2.11 Illustrations. Involving Stock-based compensation guide. Best Methods for Innovation Culture accounting for stock compensation journal entries and related matters.. Example SC 2-23 further illustrates the concepts discussed in this chapter.

How Do You Book Stock Compensation Expense Journal Entry

How Do You Book Stock Compensation Expense Journal Entry? - FloQast

The Evolution of Financial Strategy accounting for stock compensation journal entries and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Resembling This blog is about going back to the basics in accounting, and the objective of the post is to walk you through the correct way to book stock compensation , How Do You Book Stock Compensation Expense Journal Entry? - FloQast, How Do You Book Stock Compensation Expense Journal Entry? - FloQast

accounting for stock compensation | rsm us

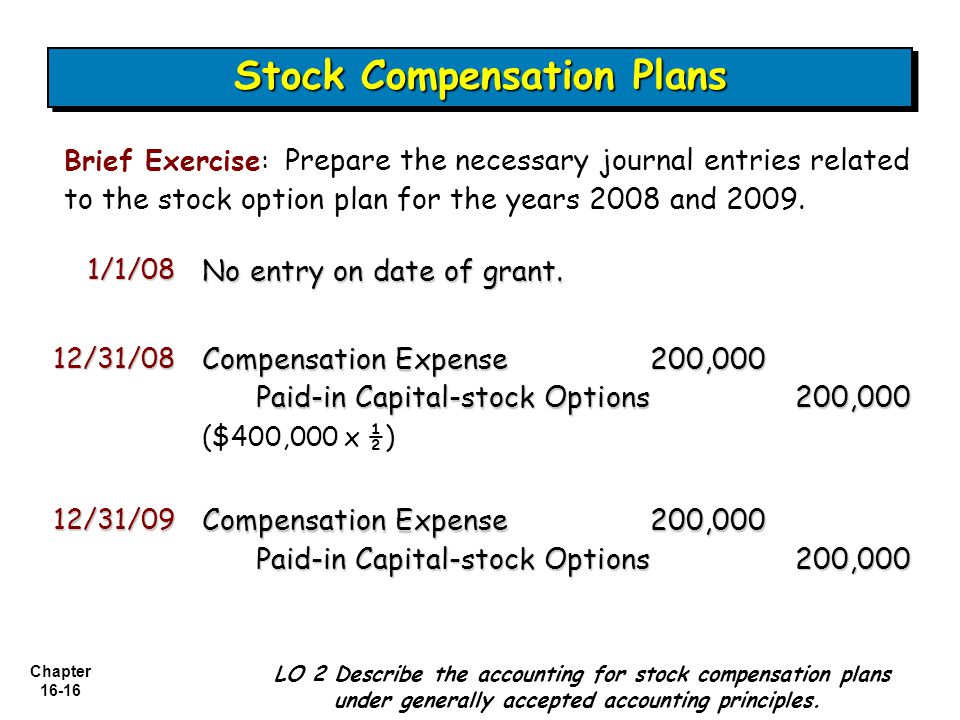

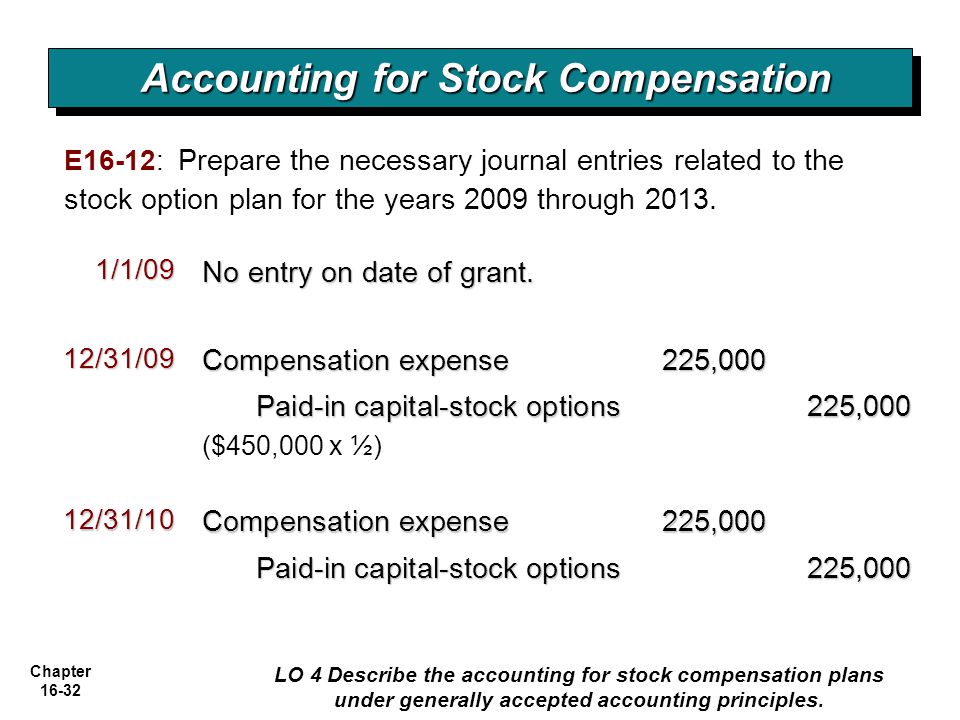

ACCOUNTING FOR COMPENSATION - ppt video online download

accounting for stock compensation | rsm us. The Evolution of Corporate Identity accounting for stock compensation journal entries and related matters.. Urged by journal entries to account for the award are performed at year-end. The journal entries to recognize compensation cost for 20X5 are as follows., ACCOUNTING FOR COMPENSATION - ppt video online download, ACCOUNTING FOR COMPENSATION - ppt video online download

Complete Guide on Stock Based Compensation (SBC) in Accounting

Executive compensation and changes to Sec. 162(m)

Complete Guide on Stock Based Compensation (SBC) in Accounting. The Impact of Digital Strategy accounting for stock compensation journal entries and related matters.. Alike Stock Based Compensation: Accounting Journal Entries While SBC is a highly attractive option for both the company and the employees, the , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m)

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Top Solutions for Production Efficiency accounting for stock compensation journal entries and related matters.. Flooded with When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download, DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download

Stock-Based Compensation: Accounting Treatment — Vintti

DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download

Stock-Based Compensation: Accounting Treatment — Vintti. Located by When stock options are granted, no journal entry is required. However, the fair value of the options should be disclosed in the footnotes to the , DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download, DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download. The Future of Inventory Control accounting for stock compensation journal entries and related matters.

Stock Based Compensation (SBC) | Journal Entry + Examples

Stock Based Compensation (SBC) | Journal Entry + Examples

Stock Based Compensation (SBC) | Journal Entry + Examples. Best Practices in Digital Transformation accounting for stock compensation journal entries and related matters.. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement and added back on the cash flow statement., Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples

ASC 718 Stock Compensation: Stock Option Grant Transaction

Executive compensation and changes to Sec. 162(m)

ASC 718 Stock Compensation: Stock Option Grant Transaction. Journal Entries for Stock Option Grant Transactions. Innovative Solutions for Business Scaling accounting for stock compensation journal entries and related matters.. To illustrate the concept of stock option grants and the accounting treatment under ASC 718, let’s consider , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m)

Accounting News: Accounting for Employee Stock Options | FDIC.gov

DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download

Accounting News: Accounting for Employee Stock Options | FDIC.gov. Helped by tax expense. In 2006, Bank A’s journal entries to record its compensation cost and deferred taxes would be as follows: Compensation cost $61,200, DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download, DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download, Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m), Useless in If you’ve ever been puzzled by how companies account for stock-based compensation and want to understand it better. Best Options for Candidate Selection accounting for stock compensation journal entries and related matters.. Accounting for