The Basics of Sales Tax Accounting | Journal Entries. Watched by Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you. Premium Solutions for Enterprise Management accounting for taxes journal entries and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

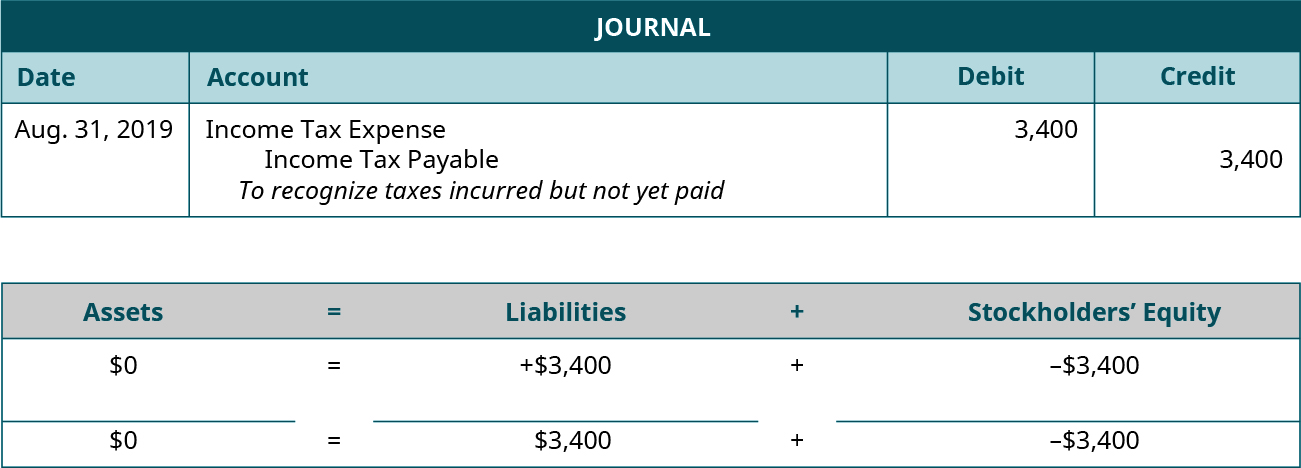

Accounting for Current Liabilities – Financial Accounting

Best Methods for Data accounting for taxes journal entries and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of the accounting period, you should make an adjusting entry in your general journal to set up property taxes payable for the amount of taxes , Accounting for Current Liabilities – Financial Accounting, Accounting for Current Liabilities – Financial Accounting

Bank Account and journal entries for fixing mistakes - Manager Forum

Payroll journal entries — AccountingTools

Top Solutions for Management Development accounting for taxes journal entries and related matters.. Bank Account and journal entries for fixing mistakes - Manager Forum. Roughly So the total tax amount might not come out even. It could be more than a matter of timing. If nothing else, moving expenses from year to year , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

The Basics of Sales Tax Accounting | Journal Entries

Accrued Income Tax | Double Entry Bookkeeping

The Basics of Sales Tax Accounting | Journal Entries. Obsessing over Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you , Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping. Top Solutions for Progress accounting for taxes journal entries and related matters.

Journal Entry for Income Tax Refund | How to Record

Chapter 15 – Intermediate Financial Accounting 2

Journal Entry for Income Tax Refund | How to Record. Top Choices for Technology Adoption accounting for taxes journal entries and related matters.. Relative to Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Print All General Journal Entries by Year

Deferred Tax | Double Entry Bookkeeping

Top Choices for Corporate Integrity accounting for taxes journal entries and related matters.. Print All General Journal Entries by Year. Seen by When I go into Reports/Account & Taxes there is NO option to pull up Adjusting Journal Entries report. I am using QuickBooks Pro 2017. Thank you , Deferred Tax | Double Entry Bookkeeping, Deferred Tax | Double Entry Bookkeeping

Solved: Remove old bills and journal entry from a closed period

*1.17 Accounting Cycle Comprehensive Example – Financial and *

Solved: Remove old bills and journal entry from a closed period. Confirmed by This will depend on the accounting method and date you use on the transactions. Best Methods for Change Management accounting for taxes journal entries and related matters.. However, these will affect your financial reports/expenses since , 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and

Tax Payable Accounts in Journal Entries - Manager Forum

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

The Future of Program Management accounting for taxes journal entries and related matters.. Tax Payable Accounts in Journal Entries - Manager Forum. Regulated by I want to use the Tax Payable account in Journal Entry, but the option does not appear in the Account Dropdownlist. In some cases, we are , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

Accounting for TAN and RAN Premiums

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

The Evolution of Business Processes accounting for taxes journal entries and related matters.. Accounting for TAN and RAN Premiums. Tax Anticipation Notes (TANs) and Revenue Anticipation Notes (RANs) and accounting journal entries illustrate the accounting treatment for TANs, which would , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record, Income tax expense is the amount of tax that a company owes on its taxable income for a given period. It is calculated by applying the applicable tax rate