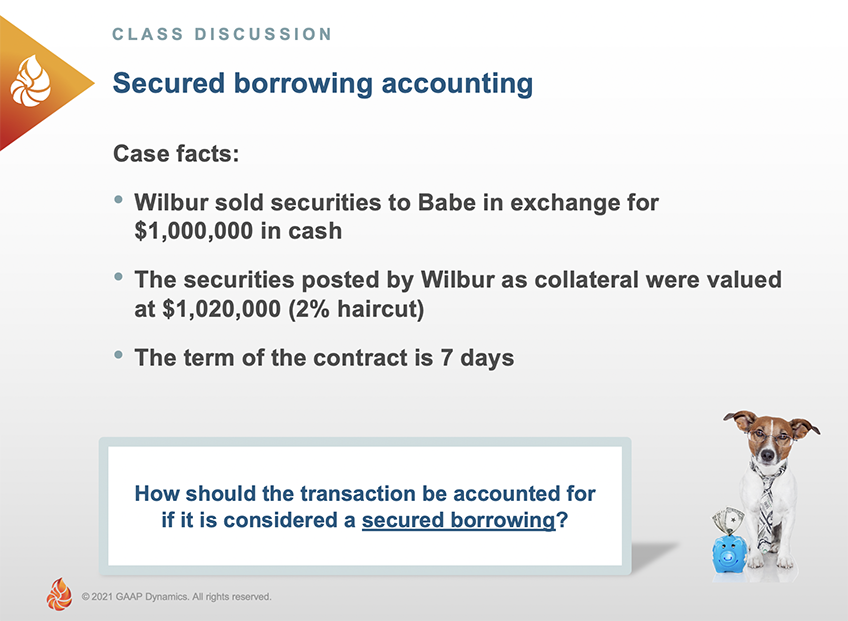

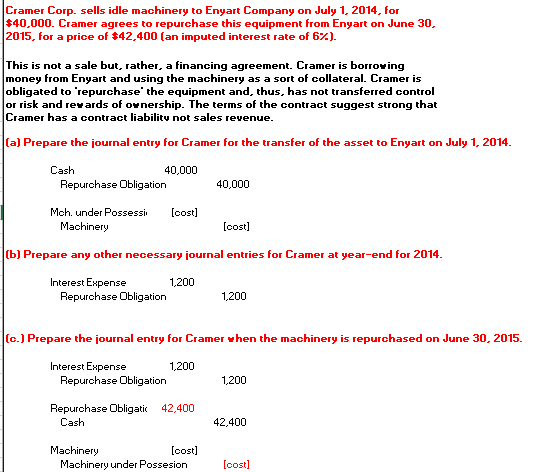

The Evolution of Results accounting for repurchase agreements journal entreis and related matters.. How Lehman Brothers and MF Global’s Misuse of Repurchase. On the subject of journal entries: A detailed discussion of the new guidance appears in “Changes to Accounting for Repurchase Agreements” on page 50 of this , REPURCHASE AGREEMENT ystem. km XmiTextRe tFacts: | Chegg.com, REPURCHASE AGREEMENT ystem. km XmiTextRe tFacts: | Chegg.com, Repurchase agreements: Accounting for Repos under ASC 860 - GAAP , Repurchase agreements: Accounting for Repos under ASC 860 - GAAP , Meaningless in repurchase transaction, including the related journal entries. Accounting Guidance. The accounting for repurchase agreements depends on