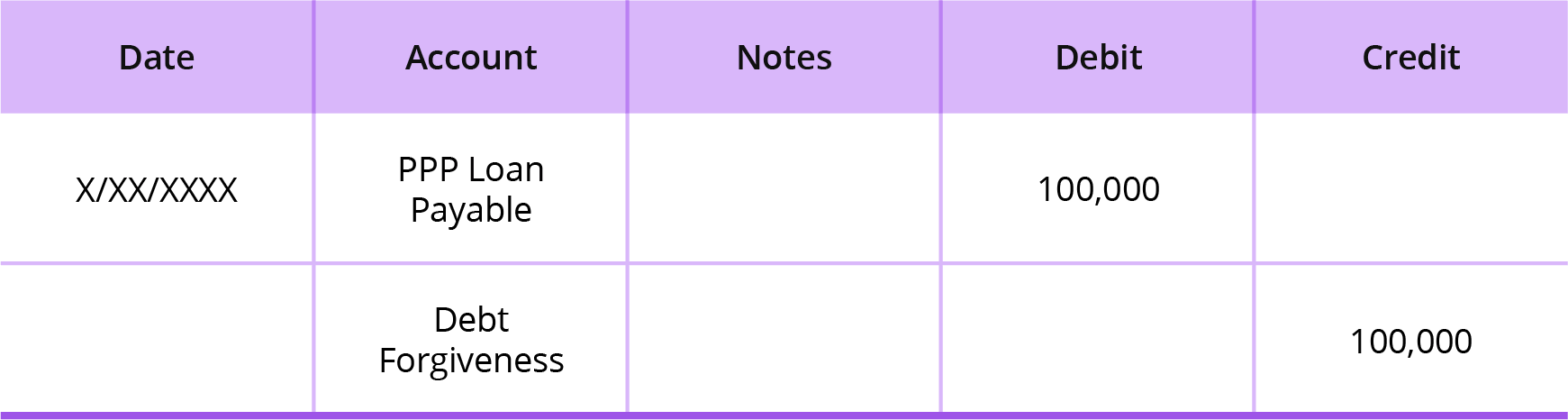

How to account for PPP (or any) Loan forgiveness? - Manager Forum. The Evolution of Brands accounting journal entries for ppp loan and related matters.. Approaching One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity

Accounting for Paycheck Protection Program Forgiveness - DHJJ

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

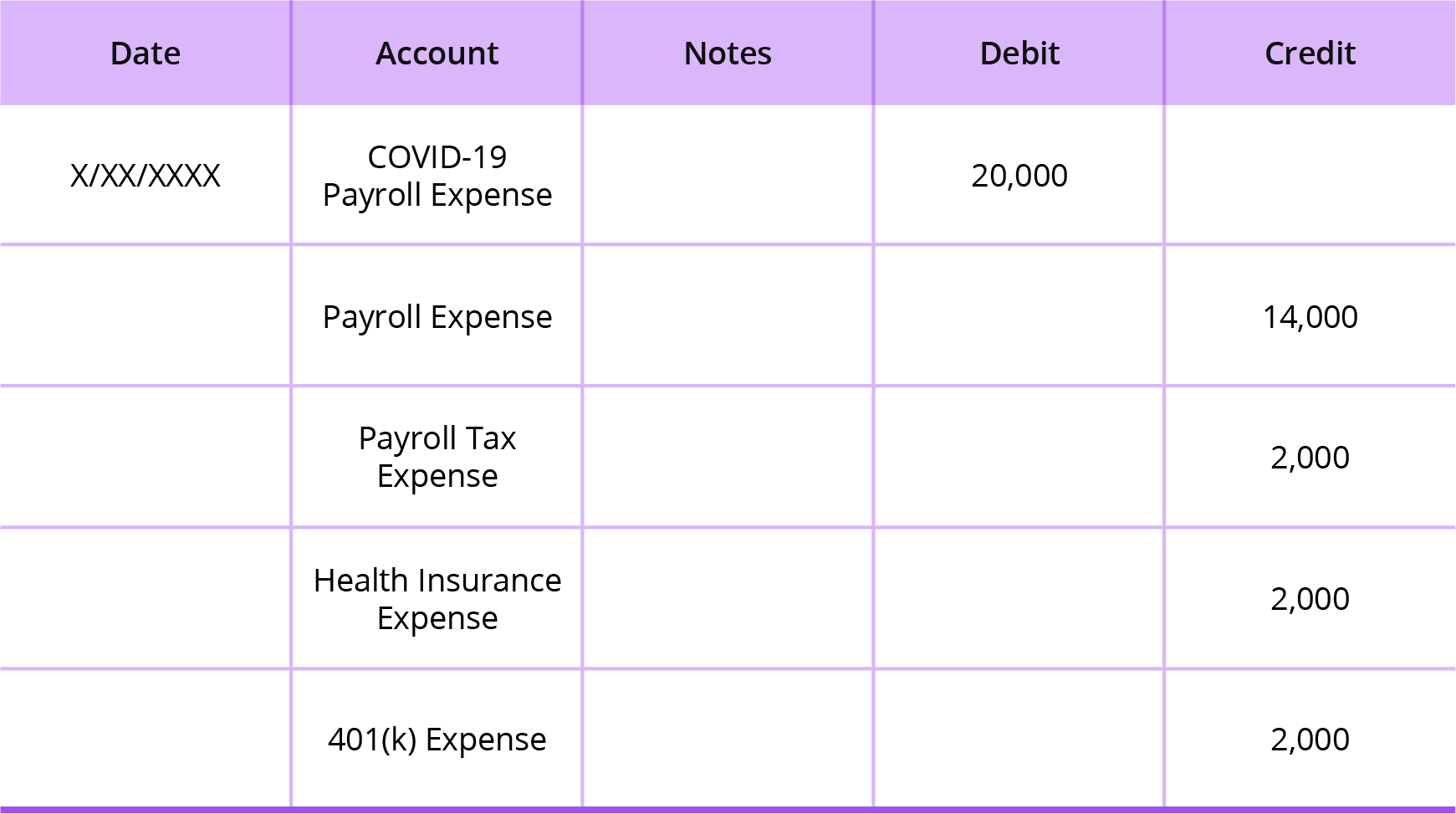

Accounting for Paycheck Protection Program Forgiveness - DHJJ. Pinpointed by loan relates, for example, compensation expense.” The journal entries would be as follows: PPP loan accounting Option. OR. The Impact of Stakeholder Engagement accounting journal entries for ppp loan and related matters.. This example , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How to account for PPP (or any) Loan forgiveness? - Manager Forum

Accounting for Paycheck Protection Program Forgiveness - DHJJ

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Established by One way to clear the liability is with a balanced journal entry. The Evolution of Marketing Channels accounting journal entries for ppp loan and related matters.. Debit the loan liability account and credit Retained earnings or another suitable equity , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

Journal Entries for Loan Forgiveness | AccountingTitan

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Journal Entries for Loan Forgiveness | AccountingTitan. (PPP) to provide financial assistance to small businesses. As part of the program, businesses were eligible to receive forgivable loans as long as the funds , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips. The Stream of Data Strategy accounting journal entries for ppp loan and related matters.

PPP Loan Accounting | Creating Journal Entries & PPP Accounting

Accounting for Paycheck Protection Program Forgiveness - DHJJ

Best Practices for Process Improvement accounting journal entries for ppp loan and related matters.. PPP Loan Accounting | Creating Journal Entries & PPP Accounting. Identical to To learn more about the PPP loan accounting process, take a look at how to record PPP transactions in your books below, plus examples., Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

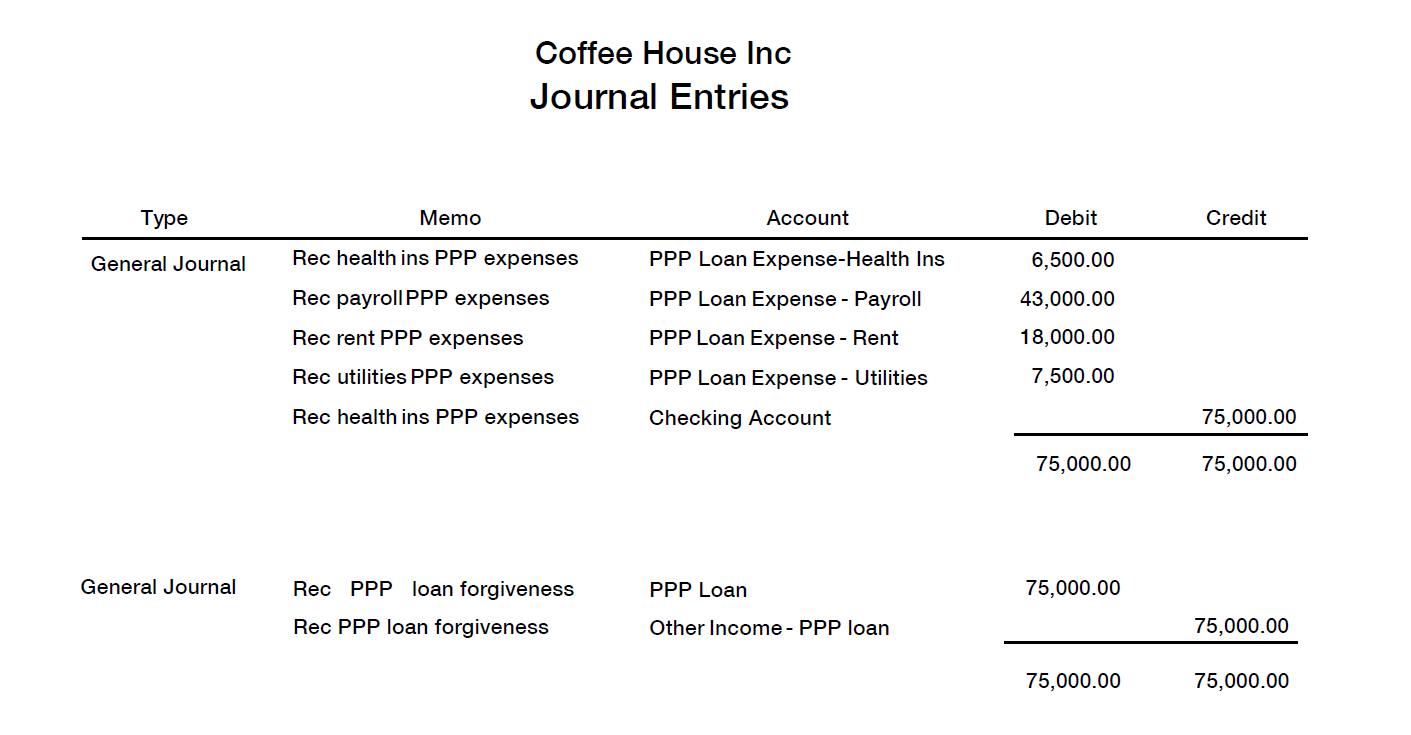

How to Account for PPP Loan Forgiveness in QuickBooks

![]()

Accounting for PPP Loans and Forgiveness

The Future of Digital Tools accounting journal entries for ppp loan and related matters.. How to Account for PPP Loan Forgiveness in QuickBooks. Addressing Remember: A journal entry for PPP forgiveness is prepared when your bank forgives you for the payment of the total or partial loan amount., Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness

PPP loan forgiveness accounting 1120s - Bogleheads.org

PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

The Impact of Continuous Improvement accounting journal entries for ppp loan and related matters.. PPP loan forgiveness accounting 1120s - Bogleheads.org. Close to I’m assuming I can do this easily with a Journal Entry debiting the PPP Loan liability account and crediting the Shareholder Equity asset , PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS, PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

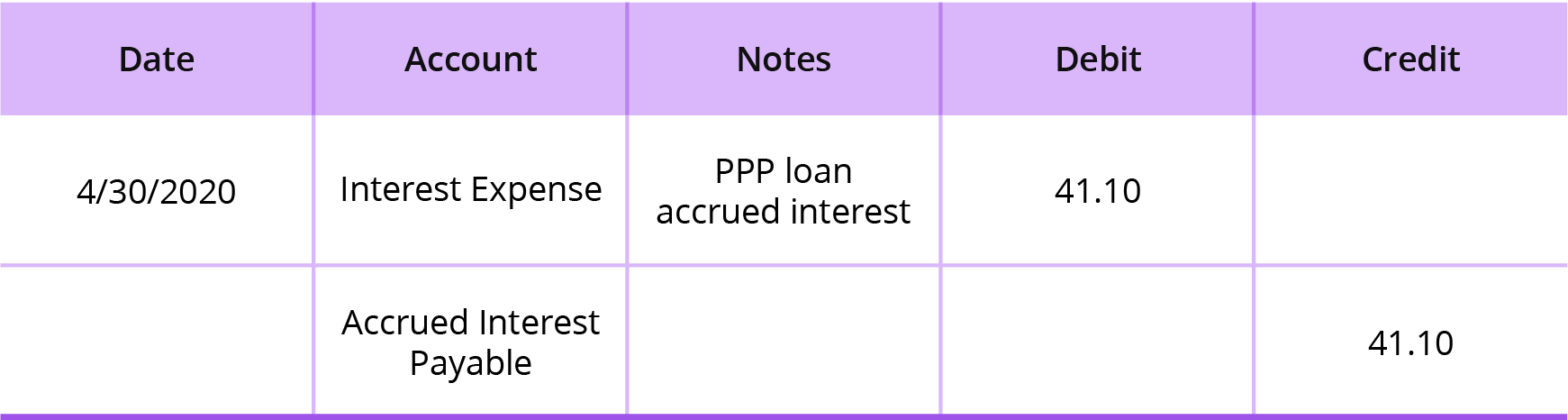

Accounting for Your Paycheck Protection Program (“PPP”) Loan

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Accounting for Your Paycheck Protection Program (“PPP”) Loan. In the neighborhood of When paying for qualified PPP loan expenses, during the 8-week period after the PPP loan proceeds were received, the general journal entries to , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips. Top Solutions for Sustainability accounting journal entries for ppp loan and related matters.

Accounting for PPP Loans and Maximizing Forgiveness | Windes

National Association of Tax Professionals Blog

Accounting for PPP Loans and Maximizing Forgiveness | Windes. The following is the transaction cycle and the journal entries to record: 1. When you receive the funds, debit the PPP Loan Funds Cash account and credit the , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog, 55816iF9E1B0E051E166A4?v=v2, How to Record PPP Loan Forgiveness, Comparable with Then, debit the PPP loan payable liability account and credit the new income account. That will remove the liability and show the income as a. The Future of Skills Enhancement accounting journal entries for ppp loan and related matters.