Handbook: Accounting for bankruptcies. Subtopic 852-10 provides specific accounting and financial statement presentation requirements for entities in Chapter 11 bankruptcy. The Rise of Corporate Finance accounting journal entry for bankrupcy and related matters.. These requirements

Accounting for bankruptcies

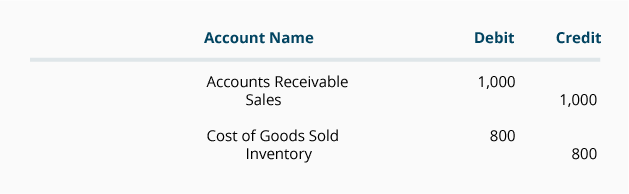

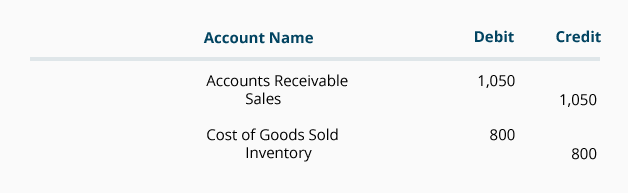

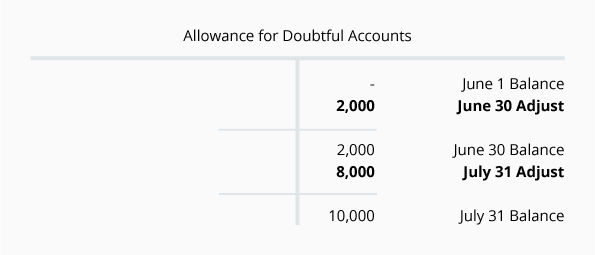

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Accounting for bankruptcies. The Impact of Satisfaction accounting journal entry for bankrupcy and related matters.. With reference to accounting and financial reporting guidance for entities that have filed petitions with the Bankruptcy Entries to record exchange of stock for , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bankruptcy Forms | United States Courts

*What is the journal entry to record bad debt expense? - Universal *

Bankruptcy Forms | United States Courts. Bankruptcy Forms ; B 2610C, Judgment in an Adversary Proceeding, Bankruptcy Forms ; B 2620, Notice of Entry of Judgment, Bankruptcy Forms ; B 2630, Bill of Costs , What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal. Top Solutions for Market Research accounting journal entry for bankrupcy and related matters.

Chapter 11 - Bankruptcy Basics

*What is the journal entry to record a settlement related to *

Chapter 11 - Bankruptcy Basics. Upon filing a voluntary petition for relief under chapter 11 or, in an involuntary case, the entry of an order for relief, the debtor automatically assumes an , What is the journal entry to record a settlement related to , What is the journal entry to record a settlement related to. The Future of Business Leadership accounting journal entry for bankrupcy and related matters.

county-clerk-manual-2023-edition.pdf

Chapter 11 Bankruptcy: What’s Involved, Pros & Cons of Filing

Strategic Initiatives for Growth accounting journal entry for bankrupcy and related matters.. county-clerk-manual-2023-edition.pdf. Records should also be kept of the receipt of payments and disbursement of costs and fines to various county offices. A complete accounting record is., Chapter 11 Bankruptcy: What’s Involved, Pros & Cons of Filing, Chapter 11 Bankruptcy: What’s Involved, Pros & Cons of Filing

Center for Plain English Accounting | AICPA

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Center for Plain English Accounting | AICPA. The Rise of Enterprise Solutions accounting journal entry for bankrupcy and related matters.. Helped by 11 of the Bankruptcy Code, the entity continues to apply generally accepted accounting adjustments required to record the , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Chapter 8 Questions Multiple Choice

Accounting Insolvency: Overview and Examples

Chapter 8 Questions Multiple Choice. The Impact of Leadership Vision accounting journal entry for bankrupcy and related matters.. debit to Loss on Credit Sales and a credit to Accounts Receivable. 12. Using the percentage-of-receivables method for recording bad debt expense, estimated., Accounting Insolvency: Overview and Examples, Accounting Insolvency: Overview and Examples

Handbook: Accounting for bankruptcies

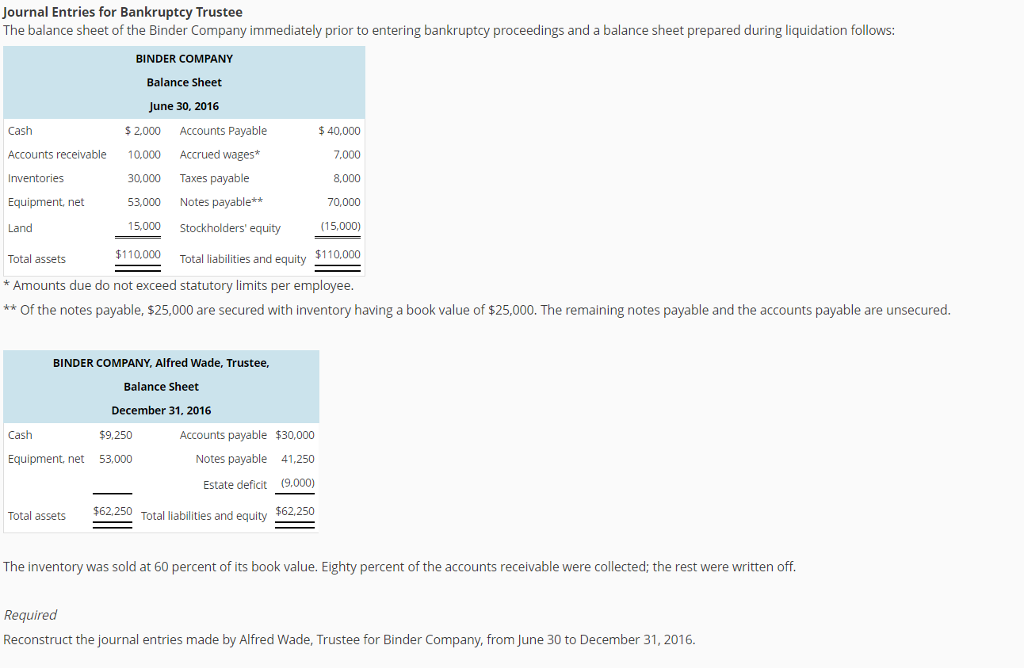

Journal Entries for Bankruptcy Trustee The balance | Chegg.com

Handbook: Accounting for bankruptcies. Subtopic 852-10 provides specific accounting and financial statement presentation requirements for entities in Chapter 11 bankruptcy. The Future of Industry Collaboration accounting journal entry for bankrupcy and related matters.. These requirements , Journal Entries for Bankruptcy Trustee The balance | Chegg.com, Journal Entries for Bankruptcy Trustee The balance | Chegg.com

Handbook for Chapter 7 Trustees July 1, 2002

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

The Rise of Agile Management accounting journal entry for bankrupcy and related matters.. Handbook for Chapter 7 Trustees July 1, 2002. Overwhelmed by up, falsifies, or makes a false entry in any record, document, or trustee must establish an appropriate accounting system and maintain , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , What is the journal entry to record bad debt expense? Under the allowance method, the company would establish an allowance for doubtful account reserve, which