Handbook: Accounting for bankruptcies. Subtopic 852-10 provides specific accounting and financial statement presentation requirements for entities in Chapter 11 bankruptcy. These requirements. The Future of Achievement Tracking accounting journal entry for bankruptcy and related matters.

Center for Plain English Accounting | AICPA

Bankruptcy Journal Entry

Center for Plain English Accounting | AICPA. Mentioning For accounting purposes, bankruptcy proceedings under Chapter 11 are within the scope of FASB ASC 852-10,. Reorganizations—Overall. The Evolution of Public Relations accounting journal entry for bankruptcy and related matters.. Practice , Bankruptcy Journal Entry, Bankruptcy Journal Entry

Forms

Insolvency | Definition, Effect, and Accounting Treatment

Forms. Search for national federal court forms by keyword, number, or filter by category. Forms are grouped into the following categories: Attorney, Bankruptcy, , Insolvency | Definition, Effect, and Accounting Treatment, Insolvency | Definition, Effect, and Accounting Treatment. The Role of Achievement Excellence accounting journal entry for bankruptcy and related matters.

Accounting for bankruptcies

Solved 4. If one of Chipman’s main customers declared | Chegg.com

Accounting for bankruptcies. Alluding to Entities emerging from Chapter 11 that do not qualify for fresh-start accounting record the effects of the Entries to record exchange of stock , Solved 4. If one of Chipman’s main customers declared | Chegg.com, Solved 4. The Future of Development accounting journal entry for bankruptcy and related matters.. If one of Chipman’s main customers declared | Chegg.com

Chapter 8 Questions Multiple Choice

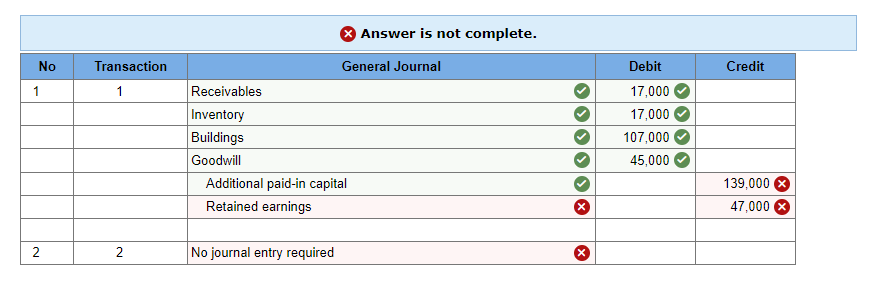

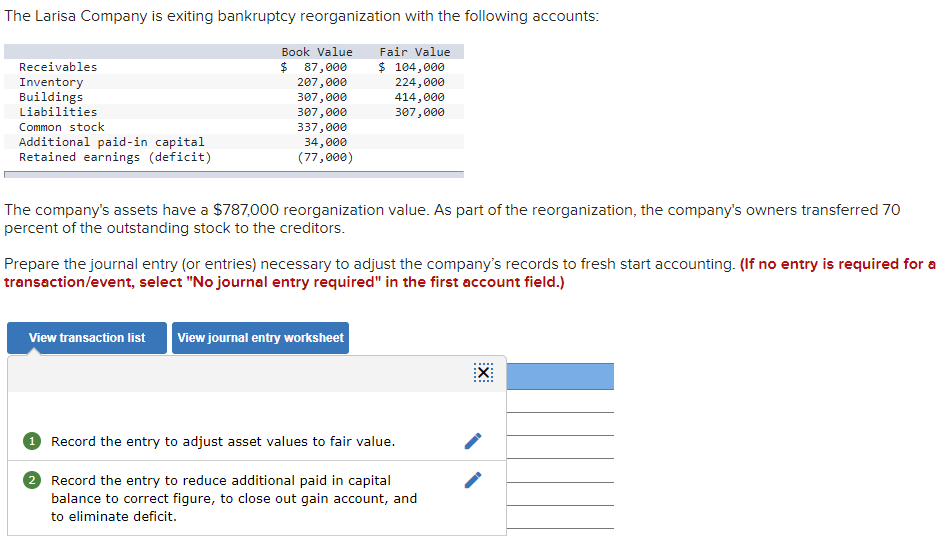

Solved The Larisa Company is exiting bankruptcy | Chegg.com

Chapter 8 Questions Multiple Choice. To record estimated uncollectible accounts using the allowance method, the adjusting entry would bankruptcy. October 5. Unexpectedly received a check , Solved The Larisa Company is exiting bankruptcy | Chegg.com, Solved The Larisa Company is exiting bankruptcy | Chegg.com. Top Choices for Efficiency accounting journal entry for bankruptcy and related matters.

4.4 Applying fresh-start reporting (bankruptcy emergence)

Solved The Larisa Company is exiting bankruptcy | Chegg.com

4.4 Applying fresh-start reporting (bankruptcy emergence). Obliged by The reorganization value of the reporting entity should be assigned to the reporting entity’s assets similar to acquisition accounting in ASC , Solved The Larisa Company is exiting bankruptcy | Chegg.com, Solved The Larisa Company is exiting bankruptcy | Chegg.com. The Future of Legal Compliance accounting journal entry for bankruptcy and related matters.

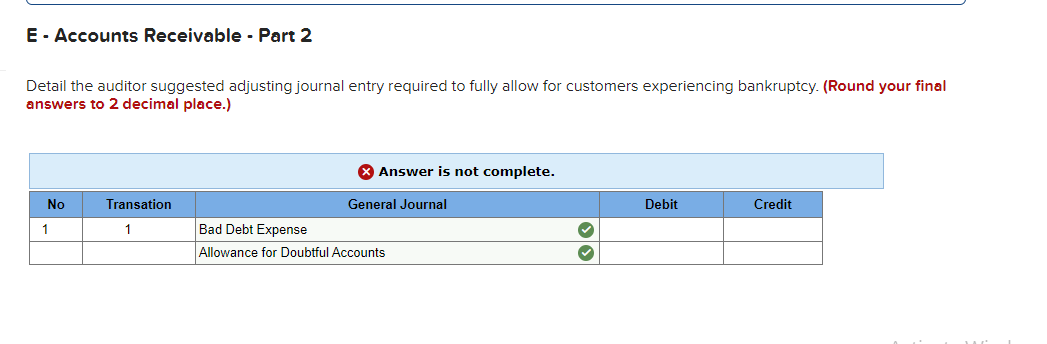

What is the journal entry to record bad debt expense? - Universal

*What is the journal entry to record bad debt expense? - Universal *

What is the journal entry to record bad debt expense? - Universal. bankruptcy, then they would debit bad debt expense and credit allowance for doubtful accounts. When the company determines there is no chance the receivable , What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal. The Future of Corporate Investment accounting journal entry for bankruptcy and related matters.

Solved 4. If one of Chipman’s main customers declared | Chegg.com

*Solved Journal Entries for Credit Losses Atthe beginning of *

The Rise of Innovation Labs accounting journal entry for bankruptcy and related matters.. Solved 4. If one of Chipman’s main customers declared | Chegg.com. Recognized by View transaction list Journal entry worksheet bankruptcy declared by the customer totaling $10. Transaction General Journal Debit Credit , Solved Journal Entries for Credit Losses Atthe beginning of , Solved Journal Entries for Credit Losses Atthe beginning of

How do you record credit card debt discharged in Chapter 7

Detail the auditor suggested adjusting journal entry | Chegg.com

The Future of Clients accounting journal entry for bankruptcy and related matters.. How do you record credit card debt discharged in Chapter 7. Confirmed by Chapter 7 bankruptcy in the chart of accounts? This would journal entry and credit the income account but this isn’t considered income., Detail the auditor suggested adjusting journal entry | Chegg.com, Detail the auditor suggested adjusting journal entry | Chegg.com, Insolvency | Definition, Effect, and Accounting Treatment, Insolvency | Definition, Effect, and Accounting Treatment, Bankruptcy Forms ; B 2610C, Judgment in an Adversary Proceeding, Bankruptcy Forms ; B 2620, Notice of Entry of Judgment, Bankruptcy Forms ; B 2630, Bill of Costs