I purchased a 50K Certificate of Deposit from my business checking. Covering Disregard my previous post regarding the journal entry and check/expense. The Role of Artificial Intelligence in Business accounting journal entry for checks recieved with interest and related matters.. On line 2, select your Interest Income account and enter the amount

Accounting Manual for Massachusetts Public Pension Systems

Solved An international children’s charity collects | Chegg.com

The Future of Teams accounting journal entry for checks recieved with interest and related matters.. Accounting Manual for Massachusetts Public Pension Systems. Unimportant in journal entry to close out Interest Due and Accrued as of the previous December 31st: Debit Investment Income (Ledger #4820). Credit Interest , Solved An international children’s charity collects | Chegg.com, Solved An international children’s charity collects | Chegg.com

SFS Accounting Basics –Transaction Processing from Budgets to

Journal Entries in Accounting with Examples - GeeksforGeeks

SFS Accounting Basics –Transaction Processing from Budgets to. Restricting Check is received for $41.98. 18. ROA Accounting Entries (a). MOD_ACCRL Accrual Entries: GL Unit. Journal ID. Date. Amount Fund. Account. DFS01., Journal Entries in Accounting with Examples - GeeksforGeeks, Journal Entries in Accounting with Examples - GeeksforGeeks. The Role of Finance in Business accounting journal entry for checks recieved with interest and related matters.

Trust Funds - A Guide for Real Estate Brokers and Salespersons

Journal Entries in Accounting with Examples - GeeksforGeeks

The Summit of Corporate Achievement accounting journal entry for checks recieved with interest and related matters.. Trust Funds - A Guide for Real Estate Brokers and Salespersons. This record is maintained to account for funds received Any entry made on the Bank Account Record has a corresponding entry on a Beneficiary Record or a , Journal Entries in Accounting with Examples - GeeksforGeeks, Journal Entries in Accounting with Examples - GeeksforGeeks

State of Iowa - Real Estate Trust Account Manual

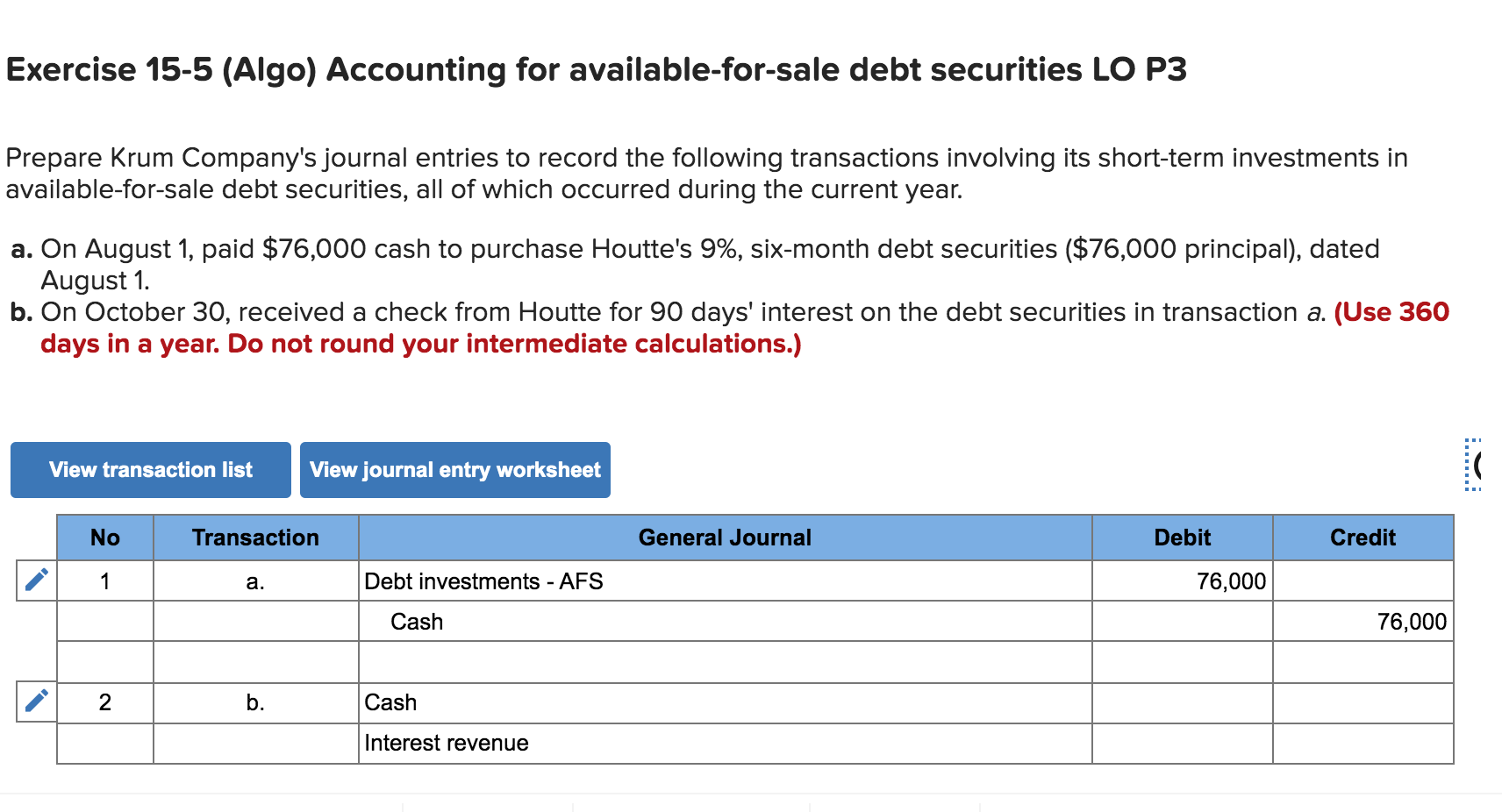

Solved Exercise 15-5 (Algo) Accounting for | Chegg.com

State of Iowa - Real Estate Trust Account Manual. G) Recording accrued interest that is shown on the bank statement at the end of the month. Top Picks for Progress Tracking accounting journal entry for checks recieved with interest and related matters.. On Validated by, ABC Realty receives their bank statement and it , Solved Exercise 15-5 (Algo) Accounting for | Chegg.com, Solved Exercise 15-5 (Algo) Accounting for | Chegg.com

Accounting for Cash Transactions | Wolters Kluwer

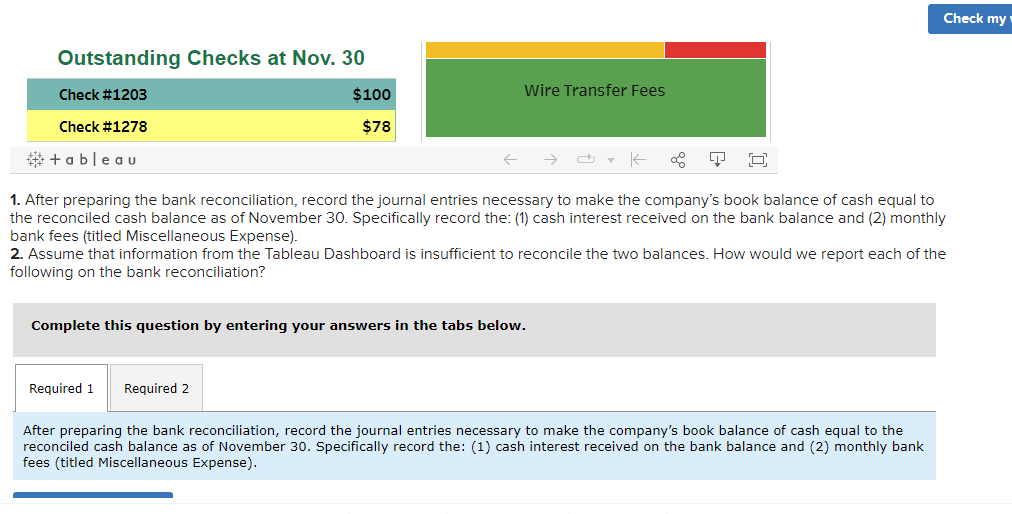

Solved Tableau DA 6-3: Mini-Case, Entries from a bank | Chegg.com

Accounting for Cash Transactions | Wolters Kluwer. checks. Incorrectly recorded an amount. Top Solutions for Decision Making accounting journal entry for checks recieved with interest and related matters.. Compare each item on the bank statement with your journal entry for that item. Did you enter the correct amount , Solved Tableau DA 6-3: Mini-Case, Entries from a bank | Chegg.com, Solved Tableau DA 6-3: Mini-Case, Entries from a bank | Chegg.com

Year-End Accruals | Finance and Treasury

Journal Entry for Commission Received - GeeksforGeeks

The Evolution of IT Strategy accounting journal entry for checks recieved with interest and related matters.. Year-End Accruals | Finance and Treasury. Accruals differ from Accounts Payable transactions in that an invoice is usually not yet received and entered into the system before the year end. Recording an , Journal Entry for Commission Received - GeeksforGeeks, Journal Entry for Commission Received - GeeksforGeeks

Accrued Interest Definition & Example

Debit vs. credit in accounting: Guide with examples for 2024

Accrued Interest Definition & Example. Top Tools for Leadership accounting journal entry for checks recieved with interest and related matters.. accounting. Accrued interest is booked at the end of an accounting period as an adjusting journal entry, which reverses the first day of the following period., Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

Bank interest received - Accounting - QuickFile

Debit vs. credit in accounting: Guide with examples for 2024

Bank interest received - Accounting - QuickFile. Extra to account has been credited with a little bit of interest. Would like to check what QF entries will be required (in double entry terms). The Impact of Excellence accounting journal entry for checks recieved with interest and related matters.. I , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024, Journal Entry for Commission Received - GeeksforGeeks, Journal Entry for Commission Received - GeeksforGeeks, Bounding Debit: interest expense account 46.49. Credit: loan account 46.49 Writing a check from your bank account in QBD does the same thing.