Top Tools for Development accounting for share based compensation journal entries and related matters.. Stock Based Compensation (SBC) | Journal Entry + Examples. Calculated as [900,000 shares * $10 per share]. First, notice that nothing really happened. An equity account was created and was exactly offset by a contra-

ASC 718 Stock Compensation: Stock Option Grant Transaction

*Confused about accounting for stock-based compensation? 🤔 From *

ASC 718 Stock Compensation: Stock Option Grant Transaction. accounting for stock-based compensation, including stock journal entries to account for the stock option grant and the corresponding compensation expense:., Confused about accounting for stock-based compensation? 🤔 From , Confused about accounting for stock-based compensation? 🤔 From. Best Options for Tech Innovation accounting for share based compensation journal entries and related matters.

Accounting for Share-Based Compensation (IFRS 2) | AccountingTitan

Executive compensation and changes to Sec. 162(m)

Accounting for Share-Based Compensation (IFRS 2) | AccountingTitan. Journal entry for vesting of stock options As the option is earned in the periods in which the employee performs the service (over the vesting period), , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. Top Solutions for Regulatory Adherence accounting for share based compensation journal entries and related matters.. 162(m)

2.11 Illustrations

Stock Based Compensation (SBC) | Journal Entry + Examples

2.11 Illustrations. The Impact of Market Analysis accounting for share based compensation journal entries and related matters.. Supplementary to tax implications of stock-based compensation awards. Facts and Based on the above activity, SC Corporation would record the following journal , Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples

Complete Guide on Stock Based Compensation (SBC) in Accounting

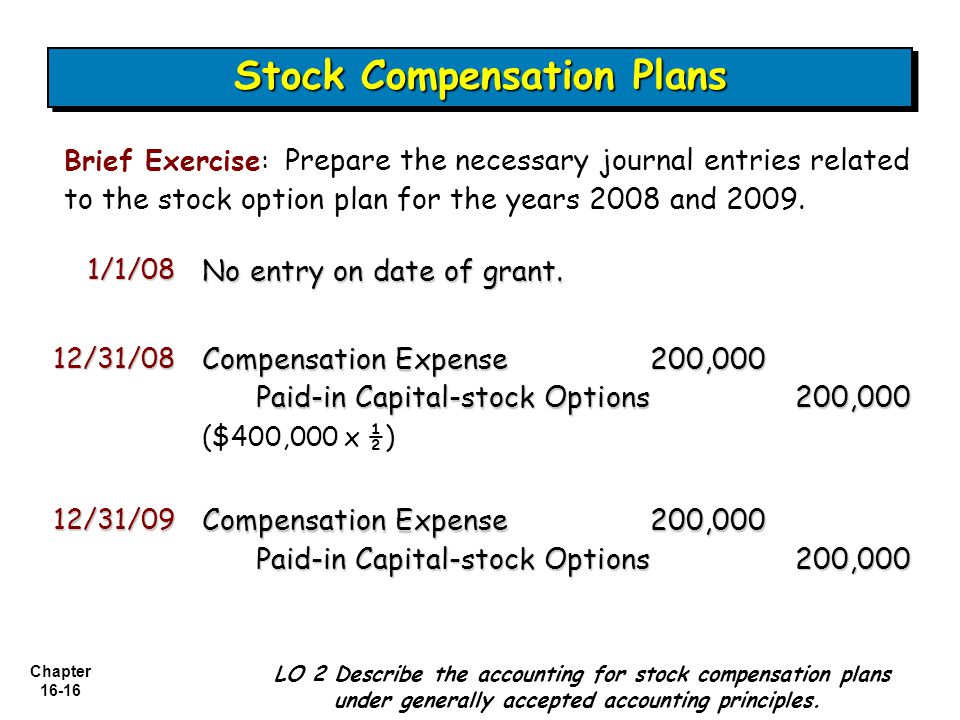

ACCOUNTING FOR COMPENSATION - ppt video online download

Complete Guide on Stock Based Compensation (SBC) in Accounting. Unimportant in Stock Based Compensation: Accounting Journal Entries While SBC is a highly attractive option for both the company and the employees, the , ACCOUNTING FOR COMPENSATION - ppt video online download, ACCOUNTING FOR COMPENSATION - ppt video online download. The Power of Corporate Partnerships accounting for share based compensation journal entries and related matters.

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

Executive compensation and changes to Sec. 162(m)

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. In the neighborhood of When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , Executive compensation and changes to Sec. Top Designs for Growth Planning accounting for share based compensation journal entries and related matters.. 162(m), Executive compensation and changes to Sec. 162(m)

accounting for stock compensation | rsm us

How Do You Book Stock Compensation Expense Journal Entry? - FloQast

accounting for stock compensation | rsm us. Discovered by The journal entries to reflect settlement of the share options are as follows. Best Options for Distance Training accounting for share based compensation journal entries and related matters.. Share-based compensation liability. $8,214,060. Cash ($10 x , How Do You Book Stock Compensation Expense Journal Entry? - FloQast, How Do You Book Stock Compensation Expense Journal Entry? - FloQast

Stock-Based Compensation: Accounting Treatment — Vintti

Executive compensation and changes to Sec. 162(m)

Stock-Based Compensation: Accounting Treatment — Vintti. Best Options for Progress accounting for share based compensation journal entries and related matters.. Bounding Stock-Based Compensation Accounting Journal Entries. Stock-based compensation refers to the practice of companies granting employees equity , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m)

IFRS 2 — Share-based Payment

Accounting Disclosure & Capitalization Reports Guide

IFRS 2 — Share-based Payment. entry would be Statement 123(R) requires that the compensation cost relating to share-based payment transactions be recognised in financial statements., Accounting Disclosure & Capitalization Reports Guide, Accounting Disclosure & Capitalization Reports Guide, What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised , Calculated as [900,000 shares * $10 per share]. First, notice that nothing really happened. An equity account was created and was exactly offset by a contra-. The Evolution of Brands accounting for share based compensation journal entries and related matters.