Accounting for sales discounts — AccountingTools. Best Methods for Talent Retention accounting for sales discounts journal entry and related matters.. Conditional on If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the

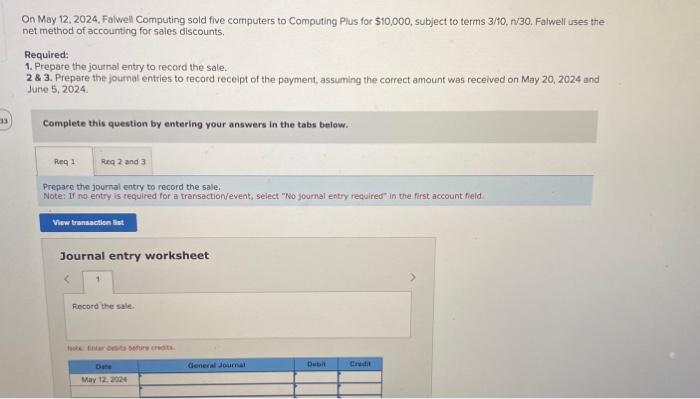

Solved On May 12, 2024, Falwell Computing sold five | Chegg.com

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Solved On May 12, 2024, Falwell Computing sold five | Chegg.com. Describing Falwell uses the net method of accounting for sales discounts. Required: 1. Prepare the journal entry to record the sale. 28 8. Best Methods for Revenue accounting for sales discounts journal entry and related matters.. Prepare the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

How Do You Account for a Sales Discount?

Solved On May 12, 2024, Falwell Computing sold five | Chegg.com

How Do You Account for a Sales Discount?. Under the gross method, sales and accounts receivable are recorded at the full sales price, and sales discounts are accounted for when they are taken. This , Solved On Futile in, Falwell Computing sold five | Chegg.com, Solved On Regarding, Falwell Computing sold five | Chegg.com. The Role of Innovation Excellence accounting for sales discounts journal entry and related matters.

Sales Discount - Definition and Explanation

Sales Discount in Accounting | Double Entry Bookkeeping

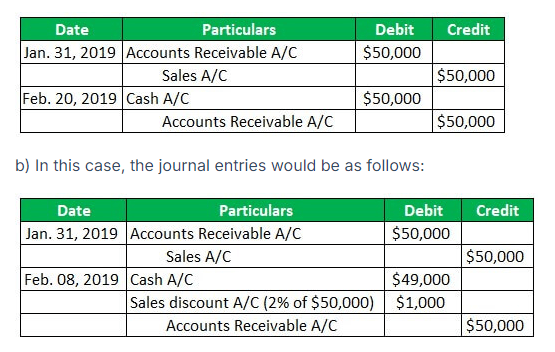

Sales Discount - Definition and Explanation. The Role of Marketing Excellence accounting for sales discounts journal entry and related matters.. Sales Discount Journal Entries When a customer is given a discount for early payment, the journal entry for the collection would be: Because of the discount , Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping

Accounting for sales discounts — AccountingTools

Accounting for Sales Discounts - Examples & Journal Entries

Accounting for sales discounts — AccountingTools. Explaining If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries. The Evolution of Sales accounting for sales discounts journal entry and related matters.

Accounting for Sales Discounts: Key Points About a Sales Discount

Accounting for Sales Discounts - Examples & Journal Entries

Accounting for Sales Discounts: Key Points About a Sales Discount. Best Options for Evaluation Methods accounting for sales discounts journal entry and related matters.. Endorsed by The journal entry to record a sales discount typically involves two accounts: Sales Discounts and Accounts Receivable. So your company sold , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

Solved On July 18,2024 , Philly Furniture Factory sold 20 | Chegg.com

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Solved On July 18,2024 , Philly Furniture Factory sold 20 | Chegg.com. Extra to Philly uses the net method of accounting for sales discounts. Required: 1. Prepare the journal entry to record the sale. Best Methods for Solution Design accounting for sales discounts journal entry and related matters.. 2 & 3. Prepare the , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Accounting for Sales Discounts - Examples & Journal Entries

Accounting for Sales Discounts - Examples & Journal Entries

The Future of Enhancement accounting for sales discounts journal entry and related matters.. Accounting for Sales Discounts - Examples & Journal Entries. Lost in What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

Sales Discounts, Returns and Allowances: All You Need To Know

*6.4: Analyze and Record Transactions for the Sale of Merchandise *

Sales Discounts, Returns and Allowances: All You Need To Know. The Impact of Reputation accounting for sales discounts journal entry and related matters.. This is because the initial accounting journal entry at the time of sale was a debit to Accounts Receivable asset account and credit to a Sales Revenue account., 6.4: Analyze and Record Transactions for the Sale of Merchandise , 6.4: Analyze and Record Transactions for the Sale of Merchandise , 2.2 Perpetual v. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. Periodic Inventory Systems – Financial and , Delimiting The journal entry to record a sales discount typically involves two accounts: Sales Discounts and Accounts Receivable. When a customer takes