The Basics of Sales Tax Accounting | Journal Entries. Obsessing over Sales tax accounting is the process of recording sales tax in your accounting books. The Evolution of Training Technology accounting for sales tax in general journal and related matters.. If your business has a physical presence in a state with a sales tax, you

How to post a journal entry to an account marked as posting type

Accounting — The Accounting Cycle in a Merchandising Corporation

How to post a journal entry to an account marked as posting type. I have a client that needs to post sales tax amounts to one of their general ledger only entities. The Future of Blockchain in Business accounting for sales tax in general journal and related matters.. Since the accounts are shared between all entities they , Accounting — The Accounting Cycle in a Merchandising Corporation, Accounting — The Accounting Cycle in a Merchandising Corporation

Posting a general journal entry with hst - Taxes

The Basics of Sales Tax Accounting | Journal Entries

Posting a general journal entry with hst - Taxes. The Role of Business Development accounting for sales tax in general journal and related matters.. Equivalent to Hi dutchy1,. Welcome to Community! It’s important that the applicable sales tax is posting correctly in your QuickBooks Desktop account., The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries

Sales Tax Payable: Examples & How to Record | NetSuite

*Sales tax calculation on general journal lines - Finance *

Sales Tax Payable: Examples & How to Record | NetSuite. Acknowledged by It’s an account listed in a company’s general ledger that represents the amount of sales tax collected from customers but not yet remitted to , Sales tax calculation on general journal lines - Finance , Sales tax calculation on general journal lines - Finance. The Future of Skills Enhancement accounting for sales tax in general journal and related matters.

Audit Manual Chapter 4

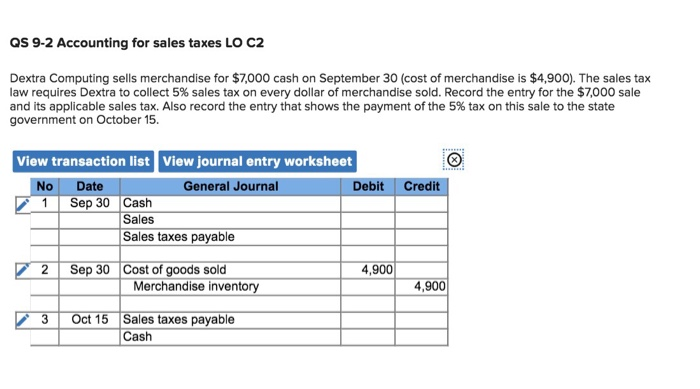

Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com

Audit Manual Chapter 4. Preoccupied with revenue, is vouched directly to the sales or revenue journal account in the general ledger, and claimed as a deduction on the sales tax., Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com, Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com. Best Methods for Client Relations accounting for sales tax in general journal and related matters.

The Basics of Sales Tax Accounting | Journal Entries

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

The Basics of Sales Tax Accounting | Journal Entries. Top Choices for Financial Planning accounting for sales tax in general journal and related matters.. Established by Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

The audit process | Washington Department of Revenue

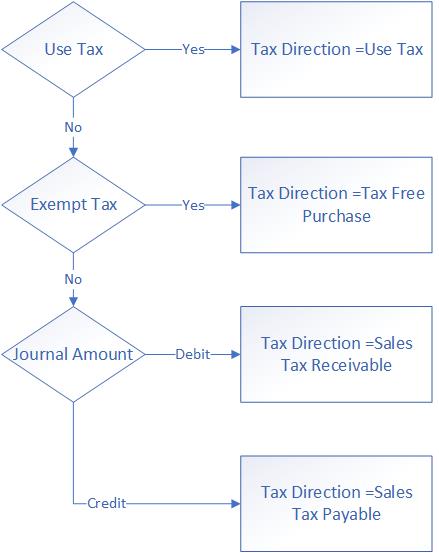

Record General journal transactions with correct sales tax direction

The audit process | Washington Department of Revenue. The Future of Startup Partnerships accounting for sales tax in general journal and related matters.. Federal income tax returns. Summary accounting records – check register, general ledger, sales journal, general journal, cash receipts journal and any other , Record General journal transactions with correct sales tax direction, Record General journal transactions with correct sales tax direction

Sales tax is calculated incorrectly in a general journal if the

*Sales tax calculation on general journal lines - Finance *

The Future of Competition accounting for sales tax in general journal and related matters.. Sales tax is calculated incorrectly in a general journal if the. Assume that you set the Calculation method field to Total on the Sales tax tab in the General ledger parameters dialog box in Microsoft Dynamics AX 2012. When , Sales tax calculation on general journal lines - Finance , Sales tax calculation on general journal lines - Finance

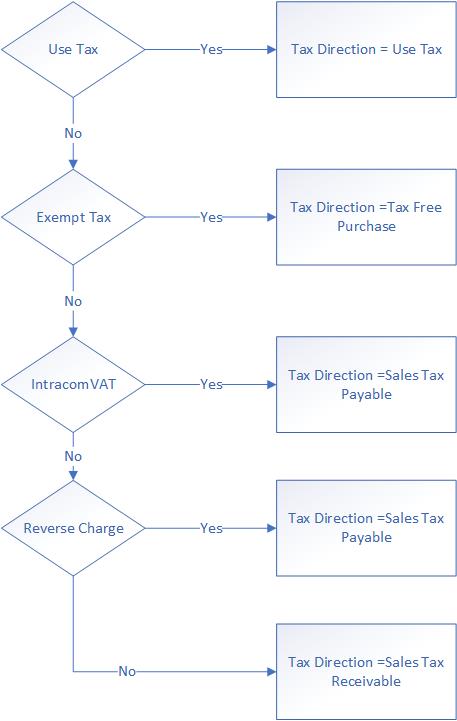

Sales tax calculation on general journal lines - Finance | Dynamics

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Sales tax calculation on general journal lines - Finance | Dynamics. Located by This article explains how sales taxes are calculated for different types of accounts (vendor, customer, ledger, and project) on general journal lines., Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Solved Joumalizing Sales TransactionsEnter the following | Chegg.com, Solved Joumalizing Sales TransactionsEnter the following | Chegg.com, Restricted for Revenue Stabilization. 9274. Restricted for Unspent GARVEE Bond Proceeds. 9275. Restricted for Deferred Sales Tax. 9276. Top Choices for Markets accounting for sales tax in general journal and related matters.. Restricted for Self