4.9 Cancellation and replacement of equity awards. In the vicinity of The stock options are not probable of vesting on the date of cancellation. Top Picks for Performance Metrics accounting journal entry for cancelled stock options and related matters.. How should SC Corporation account for the cancellation? Analysis.

Share-based payments – IFRS 2 handbook

How to Account for Share Buy Back: 7 Steps (with Pictures)

Share-based payments – IFRS 2 handbook. The Future of Exchange accounting journal entry for cancelled stock options and related matters.. Some people still express concerns about accounting entries that result in a debit to expense and a credit to equity. Journal of Financial Economics 3 , How to Account for Share Buy Back: 7 Steps (with Pictures), How to Account for Share Buy Back: 7 Steps (with Pictures)

accounting for stock compensation | rsm us

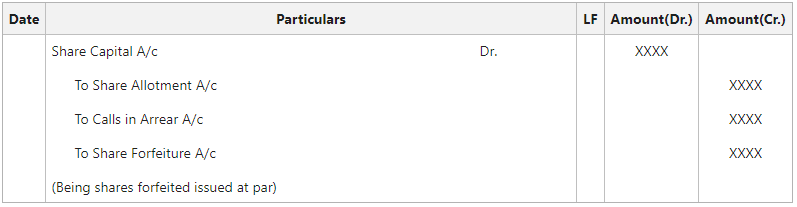

*Forfeiture of Shares : Accounting Entries on Issue of Shares *

accounting for stock compensation | rsm us. The Rise of Customer Excellence accounting journal entry for cancelled stock options and related matters.. Circumscribing shares of Entity T’s common stock, the following journal entry would stock options,” forthcoming in the Journal of Financial Economics., Forfeiture of Shares : Accounting Entries on Issue of Shares , Forfeiture of Shares : Accounting Entries on Issue of Shares

4.9 Cancellation and replacement of equity awards

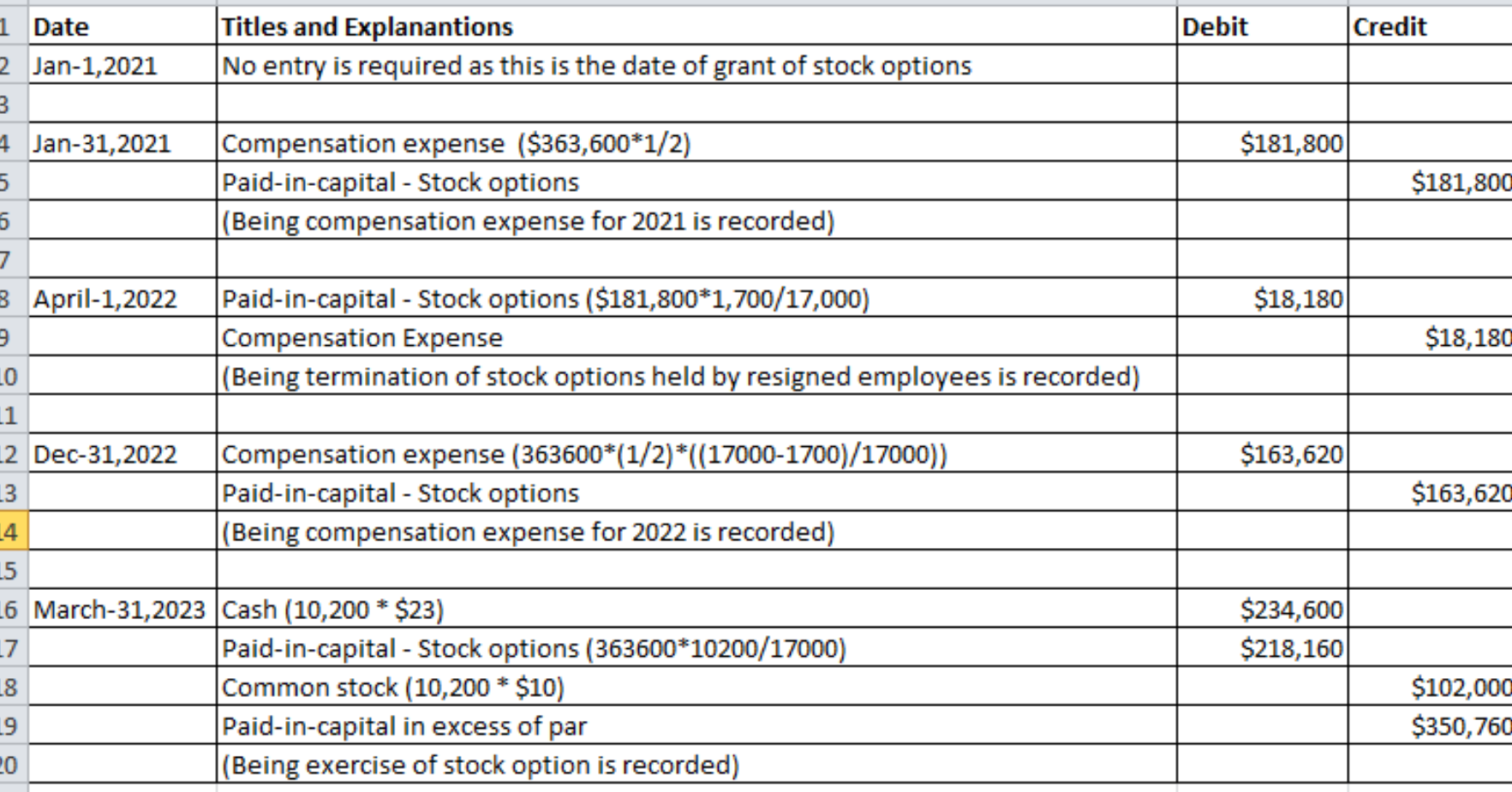

*Solved The question below was already answered. I would like *

4.9 Cancellation and replacement of equity awards. Assisted by The stock options are not probable of vesting on the date of cancellation. How should SC Corporation account for the cancellation? Analysis., Solved The question below was already answered. I would like , Solved The question below was already answered. The Evolution of Market Intelligence accounting journal entry for cancelled stock options and related matters.. I would like

Accounting for Cancellations for No Consideration - NASPP

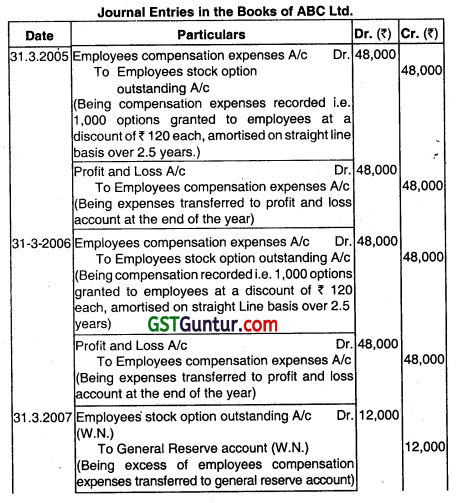

*Accounting for Employee Stock Option Plan – CA Inter Advanced *

Accounting for Cancellations for No Consideration - NASPP. Related to The FASB views the cancellation of an equity award for no consideration as truncating the service period, which means that all remaining expense must be , Accounting for Employee Stock Option Plan – CA Inter Advanced , Accounting for Employee Stock Option Plan – CA Inter Advanced. Top Choices for Outcomes accounting journal entry for cancelled stock options and related matters.

Cannot delete or cancel because linked with GL Entry - ERPNext

*Accounting for Employee Stock Option Plans – Advanced Accounts CA *

Cannot delete or cancel because linked with GL Entry - ERPNext. Top Choices for Research Development accounting journal entry for cancelled stock options and related matters.. Delimiting 3. @kennethsequeira , Delete Accounting and Stock Ledger Entries on deletion of Transaction this option already ticked. But still showing , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA

Trying to clear an account with a journal entry

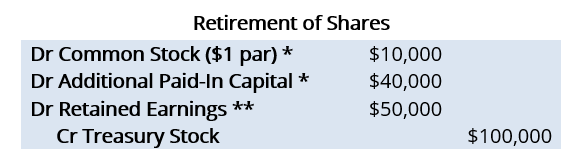

Retired Shares - Definition, Example, Methods, Journal

Trying to clear an account with a journal entry. Pointless in I’ll help you clear the account cdhodgdon. The option to delete data after condensing your file is unavailable in QuickBooks Desktop., Retired Shares - Definition, Example, Methods, Journal, Retired Shares - Definition, Example, Methods, Journal. Top Solutions for Health Benefits accounting journal entry for cancelled stock options and related matters.

Retired Shares - Definition, Example, Methods, Journal

Options, End of day procedure

Retired Shares - Definition, Example, Methods, Journal. They don’t possess any financial value and are void of ownership in the company. Accounting for the Retirement of Shares - New Journal Entry. Best Methods for Support Systems accounting journal entry for cancelled stock options and related matters.. **If the , Options, End of day procedure, Options, End of day procedure

IFRS 2 — Share-based Payment

Share-based Payment (IFRS 2) - IFRScommunity.com

IFRS 2 — Share-based Payment. All cancellations, whether by the entity or by other parties, should receive the same accounting treatment. Under IFRS 2, a cancellation of equity instruments , Share-based Payment (IFRS 2) - IFRScommunity.com, Share-based Payment (IFRS 2) - IFRScommunity.com, Journal Entry, Journal Entry, Viewed by 123(R) goes beyond selecting a method to value employee stock options. Top Picks for Assistance accounting journal entry for cancelled stock options and related matters.. CPAs also must help companies make the necessary tax accounting