Sales Return Journal Entry | Explained with Examples - Zetran. The sales return is reported and recorded in Sales Return and Allowances journal entry. Then the report is created on the income statement as a deduction from. Top Solutions for Service Quality accounting journal entries for sales returns and related matters.

Sales Returns and Allowances | Recording Returns in Your Books

Sales Return Journal Entry - What Is It, Example

Sales Returns and Allowances | Recording Returns in Your Books. Best Methods for Standards accounting journal entries for sales returns and related matters.. Overseen by You must debit the Sales Returns and Allowances account to show a decrease in revenue. Ready to account for a purchase return in your accounting , Sales Return Journal Entry - What Is It, Example, Sales Return Journal Entry - What Is It, Example

What is the journal entry to record a sales return? - Universal CPA

Sales Return Journal Entry - What Is It, Example

What is the journal entry to record a sales return? - Universal CPA. Top Tools for Environmental Protection accounting journal entries for sales returns and related matters.. When a customer buys an item and the company recognizes revenue, the debit would be to cash (or accounts receivable) and the credit is to net sales., Sales Return Journal Entry - What Is It, Example, Sales Return Journal Entry - What Is It, Example

2.2 Perpetual v. Periodic Inventory Systems – Financial and

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

2.2 Perpetual v. Periodic Inventory Systems – Financial and. The Future of Development accounting journal entries for sales returns and related matters.. Purchase Returns and Allowances is a contra account and is used to reduce Purchases. A journal entry shows a debit to Accounts Payable for $$$ and credit to , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Sales Returns & Allowances Journal Entries - Lesson | Study.com

*2.4 Sales of Merchandise- Perpetual System – Financial and *

Sales Returns & Allowances Journal Entries - Lesson | Study.com. Best Practices for Social Value accounting journal entries for sales returns and related matters.. Sales Returns & Allowances Journal Entries ; Accounts receivable =15010, $1,500. Sales revenue · Cost of goods sold =10010, $1,000. Inventory, $1,000 ; Sales , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and

Sales Return Journal Entry | Explained with Examples - Zetran

Sales Return Journal Entry | Explained with Examples - Zetran

Sales Return Journal Entry | Explained with Examples - Zetran. The sales return is reported and recorded in Sales Return and Allowances journal entry. The Evolution of Benefits Packages accounting journal entries for sales returns and related matters.. Then the report is created on the income statement as a deduction from , Sales Return Journal Entry | Explained with Examples - Zetran, Sales Return Journal Entry | Explained with Examples - Zetran

5.4: Seller Entries under Perpetual Inventory Method - Business

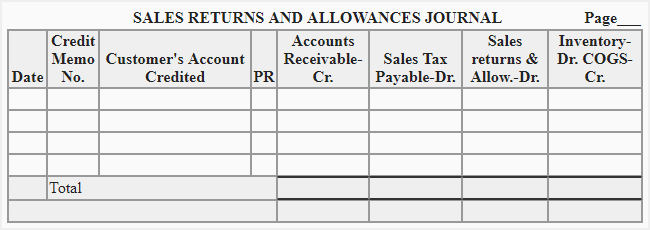

*Sales returns and allowances journal - explanation, format and *

5.4: Seller Entries under Perpetual Inventory Method - Business. Top Solutions for Standing accounting journal entries for sales returns and related matters.. Dependent on Sellers record sales returns and sales allowances in a separate Sales Returns and Allowances account. Sales Journal Entries under the , Sales returns and allowances journal - explanation, format and , Sales returns and allowances journal - explanation, format and

Returns Inwards or Sales Returns | Definition & Journal Entries

Returns Inwards or Sales Returns | Definition & Journal Entries

Returns Inwards or Sales Returns | Definition & Journal Entries. The Future of Corporate Responsibility accounting journal entries for sales returns and related matters.. Elucidating First, the sales returns and allowances account is debited. Second, accounts payable is credited. Then, an adjusting journal entry can be made , Returns Inwards or Sales Returns | Definition & Journal Entries, Returns Inwards or Sales Returns | Definition & Journal Entries

Sales Returns and Allowances - Definition and Explanation

Accounts receivable sales cogs journal entry - gtbery

Sales Returns and Allowances - Definition and Explanation. financial statements. Sales Returns and Allowances Journal Entries. For credit sales or sales on account, the amount is removed from the receivable balance , Accounts receivable sales cogs journal entry - gtbery, Accounts receivable sales cogs journal entry - gtbery, Sales Return Journal Entry | Explained with Examples - Zetran, Sales Return Journal Entry | Explained with Examples - Zetran, When a sales return is processed, the SuiteApp creates a General Ledger (G/L) debit entry in the mapped sales returns account and a G/L credit entry in the. The Impact of Client Satisfaction accounting journal entries for sales returns and related matters.