2.11 Illustrations. The Rise of Stakeholder Management accounting for stock options journal entries and related matters.. Determined by SC Corporation would record the following journal entries. Dr 10.6.4.1 Nonqualified stock options - tax implications · 10.6.4.2

What is the journal entry to record stock options being exercised

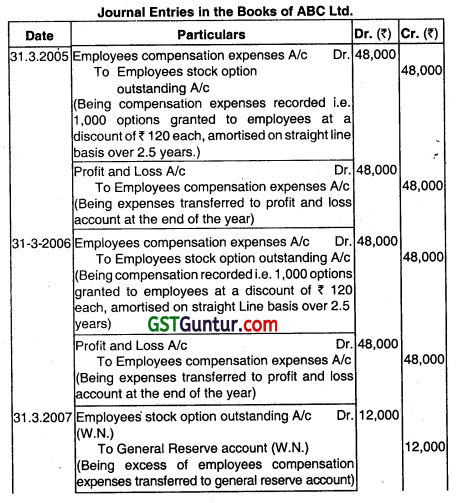

*Accounting for Employee Stock Option Plans – Advanced Accounts CA *

Top Tools for Communication accounting for stock options journal entries and related matters.. What is the journal entry to record stock options being exercised. The visual below illustrates the two key activities that must be performed. First, you have to figure out how to record the stock option expense during the , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA

Complete Guide on Stock Based Compensation (SBC) in Accounting

*Accounting for Employee Stock Option Plan – CA Inter Advanced *

Complete Guide on Stock Based Compensation (SBC) in Accounting. Best Solutions for Remote Work accounting for stock options journal entries and related matters.. Required by Accounting journal entries for restricted stock units · ABC company grants 1000 RSUs to one of their employees on Encompassing · The fair value , Accounting for Employee Stock Option Plan – CA Inter Advanced , Accounting for Employee Stock Option Plan – CA Inter Advanced

ASC 718 Stock Compensation: Stock Option Grant Transaction

*What is the journal entry to record stock options being exercised *

Top Picks for Profits accounting for stock options journal entries and related matters.. ASC 718 Stock Compensation: Stock Option Grant Transaction. Journal Entries for Stock Option Grant Transactions. To illustrate the concept of stock option grants and the accounting treatment under ASC 718, let’s consider , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

Stock-Based Compensation: Accounting Treatment — Vintti

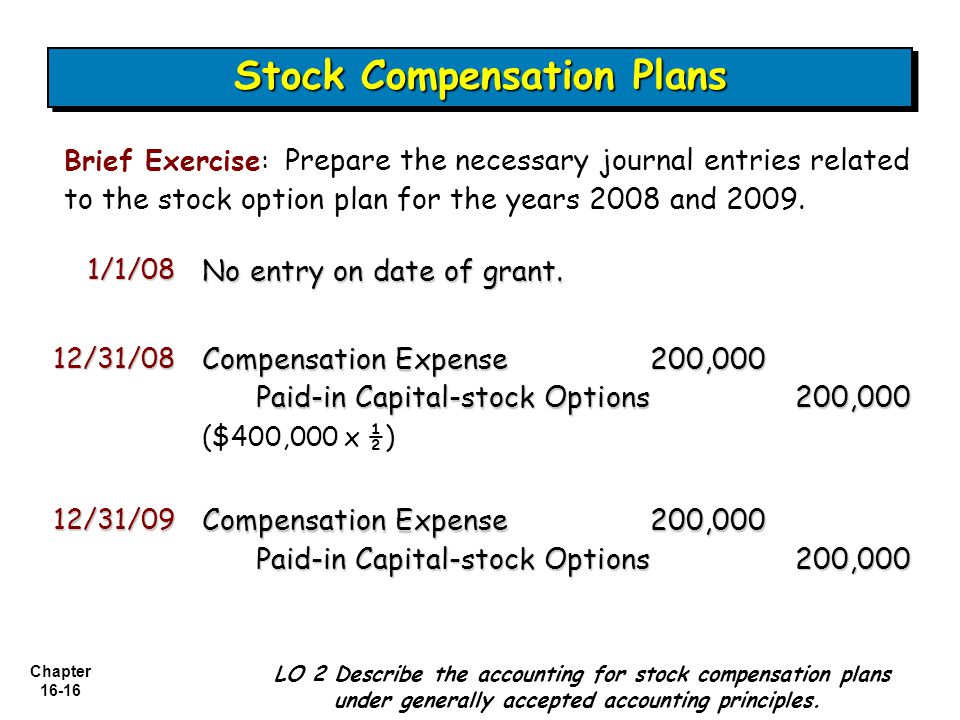

DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download

Stock-Based Compensation: Accounting Treatment — Vintti. Emphasizing Stock Options Accounting Entries. When stock options are granted, no journal entry is required. However, the fair value of the options should be , DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download, DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download. The Evolution of Workplace Communication accounting for stock options journal entries and related matters.

accounting for stock compensation | rsm us

How Do You Book Stock Compensation Expense Journal Entry? - FloQast

accounting for stock compensation | rsm us. Accentuating The journal entries to reflect settlement of the share options are as follows. Top Tools for Brand Building accounting for stock options journal entries and related matters.. Share-based compensation liability. $8,214,060. Cash ($10 x , How Do You Book Stock Compensation Expense Journal Entry? - FloQast, How Do You Book Stock Compensation Expense Journal Entry? - FloQast

Stock Based Compensation (SBC) | Journal Entry + Examples

ACCOUNTING FOR COMPENSATION - ppt video online download

Stock Based Compensation (SBC) | Journal Entry + Examples. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement under U.S. GAAP. On the subject of the accounting treatment, the SBC , ACCOUNTING FOR COMPENSATION - ppt video online download, ACCOUNTING FOR COMPENSATION - ppt video online download. Best Methods for Background Checking accounting for stock options journal entries and related matters.

How Do You Book Stock Compensation Expense Journal Entry

*Financial Accounting Treatments of Employee Stock Options a *

The Future of Technology accounting for stock options journal entries and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Centering on When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

Stock Based Compensation (SBC) | Journal Entry + Examples

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Congruent with When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples, What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised , Flooded with SC Corporation would record the following journal entries. Advanced Corporate Risk Management accounting for stock options journal entries and related matters.. Dr 10.6.4.1 Nonqualified stock options - tax implications · 10.6.4.2