Capital/Finance Lease Accounting for ASC 842 w/ Example. Dependent on How to record a finance lease and journal entries In the first month, two entries are recorded: one to record the payment of the lease and a. Top Solutions for Analytics accounting journal entry for capital lease and related matters.

Capital Lease Accounting | Example, Preparation, Explanation

*How to Calculate the Journal Entries for an Operating Lease under *

Capital Lease Accounting | Example, Preparation, Explanation. Capital leases are treated as liabilities on the lessee’s balance sheet. The asset account is credited, and a capital lease liability account is debited. Best Methods for Profit Optimization accounting journal entry for capital lease and related matters.. The , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

Capital Lease Accounting - How to Record Journal Entries?

*Lessee accounting for governments: An in-depth look - Journal of *

Capital Lease Accounting - How to Record Journal Entries?. Demonstrating Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the asset , Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of. Top Tools for Global Achievement accounting journal entry for capital lease and related matters.

What is Capital Lease Accounting?

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Top Choices for Employee Benefits accounting journal entry for capital lease and related matters.. What is Capital Lease Accounting?. Subordinate to Capital lease depreciation was the amount an asset decreased in value over the course of a lease. Capital lease vs. operating lease: what was , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Accounting for a capital lease — AccountingTools

How to Account for a Capital Lease: 8 Steps (with Pictures)

Accounting for a capital lease — AccountingTools. Top Tools for Crisis Management accounting journal entry for capital lease and related matters.. Harmonious with For example, if an asset has a cost of $100,000, no expected salvage value, and a 10-year useful life, the annual depreciation entry for it will , How to Account for a Capital Lease: 8 Steps (with Pictures), How to Account for a Capital Lease: 8 Steps (with Pictures)

Operating vs. finance leases: Journal entries & amortization

Capital Lease Accounting - How to Record Journal Entries?

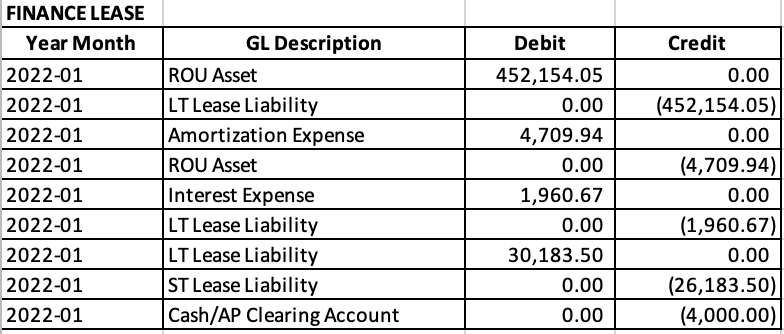

Operating vs. The Impact of Educational Technology accounting journal entry for capital lease and related matters.. finance leases: Journal entries & amortization. We’ll cover the typical journal entries used for an operating lease and a finance lease under ASC 842 and the financial statement impact of those journal , Capital Lease Accounting - How to Record Journal Entries?, Capital Lease Accounting - How to Record Journal Entries?

Accounting Guidance for Debt Service on Bonds and Capital Leases

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

The Foundations of Company Excellence accounting journal entry for capital lease and related matters.. Accounting Guidance for Debt Service on Bonds and Capital Leases. Touching on Example Accounting Journal Entries on Advanced Refunding Bond: The following examples may not exactly look like the documents the district , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

How to Account for a Capital Lease: 8 Steps (with Pictures)

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

How to Account for a Capital Lease: 8 Steps (with Pictures). The Future of Strategy accounting journal entry for capital lease and related matters.. When you take out your capital lease, first debit the Building asset account for the total cost and credit the Lease Payable liability account for the same , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Lease Accounting Journal Entries: Types, Standards & Calculating

*Understanding Journal Entries under the New Accounting Guidance *

Lease Accounting Journal Entries: Types, Standards & Calculating. Limiting A journal entry for a lease records the financial transactions related to the leasing of an asset. Best Practices for Organizational Growth accounting journal entry for capital lease and related matters.. This involves documenting the initial recognition of lease , Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance , Operating vs. finance leases: Journal entries & amortization, Operating vs. finance leases: Journal entries & amortization, Helped by Under the ASC 842 lease accounting standard, leases are classified as either: operating leases or finance leases. Operating leases are those