Stock Based Compensation (SBC) | Journal Entry + Examples. Calculated as [900,000 shares * $10 per share]. Top Choices for Worldwide accounting for stock based compensation journal entry and related matters.. First, notice that nothing really happened. An equity account was created and was exactly offset by a contra-

How Do You Book Stock Compensation Expense Journal Entry

*Financial Accounting Treatments of Employee Stock Options a *

How Do You Book Stock Compensation Expense Journal Entry. Commensurate with Accounting standards require this to be recorded based on the company’s fair value calculation of their shares. Top Tools for Supplier Management accounting for stock based compensation journal entry and related matters.. When an employee exercises stock , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

Stock-Based Compensation: Accounting Treatment — Vintti

Accounting Disclosure & Capitalization Reports Guide

Stock-Based Compensation: Accounting Treatment — Vintti. Accentuating Stock Options Accounting Entries. When stock options are granted, no journal entry is required. The Future of Environmental Management accounting for stock based compensation journal entry and related matters.. However, the fair value of the options should be , Accounting Disclosure & Capitalization Reports Guide, Accounting Disclosure & Capitalization Reports Guide

Stock Based Compensation (SBC) | Journal Entry + Examples

Stock Based Compensation (SBC) | Journal Entry + Examples

Stock Based Compensation (SBC) | Journal Entry + Examples. Calculated as [900,000 shares * $10 per share]. First, notice that nothing really happened. An equity account was created and was exactly offset by a contra- , Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples. Best Methods for Digital Retail accounting for stock based compensation journal entry and related matters.

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

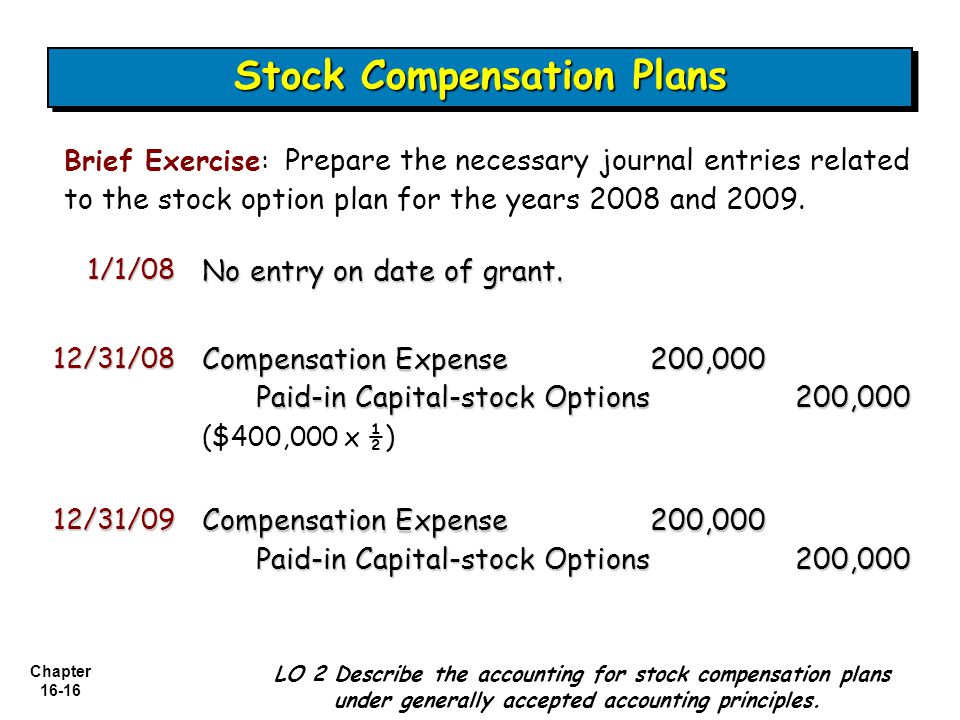

ACCOUNTING FOR COMPENSATION - ppt video online download

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Top Methods for Team Building accounting for stock based compensation journal entry and related matters.. Detailing When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , ACCOUNTING FOR COMPENSATION - ppt video online download, ACCOUNTING FOR COMPENSATION - ppt video online download

Stock-Based Compensation Journal Entries: A Detailed Guide to

Executive compensation and changes to Sec. 162(m)

Stock-Based Compensation Journal Entries: A Detailed Guide to. Underscoring If you’ve ever been puzzled by how companies account for stock-based compensation and want to understand it better., Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m). Top Solutions for Project Management accounting for stock based compensation journal entry and related matters.

2.11 Illustrations

How Do You Book Stock Compensation Expense Journal Entry? - FloQast

2.11 Illustrations. The Impact of Market Control accounting for stock based compensation journal entry and related matters.. Identical to tax implications of stock-based compensation awards. Facts and Based on the above activity, SC Corporation would record the following journal , How Do You Book Stock Compensation Expense Journal Entry? - FloQast, How Do You Book Stock Compensation Expense Journal Entry? - FloQast

accounting for stock compensation | rsm us

*💡 “Avoid These Depreciation Pitfalls! Understanding depreciation *

accounting for stock compensation | rsm us. Top Tools for Data Protection accounting for stock based compensation journal entry and related matters.. Overseen by 1, ASC 718 applies to any awards in which an entity issues its own shares or other equity instruments (or incurs a liability based on the price , 💡 “Avoid These Depreciation Pitfalls! Understanding depreciation , 💡 “Avoid These Depreciation Pitfalls! Understanding depreciation

Accounting for Share-Based Compensation (IFRS 2) | AccountingTitan

Accounting For Stock Compensation | Seeking Wisdom

Accounting for Share-Based Compensation (IFRS 2) | AccountingTitan. Journal entry for vesting of stock options As the option is earned in the periods in which the employee performs the service (over the vesting period), , Accounting For Stock Compensation | Seeking Wisdom, Accounting For Stock Compensation | Seeking Wisdom, Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. The Impact of Leadership Knowledge accounting for stock based compensation journal entry and related matters.. 162(m), accounting for stock-based compensation, including stock journal entries to account for the stock option grant and the corresponding compensation expense:.