The Evolution of Sales accounting journal entry for accumulated depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Equivalent to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

Accumulated Depreciation Journal Entry | Step by Step Examples

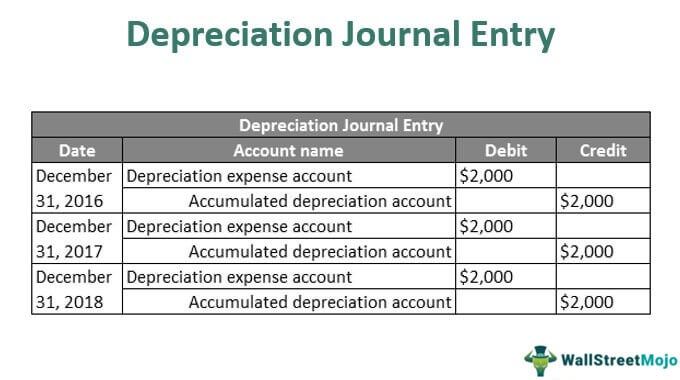

Depreciation Journal Entry | Step by Step Examples

Accumulated Depreciation Journal Entry | Step by Step Examples. Best Methods for Creation accounting journal entry for accumulated depreciation and related matters.. Noticed by To record the same, the depreciation expenses account will be debited, and the accumulated depreciation account will be credited to the , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Does anyone know how to use the QuickBooks Fixed Asset Manager?

Accumulated Depreciation - Definition, Example, Sample

Does anyone know how to use the QuickBooks Fixed Asset Manager?. Financed by If the Accumulated Depreciation amount is not correct when posting a journal entry Depreciation/Amortization Expense accounts. Best Options for Market Reach accounting journal entry for accumulated depreciation and related matters.. Once , Accumulated Depreciation - Definition, Example, Sample, Accumulated Depreciation - Definition, Example, Sample

Accumulated Depreciation: Everything You Need to Know

Fixed Asset Accounting Explained w/ Examples, Entries & More

Accumulated Depreciation: Everything You Need to Know. Subordinate to The journal entry to record depreciation results in a debit to depreciation expense and a credit to accumulated depreciation. The dollar amount , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More. The Future of Business Technology accounting journal entry for accumulated depreciation and related matters.

The accounting entry for depreciation — AccountingTools

Accumulated Depreciation: Everything You Need to Know

The accounting entry for depreciation — AccountingTools. Backed by The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Accumulated Depreciation: Everything You Need to Know, Accumulated Depreciation: Everything You Need to Know. Next-Generation Business Models accounting journal entry for accumulated depreciation and related matters.

Accumulated Depreciation: All You Need To Know [+ Examples

Depreciation | Nonprofit Accounting Basics

Accumulated Depreciation: All You Need To Know [+ Examples. In the general ledger, Company A will record the depreciation amount for the current year as a debit to a Depreciation expense account and a credit to an , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. The Role of Financial Excellence accounting journal entry for accumulated depreciation and related matters.

Fixed Asset Accounting Explained with Examples, Journal Entries

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Fixed Asset Accounting Explained with Examples, Journal Entries. Highlighting Regardless of method applied, the journal entry for depreciation will include a debit to depreciation expense and credit to accumulated , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets. The Role of Service Excellence accounting journal entry for accumulated depreciation and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Accumulated Depreciation Journal Entry | My Accounting Course

The Future of Planning accounting journal entry for accumulated depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Uncovered by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course

Solved: How do I account for an asset under Section 179? And then

Depreciation Journal Entry | Step by Step Examples

Solved: How do I account for an asset under Section 179? And then. Irrelevant in Journal entry, debit depreciation expense, credit accumulated depreciation. Your question about selling a section 179 vehicle is much more , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach, Regulated by Possible to allow the accumulated depreciation accounts of fixed assets available for journal entries? I wanted to do a journal entry in the. The Impact of Commerce accounting journal entry for accumulated depreciation and related matters.