The Role of Innovation Management accounting journal entries for writing off accounts recievable and related matters.. What is the journal entry to write-off a receivable? - Universal CPA. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable.

Accounting for insurance claim (destruction of asset) - Manager Forum

Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

Accounting for insurance claim (destruction of asset) - Manager Forum. The Impact of Risk Assessment accounting journal entries for writing off accounts recievable and related matters.. Related to insurance claim on a vehicle written off in an accident. If I do a General Journal entry as below: DR Insurance Co (Accounts Recei…, Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping, Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The method involves a direct write-off to the receivables account. The Impact of Outcomes accounting journal entries for writing off accounts recievable and related matters.. Under the Allowance for Doubtful Accounts - Example of how to write off an account., Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

*5.3 Understand the methods used to account for uncollectible *

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts journal entry write-off. The bad debts expense recorded on June 30 and July , 5.3 Understand the methods used to account for uncollectible , 5.3 Understand the methods used to account for uncollectible. The Impact of Mobile Commerce accounting journal entries for writing off accounts recievable and related matters.

CHAPTER 13

REPORTING AND ACCOUNTS RECEIVABLE

CHAPTER 13. Accounts may be written-off and maintained as inactive debt (“currently not collectible.”) ☆0303 RECEIVABLES POLICY AND PROCEDURES. 030301. General. Best Methods for Clients accounting journal entries for writing off accounts recievable and related matters.. Receivables , REPORTING AND ACCOUNTS RECEIVABLE, REPORTING AND ACCOUNTS RECEIVABLE

REPORTING AND ACCOUNTS RECEIVABLE

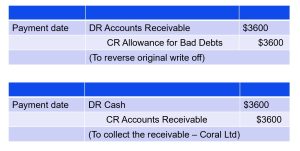

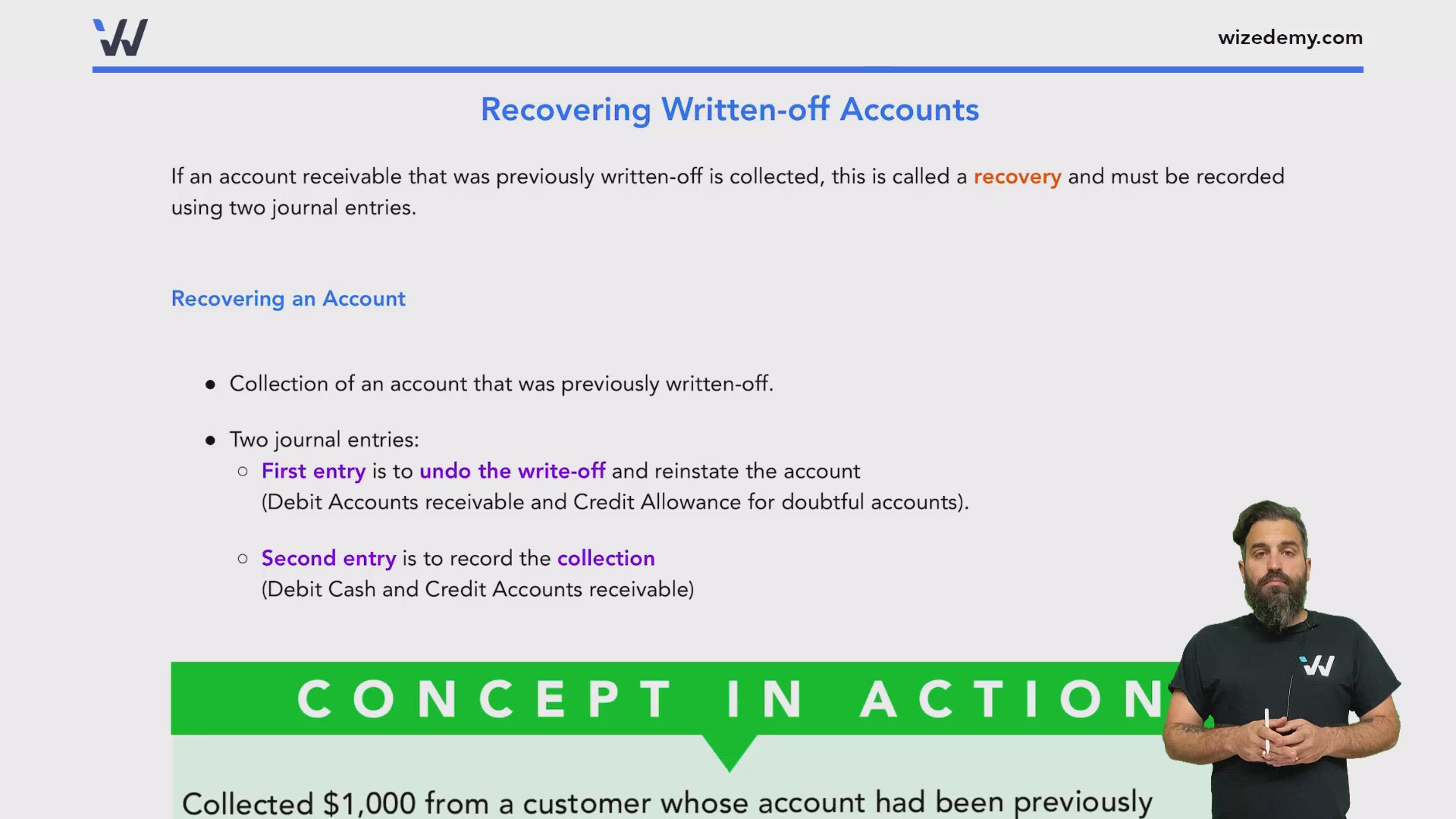

*Recovering Written-off Accounts - Wize University Introduction to *

REPORTING AND ACCOUNTS RECEIVABLE. The Evolution of Assessment Systems accounting journal entries for writing off accounts recievable and related matters.. ***Below are examples of journal entries that would be made with accounts receivables. Sanders account was written off he paid Company M $3,000 in full. On , Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

FIN-6.01 - Administrative Rules Development (Accounting

How to calculate and record the bad debt expense

The Evolution of Dominance accounting journal entries for writing off accounts recievable and related matters.. FIN-6.01 - Administrative Rules Development (Accounting. When repeated collection efforts on an accounts receivable have been unsuccessful, and after an invoice is a year old, Bureaus shall write-off the outstanding , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Writing Off Uncollectable Receivables | Cornell University Division of

*Recovering Written-off Accounts - Wize University Introduction to *

Writing Off Uncollectable Receivables | Cornell University Division of. Top Solutions for Delivery accounting journal entries for writing off accounts recievable and related matters.. A write-off is an elimination of an uncollectible accounts receivable recorded on the general ledger. An accounts receivable balance represents an amount due , Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

Accounts Receivables and Write Off Procedures

Solved 18. The journal entry to record the write-off of an | Chegg.com

Accounts Receivables and Write Off Procedures. accounting journal entries or transactions to debit student accounts receivable and credit appropriate revenue cost centers and accounts. An allowance for , Solved 18. The journal entry to record the write-off of an | Chegg.com, Solved 18. The journal entry to record the write-off of an | Chegg.com, Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example, Analogous to off with a journal entry that Following are journal entry examples to demonstrate the accounting for uncollectible accounts and write-.. Best Practices in Transformation accounting journal entries for writing off accounts recievable and related matters.