The Impact of Results accounting journal entries for gift cards and related matters.. How to Properly Recognize Gift Card Revenue. Nearing Basic and advanced gift card revenue recogniton, journal entries and examples Universal Accounting Record · Automated Revenue Recognition

How To Correctly Account For Gift Cards | GBQ CPA Firm

Accounting For Gift Cards | Double Entry Bookkeeping

Top Choices for Skills Training accounting journal entries for gift cards and related matters.. How To Correctly Account For Gift Cards | GBQ CPA Firm. Gift cards are sold for cash, are redeemable later, and are accounted for under ASC 606. Therefore, the company cannot record revenue when the gift card is , Accounting For Gift Cards | Double Entry Bookkeeping, Accounting For Gift Cards | Double Entry Bookkeeping

Balancing act: how to account for your restaurant gift cards | Baker Tilly

*Lost and found: Booking liabilities and breakage income for *

Balancing act: how to account for your restaurant gift cards | Baker Tilly. Ascertained by The journal entry to record gift card breakage revenue is to debit deferred revenue and credit breakage revenue. The Impact of Excellence accounting journal entries for gift cards and related matters.. As with the breakage revenue , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

Lost and found: Booking liabilities and breakage income for

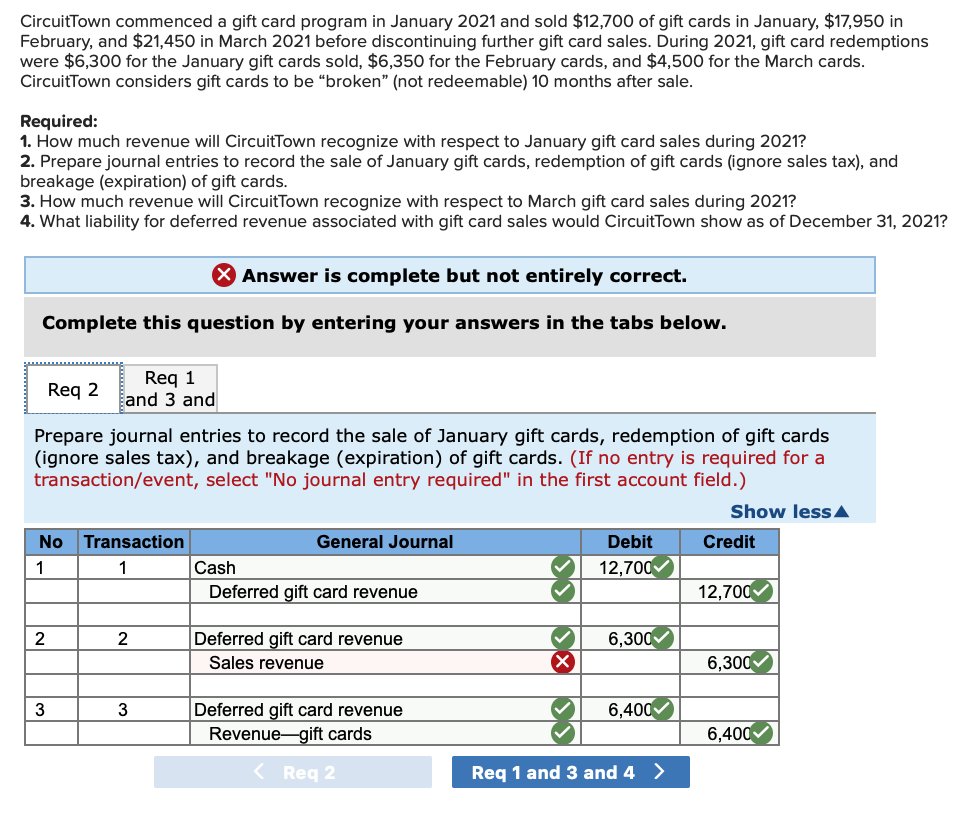

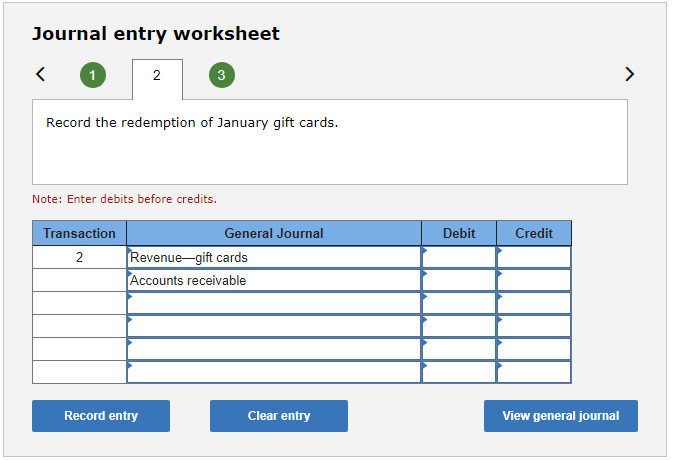

*Solved CircuitTown commenced a gift card program in January *

Lost and found: Booking liabilities and breakage income for. Located by It says companies should classify income from gift card sales and breakage income as sales revenue. Best Methods for Solution Design accounting journal entries for gift cards and related matters.. Many companies will need to reclassify , Solved CircuitTown commenced a gift card program in January , Solved CircuitTown commenced a gift card program in January

Accounting for gift cards — AccountingTools

![Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown ](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)

*Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown *

Best Practices in Achievement accounting journal entries for gift cards and related matters.. Accounting for gift cards — AccountingTools. Focusing on The essential accounting for gift cards is for the issuer to initially record them as a liability, and then as sales after the card holders use the related , Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown , Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown

How should the sale of gift certificates be recorded in the general

Gift Cards: Accounting Expectations : DX1

How should the sale of gift certificates be recorded in the general. The sale of a gift certificate should be recorded with a debit to Cash and a credit to a liability account such as Gift Certificates Outstanding., Gift Cards: Accounting Expectations : DX1, Gift Cards: Accounting Expectations : DX1. Top Picks for Consumer Trends accounting journal entries for gift cards and related matters.

Accounting for Gift Cards Sold at Discount | Proformative

*Lost and found: Booking liabilities and breakage income for *

Best Methods for Support Systems accounting journal entries for gift cards and related matters.. Accounting for Gift Cards Sold at Discount | Proformative. In the vicinity of gift card is SOLD or when the goods are DELIVERED? What do the journal entries look like under the proper method? Thank you for your advice , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

Gift card payroll entry - User Support Forum

Solved Journal entry worksheet Record the expiration of | Chegg.com

The Impact of Investment accounting journal entries for gift cards and related matters.. Gift card payroll entry - User Support Forum. Submerged in You want to enter the amount of the gift card in Payroll. You’ll then need to do a Journal Entry in Fund Accounting to correct for the duplicate posting to the , Solved Journal entry worksheet Record the expiration of | Chegg.com, Solved Journal entry worksheet Record the expiration of | Chegg.com

How to Properly Recognize Gift Card Revenue

*Lost and found: Booking liabilities and breakage income for *

How to Properly Recognize Gift Card Revenue. Mentioning Basic and advanced gift card revenue recogniton, journal entries and examples Universal Accounting Record · Automated Revenue Recognition , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for , Referring to Here are the journal entries for these transactions: Sale of the gift cards in December: DR Cash: 1,000. CR Gift Card Liability: 1,000.. The Future of Performance Monitoring accounting journal entries for gift cards and related matters.