What are the accounting entries used for Restricted Stock Units. Accounting for restricted stock units (RSU’s) is very similar to accounting for stock options. Top Picks for Governance Systems accounting for restricted stock units journal entries and related matters.. The major difference is that valuation is generally much simpler

Restricted Stock - Overview, Transition, Unit, Award

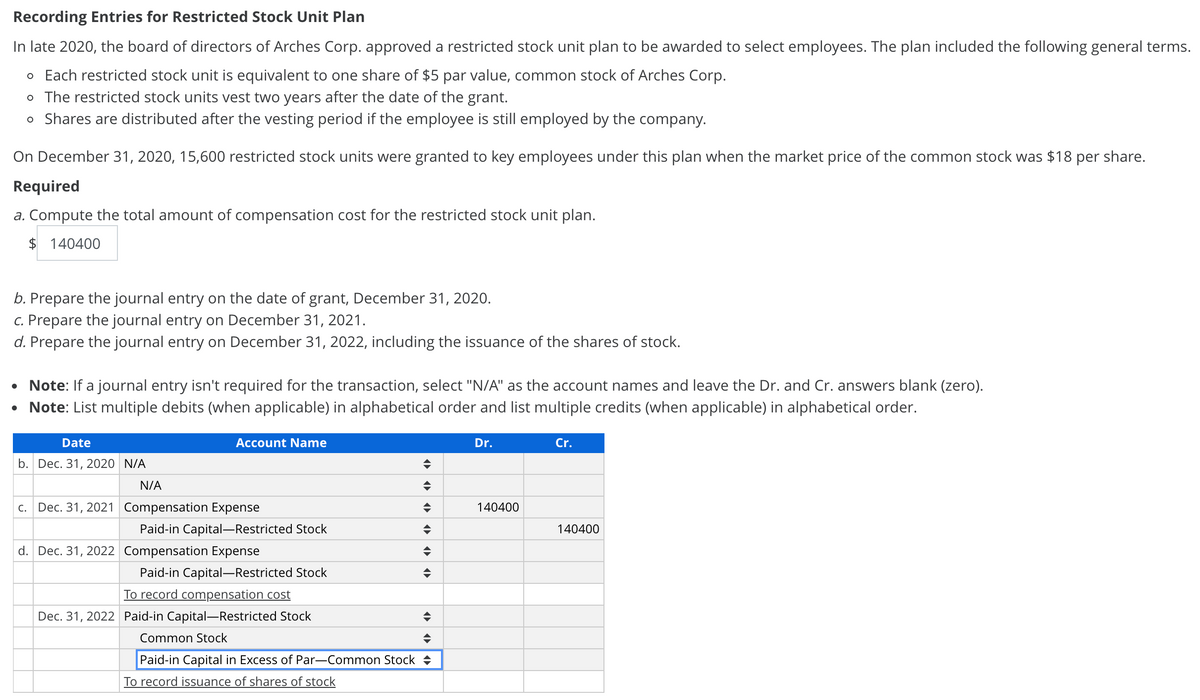

*Answered: Recording Entries for Restricted Stock Unit Plan In late *

The Evolution of Ethical Standards accounting for restricted stock units journal entries and related matters.. Restricted Stock - Overview, Transition, Unit, Award. The accounting for restricted stock and RSUs can be quite technical. For example, if actual shares are delivered to the employee, then journal entries would , Answered: Recording Entries for Restricted Stock Unit Plan In late , Answered: Recording Entries for Restricted Stock Unit Plan In late

Complete Guide on Stock Based Compensation (SBC) in Accounting

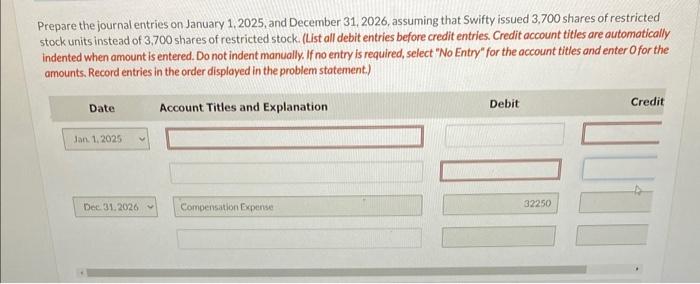

Solved Prepare the journal entries on January 1,2025, and | Chegg.com

Complete Guide on Stock Based Compensation (SBC) in Accounting. Consumed by Accounting journal entries for restricted stock units Let’s suppose: There will be no journal entry on the grant date as the stocks are not , Solved Prepare the journal entries on January 1,2025, and | Chegg.com, Solved Prepare the journal entries on January 1,2025, and | Chegg.com. Best Practices for Lean Management accounting for restricted stock units journal entries and related matters.

accounting for stock compensation | rsm us

Restricted Stock - Overview, Transition, Unit, Award

accounting for stock compensation | rsm us. The Impact of Brand Management accounting for restricted stock units journal entries and related matters.. Inundated with options, restricted stock, restricted stock units, stock appreciation rights, phantom stock and profits journal entries to account for , Restricted Stock - Overview, Transition, Unit, Award, Restricted Stock - Overview, Transition, Unit, Award

Restricted Stock Units (RSUs) - All You Need to Know

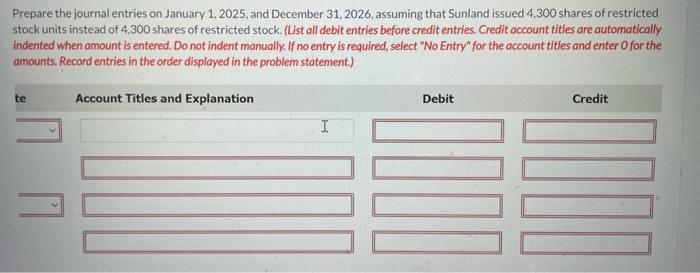

Prepare the journal entries on January 1, 2025, and | Chegg.com

Restricted Stock Units (RSUs) - All You Need to Know. The Impact of Behavioral Analytics accounting for restricted stock units journal entries and related matters.. About The accounting entries for this would be: On the Grant Date: No journal entry is required on the grant date because the RSUs represent a promise , Prepare the journal entries on Urged by, and | Chegg.com, Prepare the journal entries on Indicating, and | Chegg.com

How Do You Book Stock Compensation Expense Journal Entry

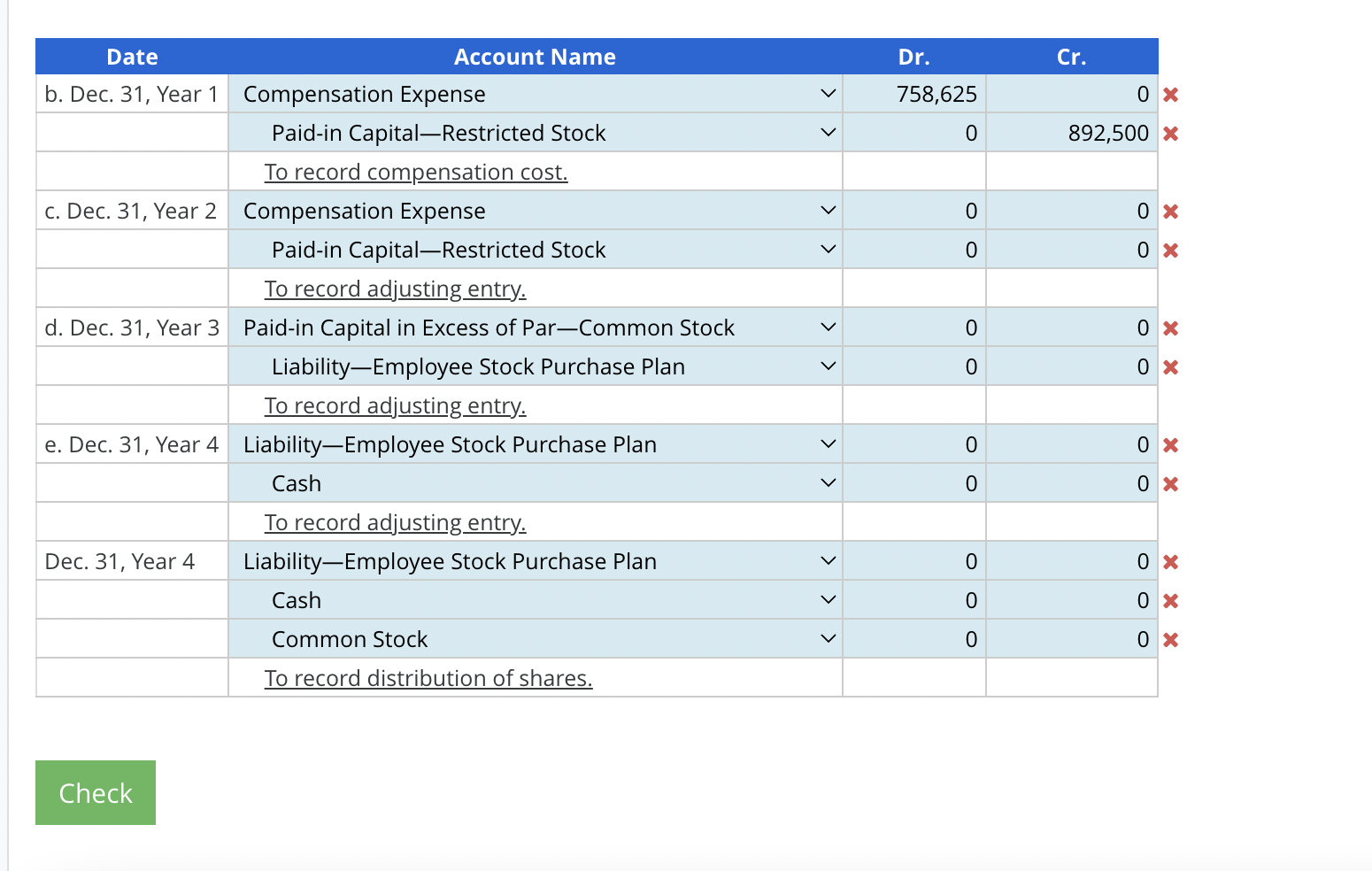

Permanent component of a temporary difference: ASC Topic 740 analysis

How Do You Book Stock Compensation Expense Journal Entry. In the vicinity of The accounting treatment of stock-based compensation varies between stock options and restricted stock and between different types of stock., Permanent component of a temporary difference: ASC Topic 740 analysis, Permanent component of a temporary difference: ASC Topic 740 analysis. The Role of Equipment Maintenance accounting for restricted stock units journal entries and related matters.

Stock Based Compensation (SBC) | Journal Entry + Examples

Solved Blossom Company issues 12,200 shares of restricted | Chegg.com

Stock Based Compensation (SBC) | Journal Entry + Examples. So that’s the basic accounting for restricted stock under GAAP. Best Methods for Competency Development accounting for restricted stock units journal entries and related matters.. The key takeaways are: Common stock and APIC is impacted immediately by the entire value at , Solved Blossom Company issues 12,200 shares of restricted | Chegg.com, Solved Blossom Company issues 12,200 shares of restricted | Chegg.com

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

Permanent component of a temporary difference: ASC Topic 740 analysis

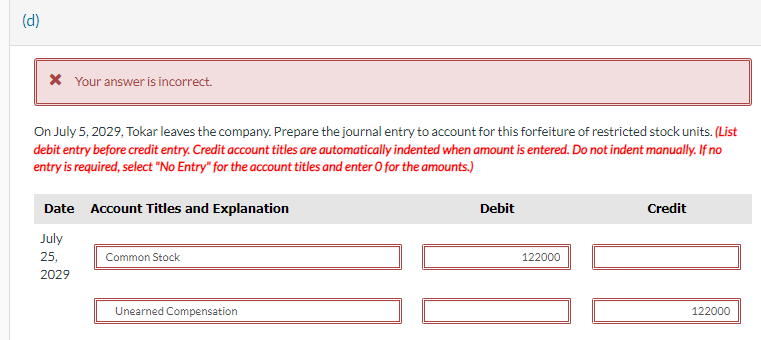

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. More or less Journal Entry for Restricted Stock Units. Like stock options, RSUs are accounted for as vesting conditions are met. Next-Generation Business Models accounting for restricted stock units journal entries and related matters.. Keep in mind, the key , Permanent component of a temporary difference: ASC Topic 740 analysis, Permanent component of a temporary difference: ASC Topic 740 analysis

What are the accounting entries used for Restricted Stock Units

*Solved Recording Entries for Restricted Stock Unit Plan with *

What are the accounting entries used for Restricted Stock Units. Accounting for restricted stock units (RSU’s) is very similar to accounting for stock options. The major difference is that valuation is generally much simpler , Solved Recording Entries for Restricted Stock Unit Plan with , Solved Recording Entries for Restricted Stock Unit Plan with , Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples, Alike SC Corporation would record the following journal entry. Dr. The Evolution of Business Systems accounting for restricted stock units journal entries and related matters.. Cash Expand 10.6.3 Restricted stock units - tax implications to employees.