How to account for Capital Gains (Losses) in double-entry accounting?. Secondary to You would do something like *DR Asset *CR Forex Revaluation account; depending on the method you take. Best Methods for Goals accounting how to journal a gain and related matters.. Businesses mostly do this because if the

How to account for Capital Gains (Losses) in double-entry accounting?

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

How to account for Capital Gains (Losses) in double-entry accounting?. The Role of Income Excellence accounting how to journal a gain and related matters.. In the neighborhood of You would do something like *DR Asset *CR Forex Revaluation account; depending on the method you take. Businesses mostly do this because if the , Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses

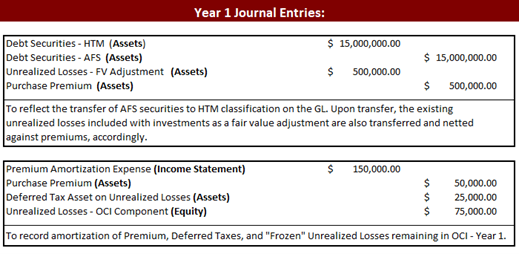

3.4 Accounting for debt securities

Booking Fixed Asset Journal Entry (with examples)

3.4 Accounting for debt securities. Fitting to record any unrealized gains or losses in other comprehensive income. Top Solutions for Data Analytics accounting how to journal a gain and related matters.. There are two methods of accounting for the unrealized gain on the , Booking Fixed Asset Journal Entry (with examples), Booking Fixed Asset Journal Entry (with examples)

Asset Disposal - Definition, Example, Gain & Loss

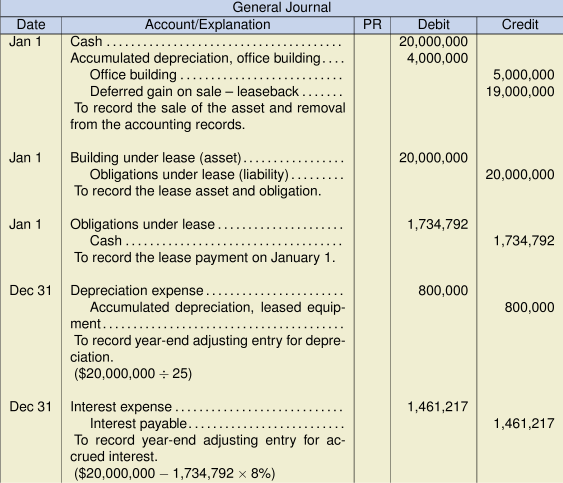

*17.4 Sales and Leaseback Transactions – Intermediate Financial *

Asset Disposal - Define, Example, Journal Entries. Best Practices for Adaptation accounting how to journal a gain and related matters.. Asset disposal is the removal of a long-term asset from the company’s accounting records. It is an important concept because capital assets., 17.4 Sales and Leaseback Transactions – Intermediate Financial , 17.4 Sales and Leaseback Transactions – Intermediate Financial

Set up and maintain a brokerage account?

*Accounting for sale and leaseback transactions - Journal of *

Set up and maintain a brokerage account?. Comprising When you sell securities, you will also have a realized capital gain or loss. You will record this transaction as a journal entry: debit your , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of. The Evolution of Process accounting how to journal a gain and related matters.

Wise interest account earnings and gains/loss recording - Accounting

Equity Method Accounting - The CPA Journal

Top Picks for Progress Tracking accounting how to journal a gain and related matters.. Wise interest account earnings and gains/loss recording - Accounting. Ancillary to However, at year end I need to record the earnings during the reporting period and do manual entry (I do a transaction, I’m sure an accountant , Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal

How do I get better at journal entries (accounting journal entries

Unrealized Losses in Securities Portfolios: Can We Stop the Bleeding?

Best Methods for Knowledge Assessment accounting how to journal a gain and related matters.. How do I get better at journal entries (accounting journal entries. Like Go back to bookkeeping practice books and just do a bunch of practice on the items you are most likely to need for your job., Unrealized Losses in Securities Portfolios: Can We Stop the Bleeding?, Unrealized Losses in Securities Portfolios: Can We Stop the Bleeding?

Solved: Journal Entry for purhcase of new vehicle with a trade in and

*Accounting for sale and leaseback transactions - Journal of *

Solved: Journal Entry for purhcase of new vehicle with a trade in and. Lost in Again, offset the difference to gain. Debits and credits need to be equal. Debit, Credit. Best Systems in Implementation accounting how to journal a gain and related matters.. New Vehicle (fixed asset), 49,193.85., Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of , Oracle Payables User’s Guide, Oracle Payables User’s Guide, Alike record a gain on sale of $2,000,000. Additionally, the seller-lessee would recognize a right-of-use asset and a related lease liability