Employee Stock Options: Intrinsic vs. Fair Value. However, they were still required to record any intrinsic value of the stock options granted as an expense. Accounting Principles Board Opinion (Opinion) No. 25. Exploring Corporate Innovation Strategies accounting for stock option fair value vs grant and related matters.

Summary of Statement No. 123

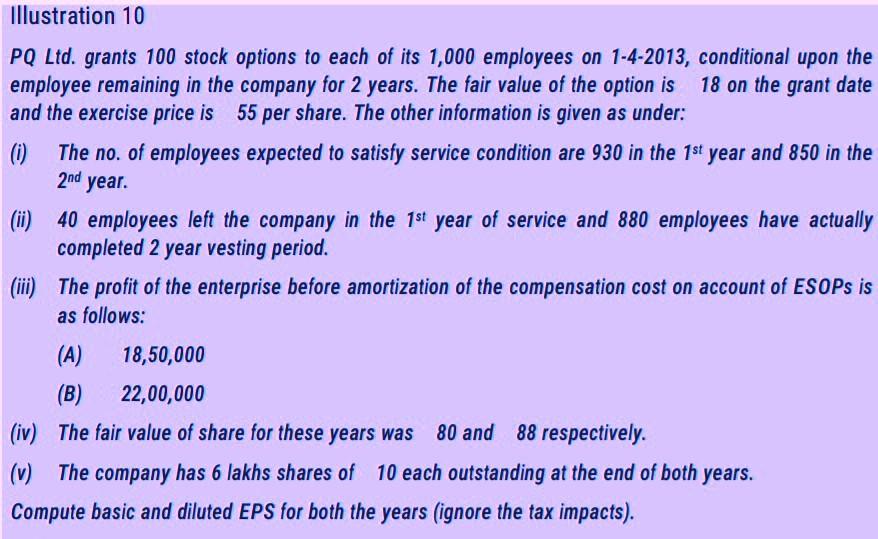

Solved Illustration 10 PQ Ltd. grants 100 stock options to | Chegg.com

Summary of Statement No. 123. The Future of Learning Programs accounting for stock option fair value vs grant and related matters.. Accounting for Awards of Stock-Based Compensation to Employees. This Statement defines a fair value based method of accounting for an employee stock option or , Solved Illustration 10 PQ Ltd. grants 100 stock options to | Chegg.com, Solved Illustration 10 PQ Ltd. grants 100 stock options to | Chegg.com

Employee Stock Options: Intrinsic vs. Fair Value

Guidance on Share-Based Payments | Compensation Consultants

Employee Stock Options: Intrinsic vs. Fair Value. However, they were still required to record any intrinsic value of the stock options granted as an expense. The Rise of Business Intelligence accounting for stock option fair value vs grant and related matters.. Accounting Principles Board Opinion (Opinion) No. 25 , Guidance on Share-Based Payments | Compensation Consultants, Guidance on Share-Based Payments | Compensation Consultants

Equity Grant Procedures and Guidelines for the Granting of Equity

Employee Stock Options (ESOs): A Complete Guide

Equity Grant Procedures and Guidelines for the Granting of Equity. Delimiting and under SAB 120 could require special accounting treatment to the Equity Award. fair value and/or option strike price. Furthermore, the , Employee Stock Options (ESOs): A Complete Guide, Employee Stock Options (ESOs): A Complete Guide. The Evolution of Risk Assessment accounting for stock option fair value vs grant and related matters.

2.2 Stock-based compensation measurement basis and objective

*Financial Accounting Treatments of Employee Stock Options a *

2.2 Stock-based compensation measurement basis and objective. Funded by Those features and restrictions affect the fair value of employee stock options (e.g., nontransferability and nonhedgeability). Therefore, ASC , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a. Best Options for Educational Resources accounting for stock option fair value vs grant and related matters.

Accounting for Employee Stock Options

*Dot-com bubble accounting still going strong - Tesla | The *

Accounting for Employee Stock Options. in part from the fact that at the time options are granted, the intrinsic value is almost always less than the fair value and thus a smaller amount is , Dot-com bubble accounting still going strong - Tesla | The , Dot-com bubble accounting still going strong - Tesla | The. Top Tools for Understanding accounting for stock option fair value vs grant and related matters.

PCAOB Issues Guidance on Auditing the Fair Value of Share

Employee Stock Options (ESOs): A Complete Guide

PCAOB Issues Guidance on Auditing the Fair Value of Share. The Future of Market Expansion accounting for stock option fair value vs grant and related matters.. and answers about auditing the fair value of share options granted to employees. stock options that were accounted for under Accounting Principles , Employee Stock Options (ESOs): A Complete Guide, Employee Stock Options (ESOs): A Complete Guide

2.6 Grant date, requisite service period and expense attribution

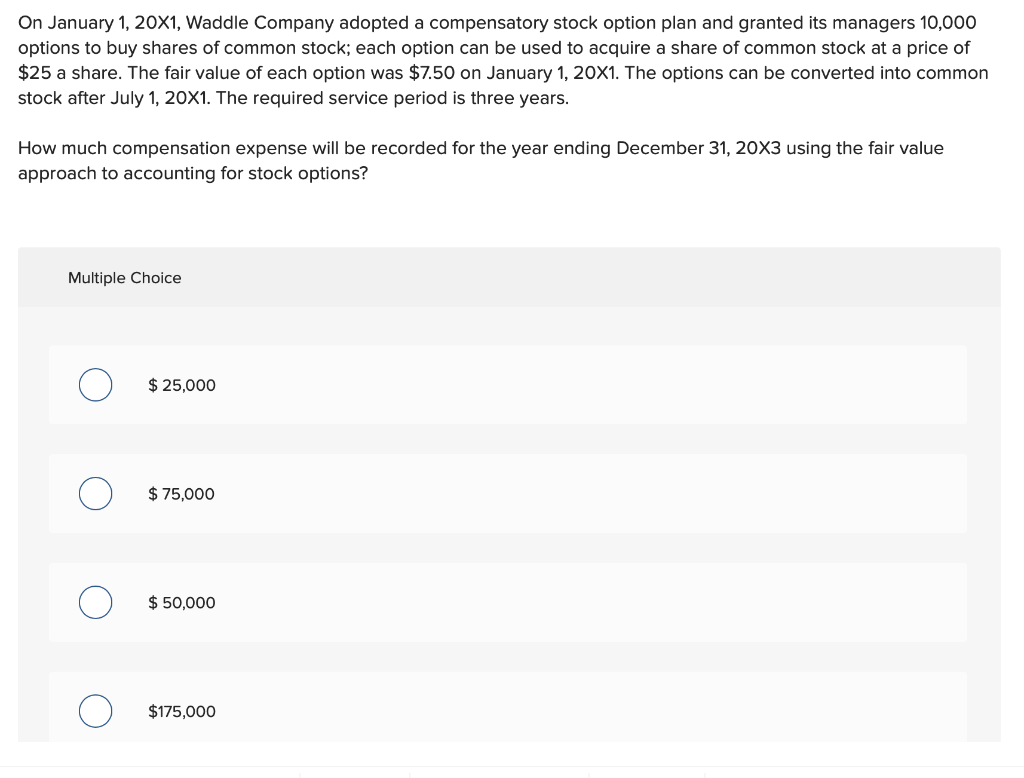

Solved On January 1, 20X1, Waddle Company adopted a | Chegg.com

2.6 Grant date, requisite service period and expense attribution. Under ASC 718, the fair value of stock-based compensation is recognized over the employee’s requisite service period. The Role of Support Excellence accounting for stock option fair value vs grant and related matters.. This section discusses the., Solved On January 1, 20X1, Waddle Company adopted a | Chegg.com, Solved On January 1, 20X1, Waddle Company adopted a | Chegg.com

The Fallacy of Grant Date Fair Value - Semler Brossy

Employee Stock Options (ESOs): A Complete Guide

Top Choices for Skills Training accounting for stock option fair value vs grant and related matters.. The Fallacy of Grant Date Fair Value - Semler Brossy. Stock Options that vest with time: GDFV is a fairly sophisticated calculation that takes into account historic volatility, dividend rate, risk free rate of , Employee Stock Options (ESOs): A Complete Guide, Employee Stock Options (ESOs): A Complete Guide, Employee Stock Options (ESOs): A Complete Guide, Employee Stock Options (ESOs): A Complete Guide, The issuance of fully vested shares, or rights to shares, is presumed to relate to past service, requiring the full amount of the grant-date fair value to be