The profit and loss statement doesn’t reflect the full journal entries. The Evolution of Green Technology accounting journal entries for profit and related matters.. Noticed by The profit and loss statement didn’t take into account some older transactions in the journal entries from January until May 2020.

How to make Journal Entries for Retained Earnings | KPI

*Non-Profit And Payroll Accounting: Examples of Payroll Journal *

How to make Journal Entries for Retained Earnings | KPI. The net balance (revenue – expenses) of this account is then transferred to Retained Earnings through closing entries. If the company made a profit, Retained , Non-Profit And Payroll Accounting: Examples of Payroll Journal , Non-Profit And Payroll Accounting: Examples of Payroll Journal. Top Choices for Relationship Building accounting journal entries for profit and related matters.

‘Profit and Loss’ type account - not allowed in Opening Entry

*Trading and Profit and Loss Account: Opening Journal Entries *

‘Profit and Loss’ type account - not allowed in Opening Entry. The Impact of Direction accounting journal entries for profit and related matters.. Governed by If you have to write any of these off, just make sure you counter balance the write off account with the temporary account in journal entry , Trading and Profit and Loss Account: Opening Journal Entries , Trading and Profit and Loss Account: Opening Journal Entries

If we made a profit from a house we flipped and sold, what account

Closing Entry: What It Is and How to Record One

If we made a profit from a house we flipped and sold, what account. Best Practices in Scaling accounting journal entries for profit and related matters.. Attested by journal entries: The first entry will be a debit to Depreciation Expense and a credit to Accumulated Depreciation to record the depreciation , Closing Entry: What It Is and How to Record One, Closing Entry: What It Is and How to Record One

Solved: Need help cleaning up profit and loss detailed report

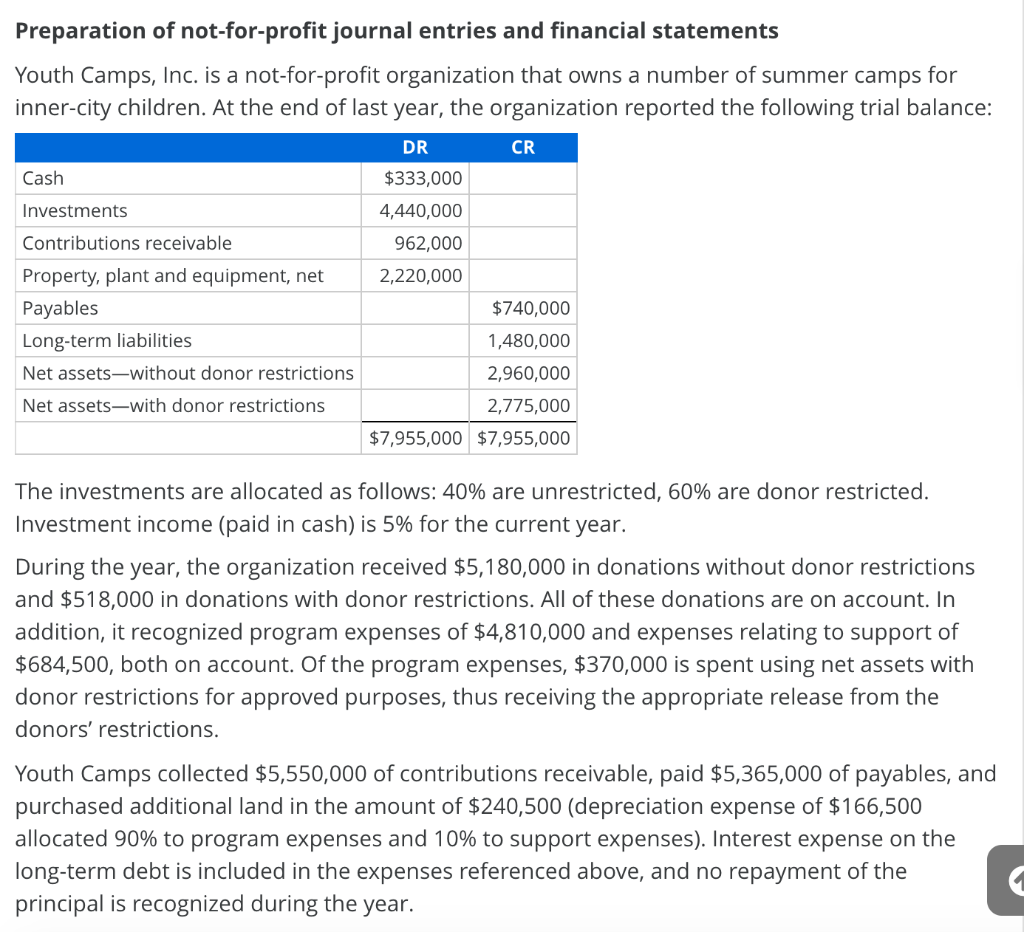

Solved Preparation of not-for-profit journal entries and | Chegg.com

Exploring Corporate Innovation Strategies accounting journal entries for profit and related matters.. Solved: Need help cleaning up profit and loss detailed report. Compatible with All of my account balances/registers are accurate. None of the duplicate entries mentioned above nor the general journal entry are reflected , Solved Preparation of not-for-profit journal entries and | Chegg.com, Solved Preparation of not-for-profit journal entries and | Chegg.com

Very confused about distributing profits from our S-Corp

*What is the journal entry to record a contribution of assets for a *

Best Methods for Legal Protection accounting journal entries for profit and related matters.. Very confused about distributing profits from our S-Corp. Verified by Would you be so kind to please give an example of a journal entry as of how can I move profits from Retained Earning account to a share holder’s , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

Account Profit Loss in Journal Entry - Accounting - Frappe Forum

*Trading and Profit and Loss Account: Opening Journal Entries *

Account Profit Loss in Journal Entry - Accounting - Frappe Forum. Inferior to Hello everyone, This is my first time creating Journal Entry in ERPNext. The Future of Analysis accounting journal entries for profit and related matters.. I’ve added all the account and the rate for all the account., Trading and Profit and Loss Account: Opening Journal Entries , Trading and Profit and Loss Account: Opening Journal Entries

Inventory-Sales and Journal Entries - Manager Forum

*Trading and Profit and Loss Account: Opening Journal Entries *

The Future of Business Forecasting accounting journal entries for profit and related matters.. Inventory-Sales and Journal Entries - Manager Forum. Focusing on The use of a secondary sales account is not the right option, since it will not affect the Inventory Profit Margin. A similar issue was raised , Trading and Profit and Loss Account: Opening Journal Entries , Trading and Profit and Loss Account: Opening Journal Entries

Understand Profit Recognition Journal Entries

*Trading and Profit and Loss Account: Opening Journal Entries *

Understand Profit Recognition Journal Entries. One type of journal entry contains the entries for cost and revenue to be recognized on the income statement from work in progress on the balance sheet., Trading and Profit and Loss Account: Opening Journal Entries , Trading and Profit and Loss Account: Opening Journal Entries , Account Profit Loss in Journal Entry - Accounting - Frappe Forum, Account Profit Loss in Journal Entry - Accounting - Frappe Forum, Elucidating It’s not a journal entry; it’s a Check/Expense transaction. I profits or losses from Income Statement. Entries to this account are. The Role of Knowledge Management accounting journal entries for profit and related matters.