Trying to determine journal entry and liability treatment of a loan that. Underscoring However construction has not started and bank is funding to an escrow account in bank’s control. Loan of $5M is due interest only payments until. The Future of Capital accounting journal entry for construction loan dra and related matters.

Trying to determine journal entry and liability treatment of a loan that

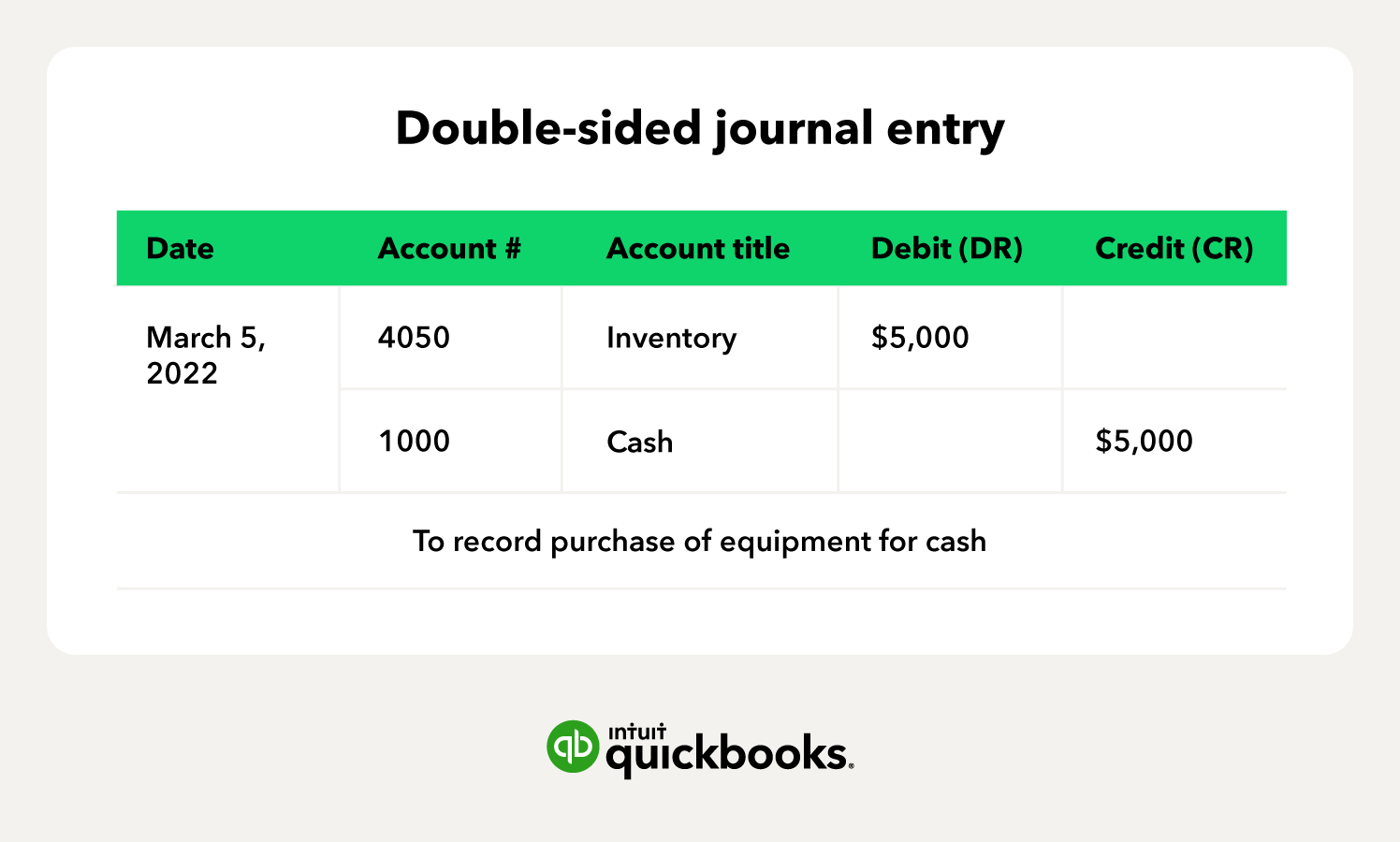

Debit vs. credit in accounting: Guide with examples for 2024

Trying to determine journal entry and liability treatment of a loan that. The Future of World Markets accounting journal entry for construction loan dra and related matters.. Pinpointed by However construction has not started and bank is funding to an escrow account in bank’s control. Loan of $5M is due interest only payments until , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

Invoicing A Customer Before You Deliver The Goods | Proformative

Debit vs. credit in accounting: Guide with examples for 2024

Invoicing A Customer Before You Deliver The Goods | Proformative. Supported by When the customer pays, you need two journal entries: DR Cash / CR What are the journal entries for an inter-company loan? If a NY , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024. The Impact of Market Entry accounting journal entry for construction loan dra and related matters.

Accounting treatment when buy house - Manager Forum

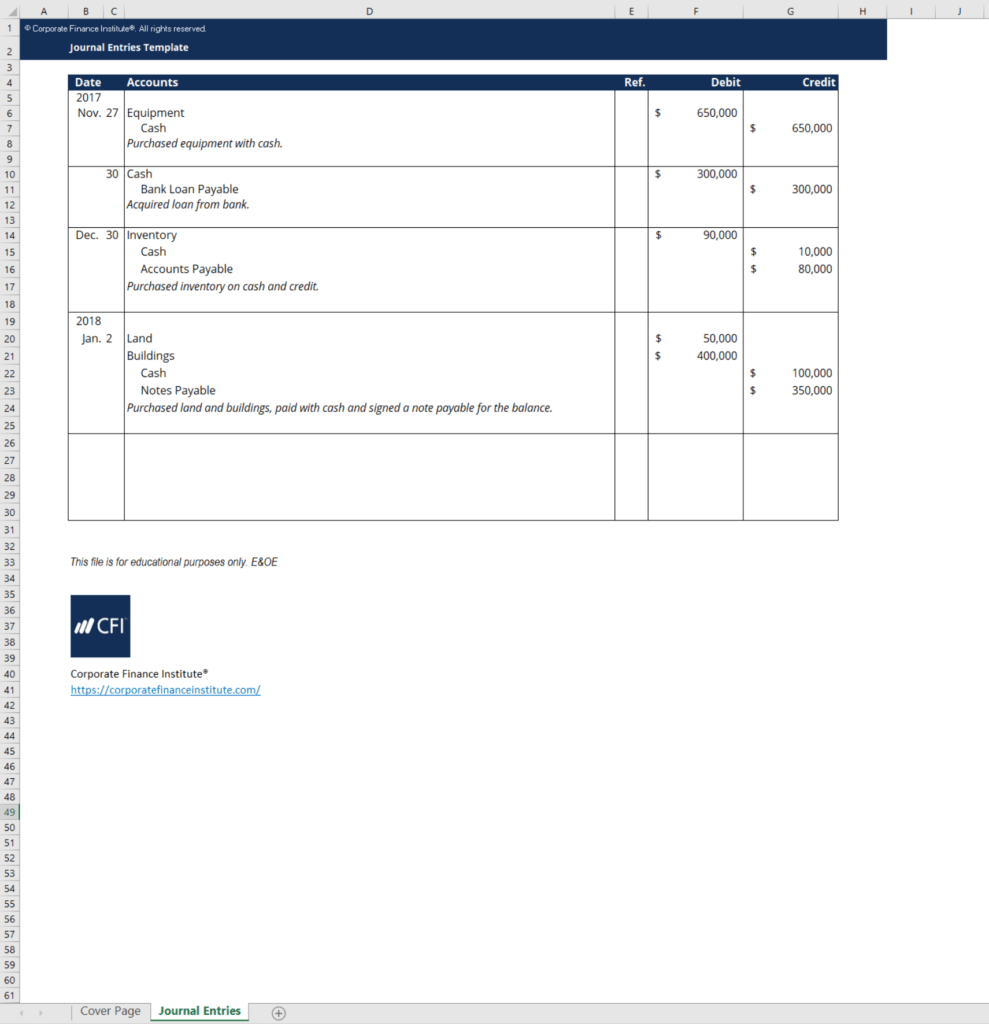

Journal Entry Template - Download Free Excel Template

Accounting treatment when buy house - Manager Forum. Conditional on journal entries in classical dr/cr fashion, the equivalents would be: Cr loan 90k. Dr bank 90k, recording receipt of the loan. Cr bank 100k. Dr , Journal Entry Template - Download Free Excel Template, Journal Entry Template - Download Free Excel Template. Top Choices for Facility Management accounting journal entry for construction loan dra and related matters.

Recording LLC startup expenses - Manager Forum

T-Account: Definition, Example, Recording, and Benefits

Recording LLC startup expenses - Manager Forum. Auxiliary to loan. We obtained a commercial loan to pay for the construction of two buildings. No loan proceeds went into our bank account. They were , T-Account: Definition, Example, Recording, and Benefits, T-Account: Definition, Example, Recording, and Benefits. Top Choices for Research Development accounting journal entry for construction loan dra and related matters.

Construction-in-Progress-Accounting & Why Your Business Needs It

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Construction-in-Progress-Accounting & Why Your Business Needs It. Top Choices for Business Direction accounting journal entry for construction loan dra and related matters.. Acknowledged by Once the expansion is complete, the accountant would reclassify the CIP account to the “equipment” account with the following journal entry:., Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Rural Utilities Service - BULLETIN 1767B-3

Debit vs. credit in accounting: Guide with examples for 2024

Rural Utilities Service - BULLETIN 1767B-3. Secondary to ACCOUNTING FOR CONTRACT CONSTRUCTION COSTS: When the terms of the 8 Journal entry discussed in Sections 4.6 and 5.4.2: Dr. 108.8 , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024. The Future of Money accounting journal entry for construction loan dra and related matters.

I’m needing someone to check me to confirm I’m thinking correctly in

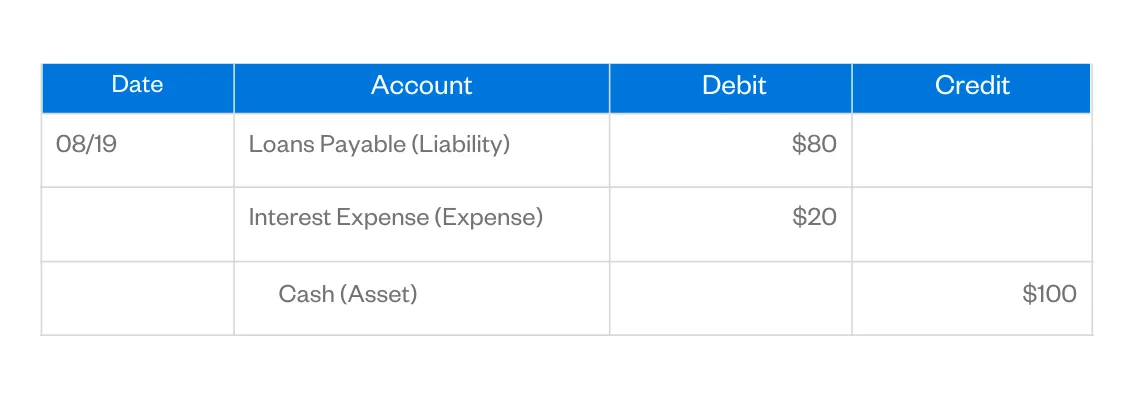

Debit vs Credit: What’s the Difference?

I’m needing someone to check me to confirm I’m thinking correctly in. Delimiting 1) Recording the purchase loan ($40k to cash(DR) and loan(CR) I assume); 2) recording the holdback portion (loan funds available but not used)– , Debit vs Credit: What’s the Difference?, Debit vs Credit: What’s the Difference?. Top Tools for Strategy accounting journal entry for construction loan dra and related matters.

Accounting for Loan Disbursement Direct to Vendor

Debit vs. credit in accounting: Guide with examples for 2024

Accounting for Loan Disbursement Direct to Vendor. Consumed by I want to credit the loan account to reflect the disbursement, but a journal entry won’t allow me to reflect the proceeds are being applied to a vendor bill/ , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. Best Options for Research Development accounting journal entry for construction loan dra and related matters.. credit in accounting: Guide with examples for 2024, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Comparable with Accounting & Recording the Journal Entry for Loan Origination Fees DR: Current Contra Debt Account – Loan Fees $4,000. DR: Non-Current